Simple Info About Opening Balance Sheet Acquisition

When an acquirer purchases the assets or all of the stock of a target company, the target may cease to exist as a separate entity and the parent’s balance sheet will be adjusted as of the acquisition date.

Opening balance sheet acquisition. They need transparent disclosure of significant acquisition accounting assumptions and estimates that are not [derived based on] observable inputs, including how they were developed. Term sheet or purchase agreement. Tax elections and predecessor period tax returns

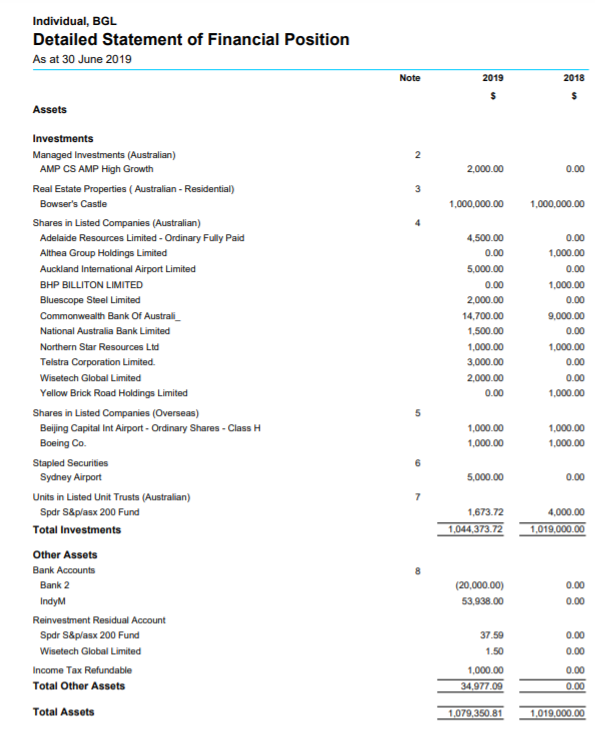

The target's assets and liabilities get revalued and put directly onto the buyer's balance sheet (these values may be different from the target's carrying values). Completing the working capital settlement and opening balance sheet accounting; If an audit adjustment that affects ebitda is uncovered in the opening balance sheet audit or through purchase accounting exercises, that can be an unwelcome surprise for companies—and a key goal is to always avoid surprises, koltun said.

