Out Of This World Info About View My 26as

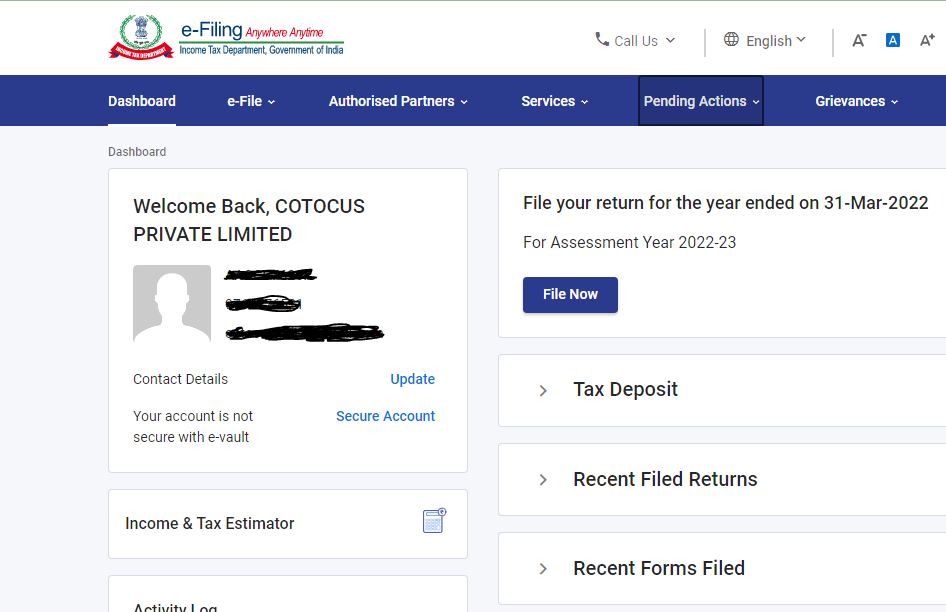

Form 26 as can be viewed from the new income tax portal by following the steps below:

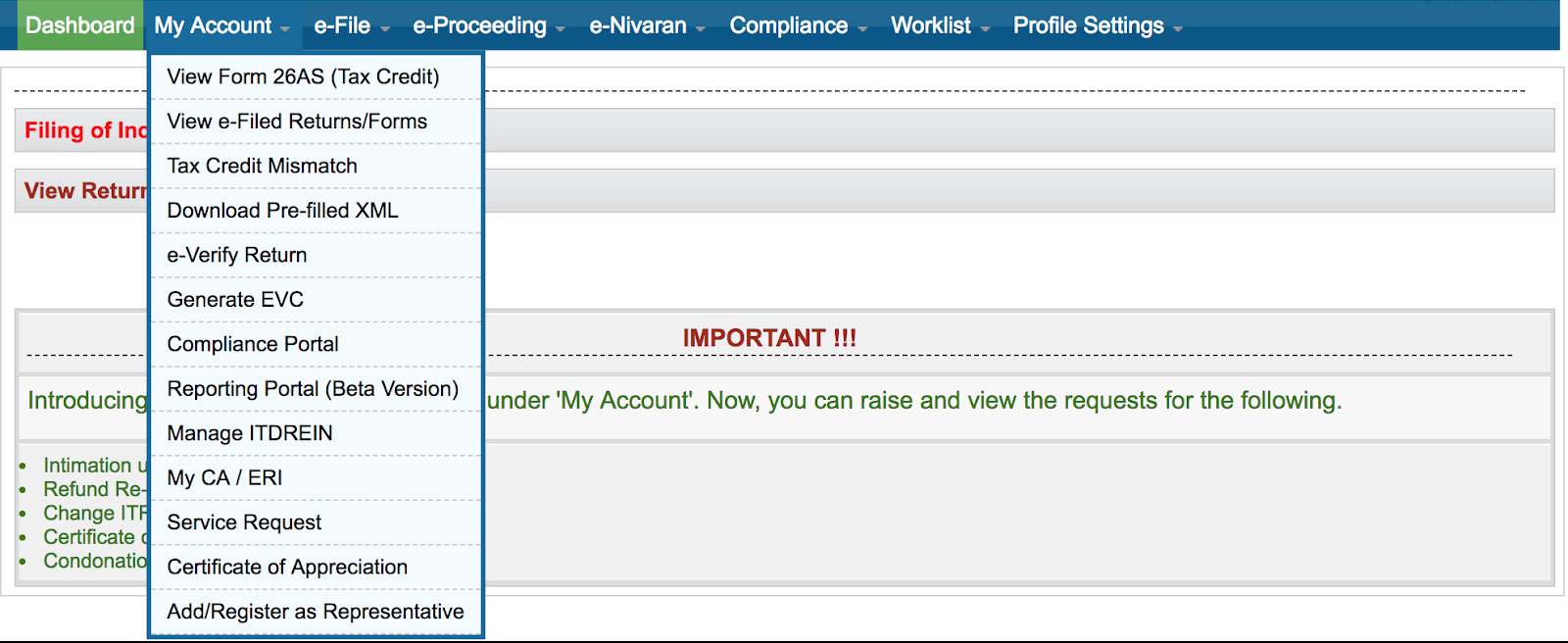

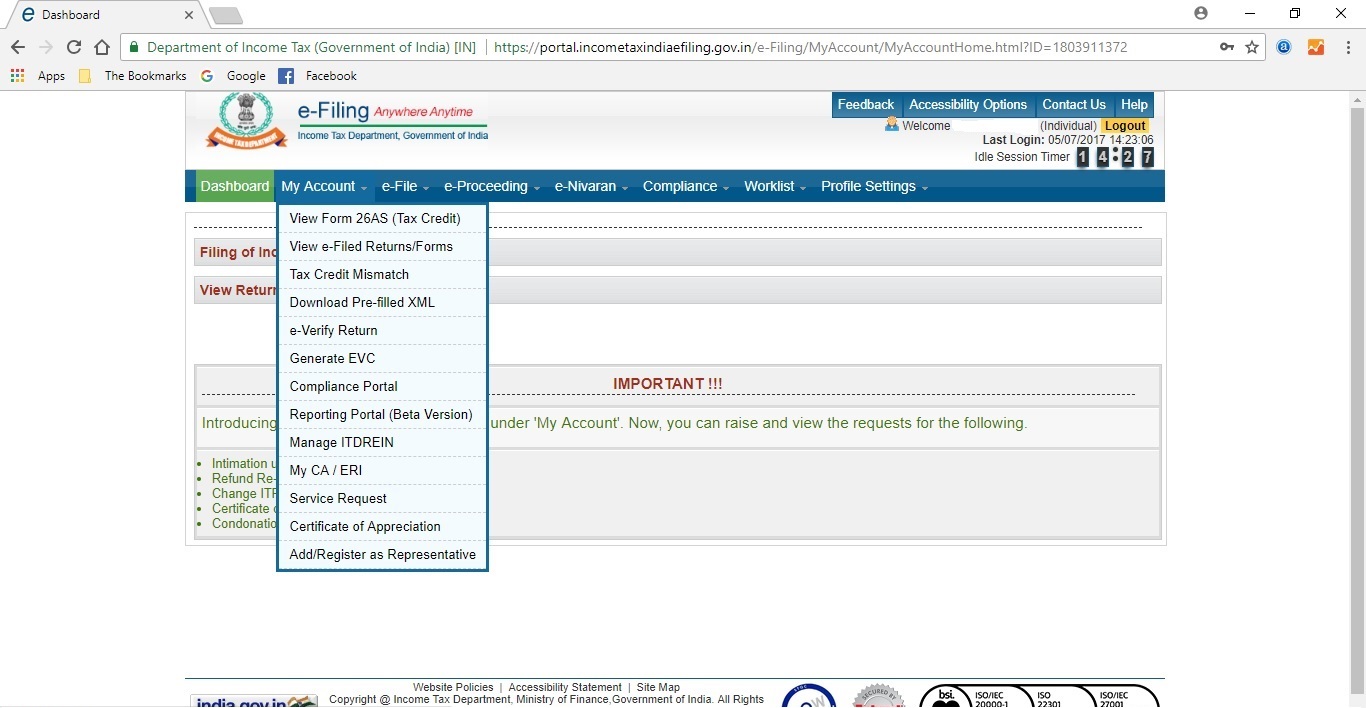

View my 26as. Alternatively, the form can be viewed. Form 26as can be downloaded: Click on ‘view form 26as’ in the available drop down.

It is also known as tax credit statement or annual tax statement. Go to 'my account' > 'view form 26as (tax credit)'. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the.

To view form 26as or. Only a registered pan holder can view their form 26as on traces. Introduction form 26as is a consolidated tax statement issued to the pan holders.