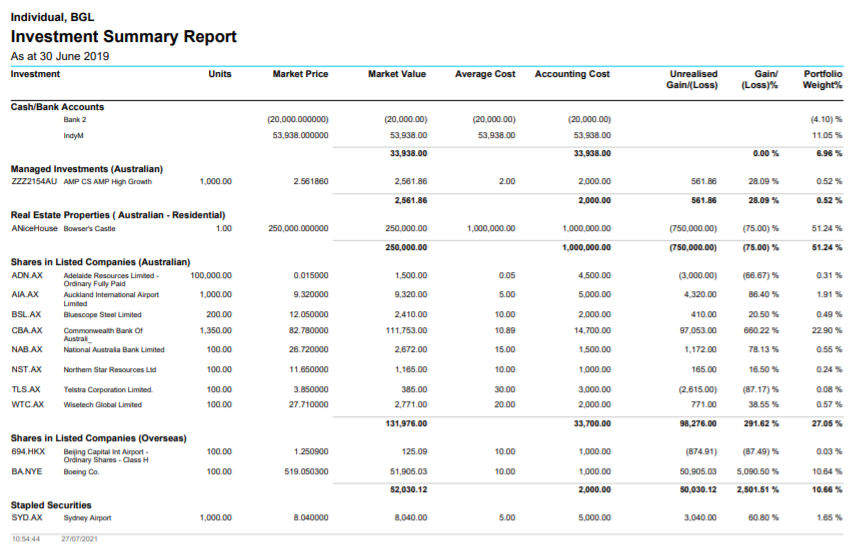

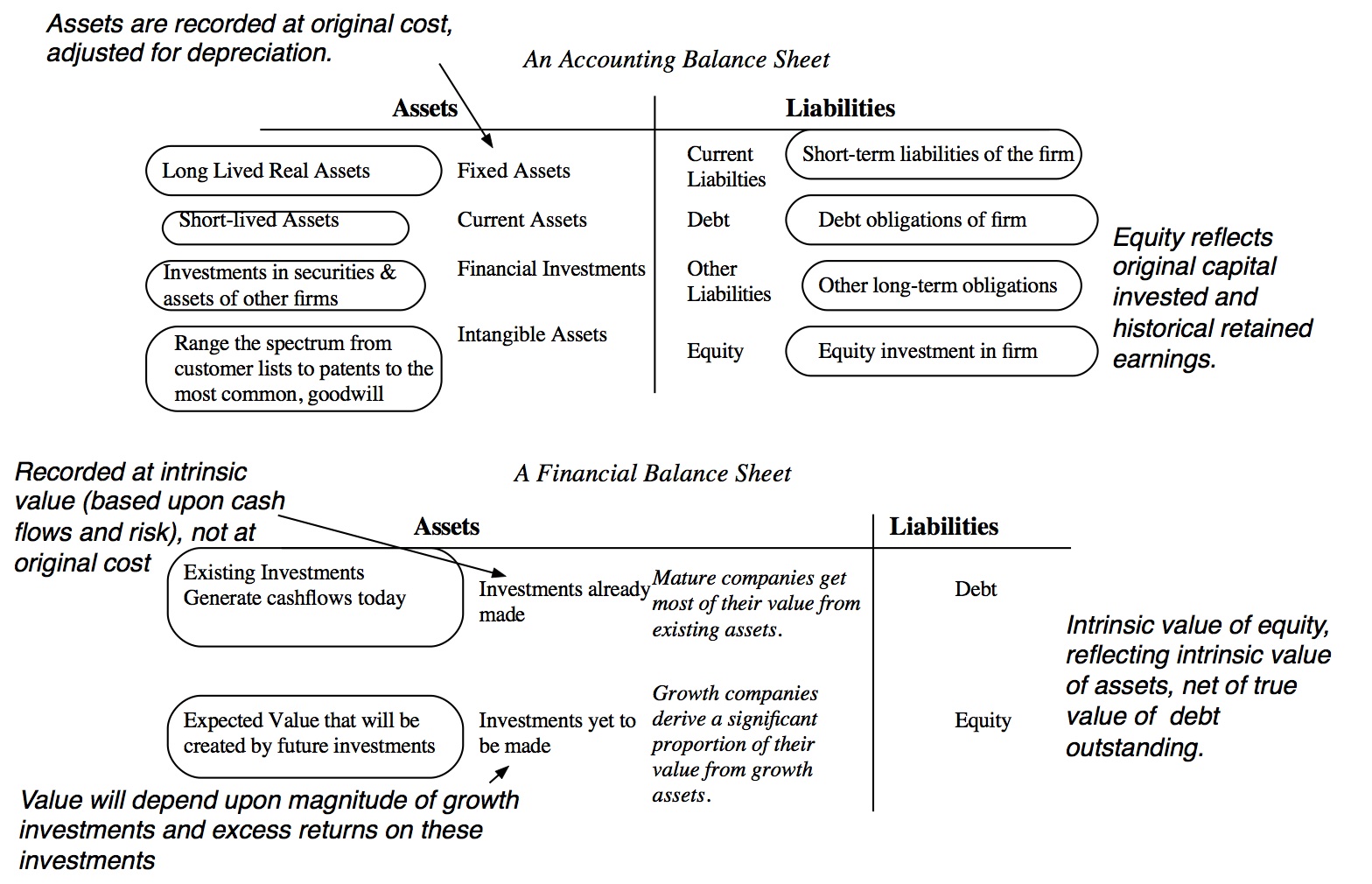

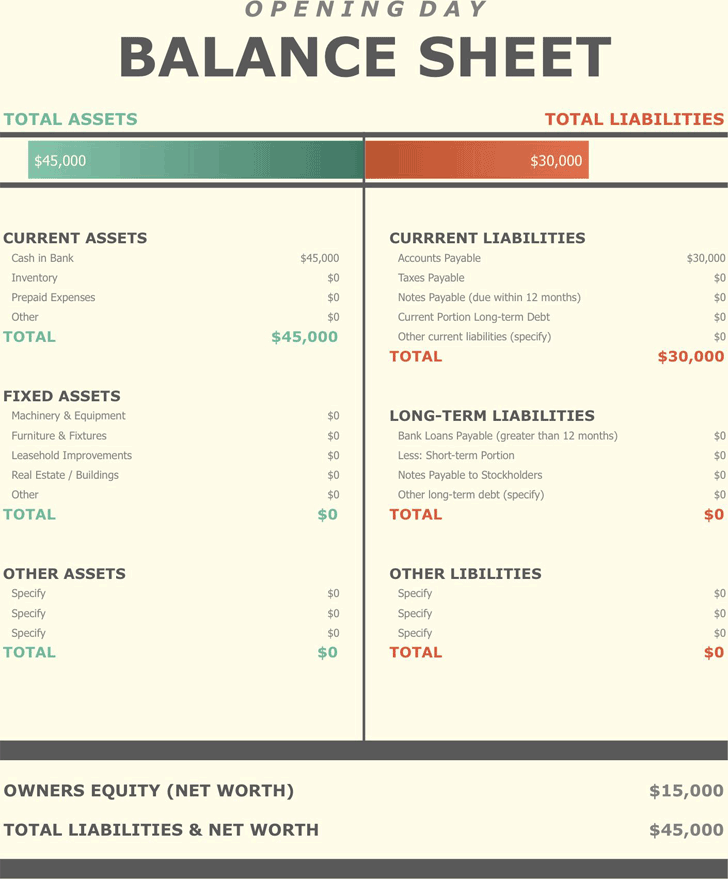

What is acquisition accounting? The acquisition date is critical because it determines when the acquirer recognises and measures the consideration transferred, the assets acquired, and liabilities assumed. Fair value and other balance sheet accounts some accounts will need to be revalued because opening balance sheet rules require different measurement than accounting for continuing entities.

Purchase acquisition accounting is a method of reporting the purchase of a company on the balance sheet of the company that acquires it. Because the asset or liability is required to be recognized at fair value, the amount initially recorded on the opening balance sheet will typically not. Now, it is paying dearly for that.

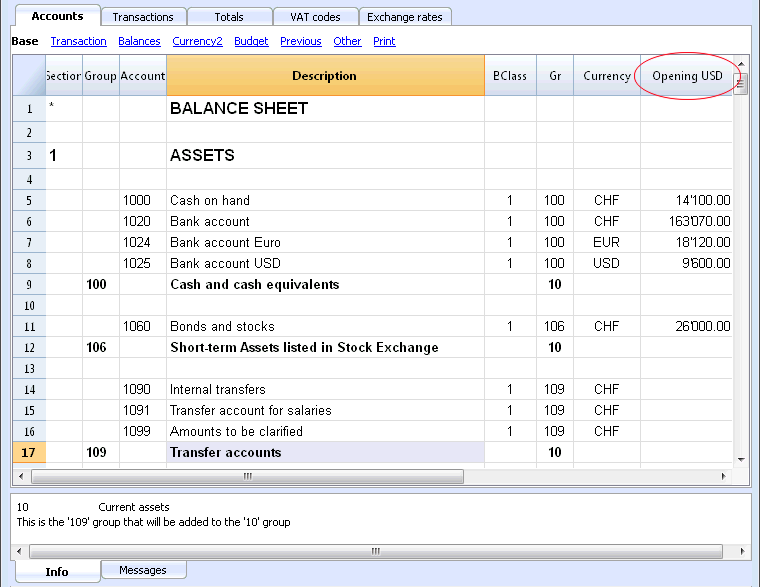

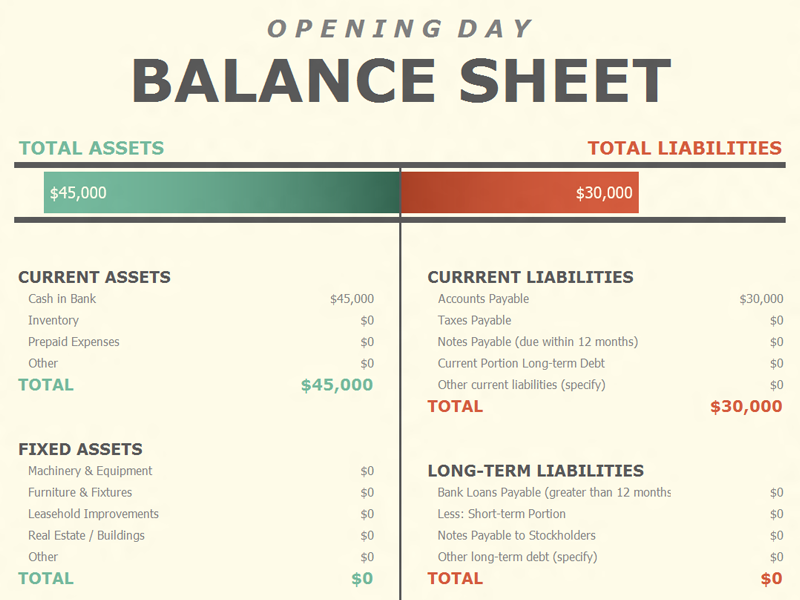

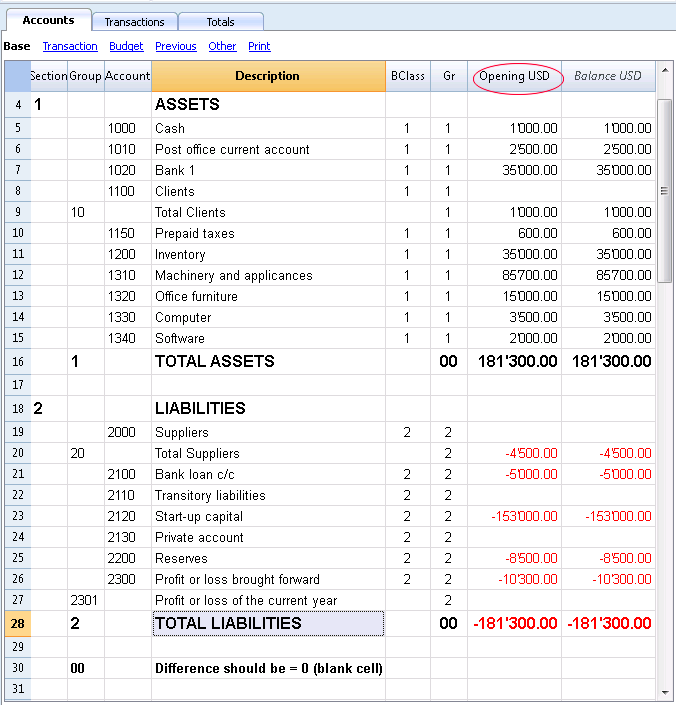

You need to do this once you start making business transactions and at the beginning of each subsequent financial year. We can help with a variety of tax needs, including due diligence, business structuring, process optimization, opening balance sheet tax provisions, and more. These balances are usually carried forward from the ending balance sheet for the.

A pro forma balance sheet, based on the registrant’s latest balance sheet, and income statement, based on the registrant’s latest fiscal year and interim period, are generally required under sec rules if the business acquisition is deemed to be significant. The key steps in applying the acquisition method are summarised below: Preparing your opening balance sheet.

The acquiree’s results are consolidated from this date. Two examples of items that are generally adjusted are deferred revenue and inventory. The key consideration when classifying a transaction as an asset acquisition or a business combination is the definition of a business.