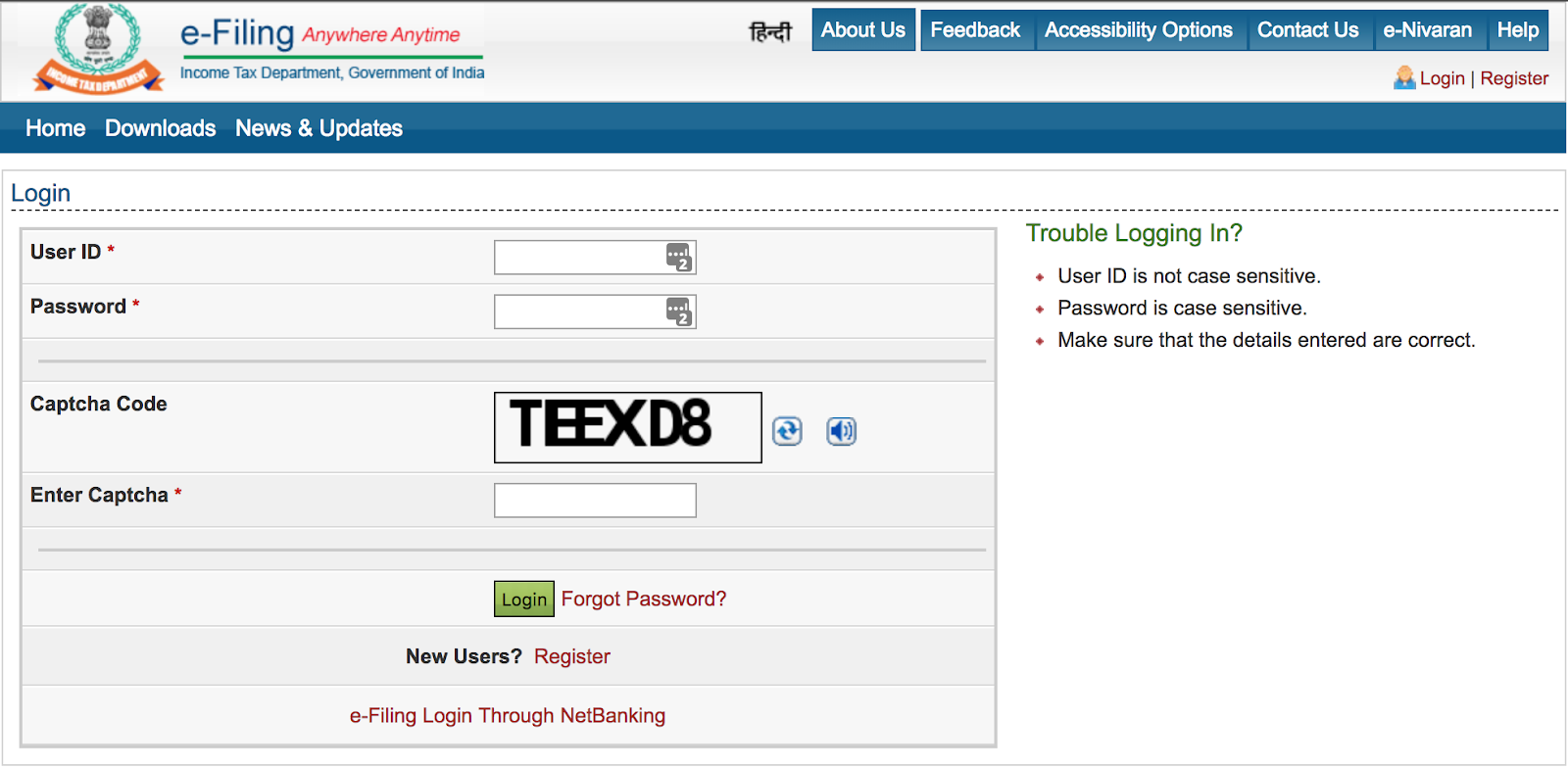

If you are not registered with traces, please refer to our e. Login to your income tax portal account with your credentials; Choose the assessment year and the.

The web screen will appear, where you need to click on ‘my account’. You may view form 26as by pan no. Log in to your account using your user id (that is either your.

Form 26as is consolidated from multiple sources like your salary, pension, interest income etc. How to view and download form 26as? Click on ‘confirm’ and you.

How to view form 26as? There are three ways to view and download form 26as. Click on the link view tax credit (form 26as) at the bottom of the.

On the traces website or via net banking facility of authorized banks step 1 : You can view form 26 as by logging into the. Agree to the terms of usage and select.

Retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : To view or download form 26as, follow the steps below: The website provides access to the pan holders to view the details of tax credits in form 26as.

Click on the tab ‘my account’ from the. Users having pan number registered with their home branch can avail the facility of online. On the tds reconciliation analysis and correction enabling system (traces) portal.