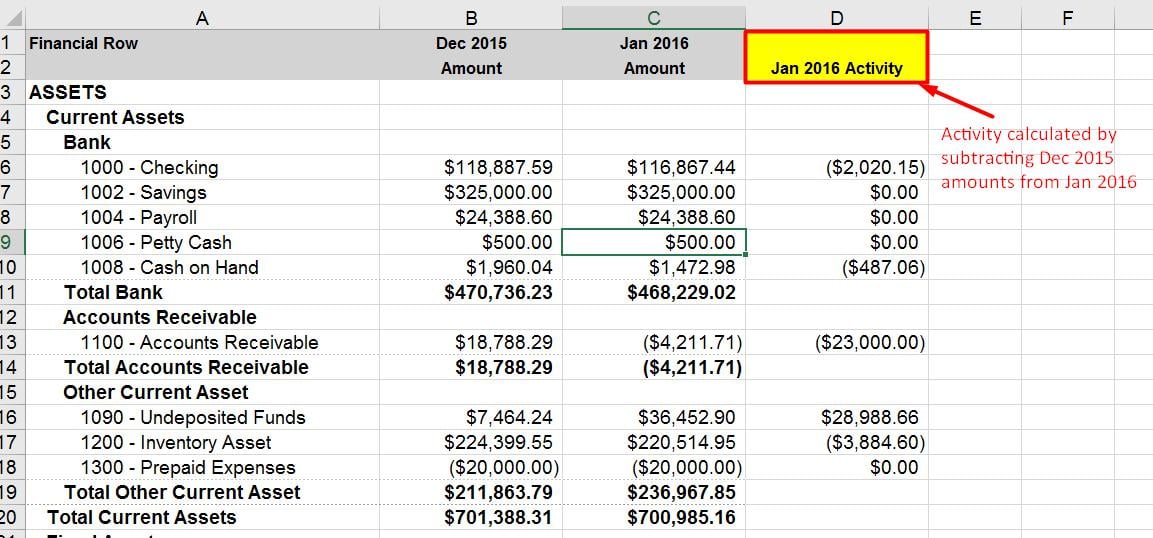

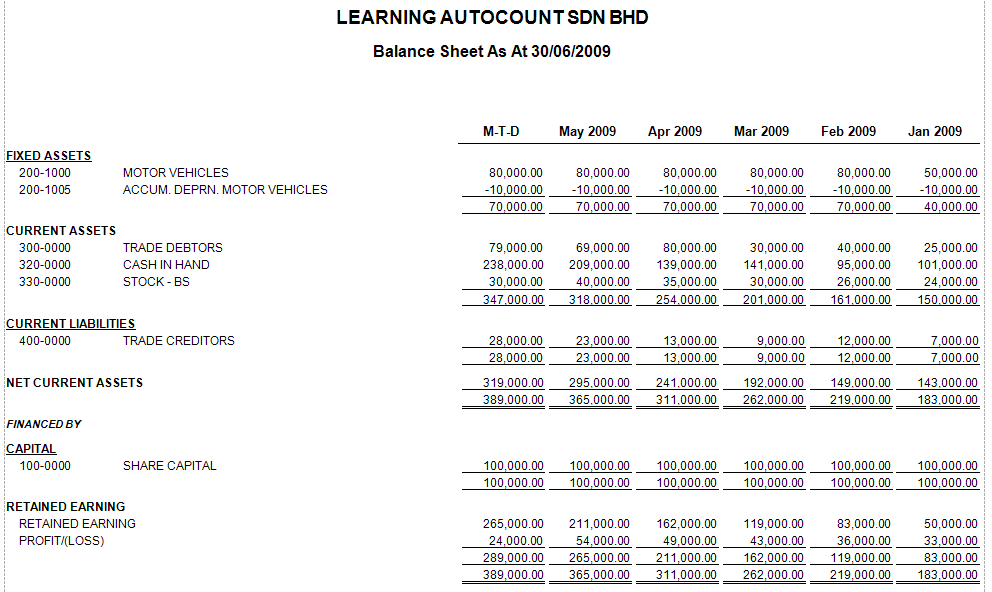

The critical assumptions regarding opening day balance sheet values are important for financial statement users, said mcgahan. Published on 26 sep 2017. An opening balance sheet contains the beginning balances at the start of a reporting period.

When to make opening balance sheet adjustments at acquisition. During last spring’s banking crisis, when a competing lender went under, new york community bank pounced, acquiring a big chunk of its business. Ifrs 3 establishes the accounting and reporting requirements (known as ‘the acquisition method’) for the acquirer in a business combination.

The right audit facilitation partner makes all the difference. The acquisition method. In an operating firm, the ending balance at the end of one month or year becomes the opening balance for the beginning of the next month or accounting year.