Out Of This World Tips About Dividend Cash Flow

20, 2024 — the board of directors of walmart inc.

Dividend cash flow. Dividends are announced by the directors of the company. Dividends represent a portion of a company’s profits that are distributed to its shareholders as a reward for their investment. Unlike the traditional dividend payout ratio,.

We test the cash flow signalling and free cash flow/overinvestment explanations of the impact of dividend announcements on stock prices. The free cash flow theory is based on the idea that managers rely on the dividend policy as a means of communication with the investors to signal income growth. Because dividends are considered a liability, rather than an asset, they won’t influence your business’s cash flow until the dividends are issued.

The cash flow statement is a financial statement that reports a company's sources and use of cash over time. Dividends are included on the cash flow statement to provide transparency and show the cash outflows resulting from. Bentonville, ark., feb.

The cash flow statement reports cash flows when they. Penman, theodore sougiannis first published: The company reported a £1.6.

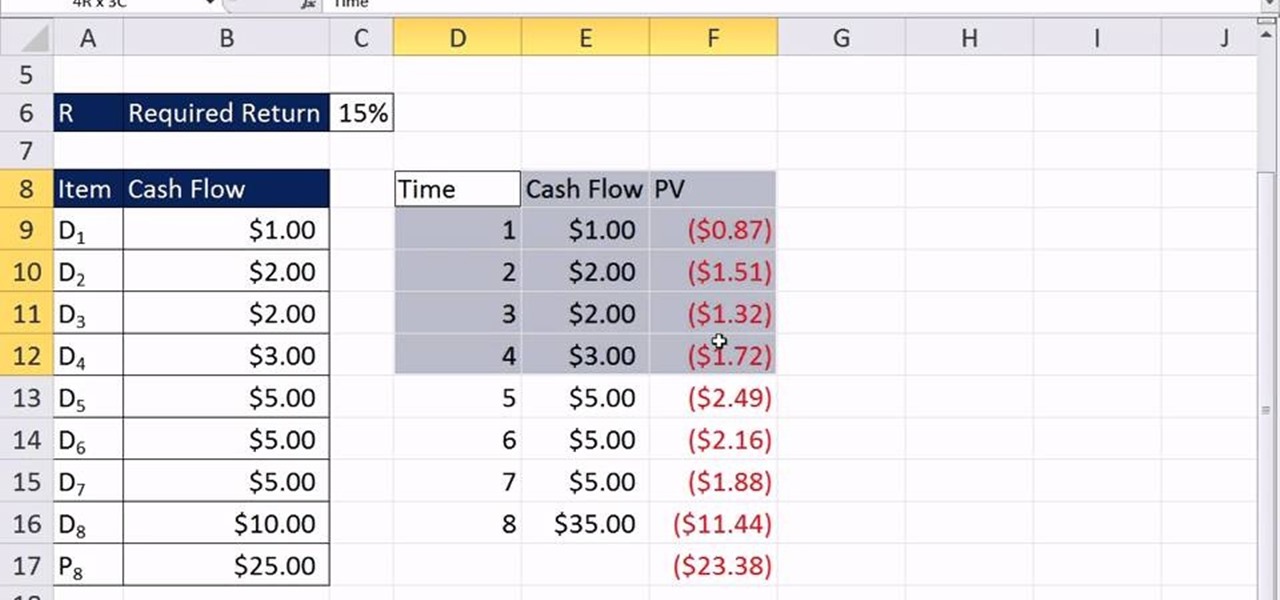

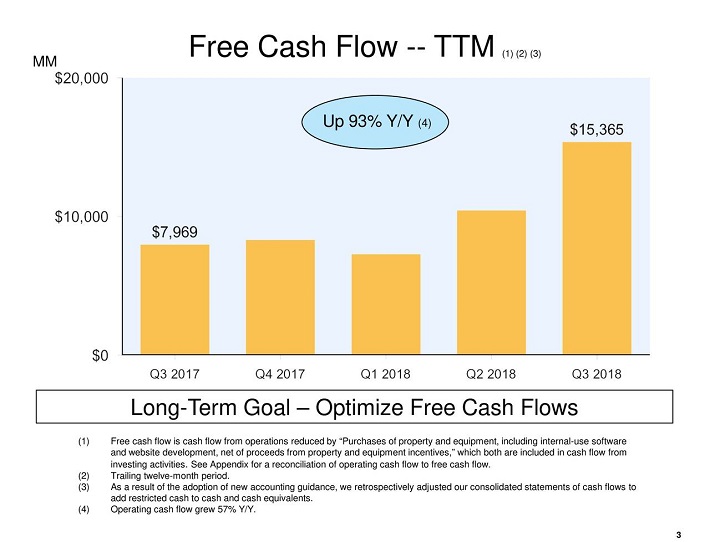

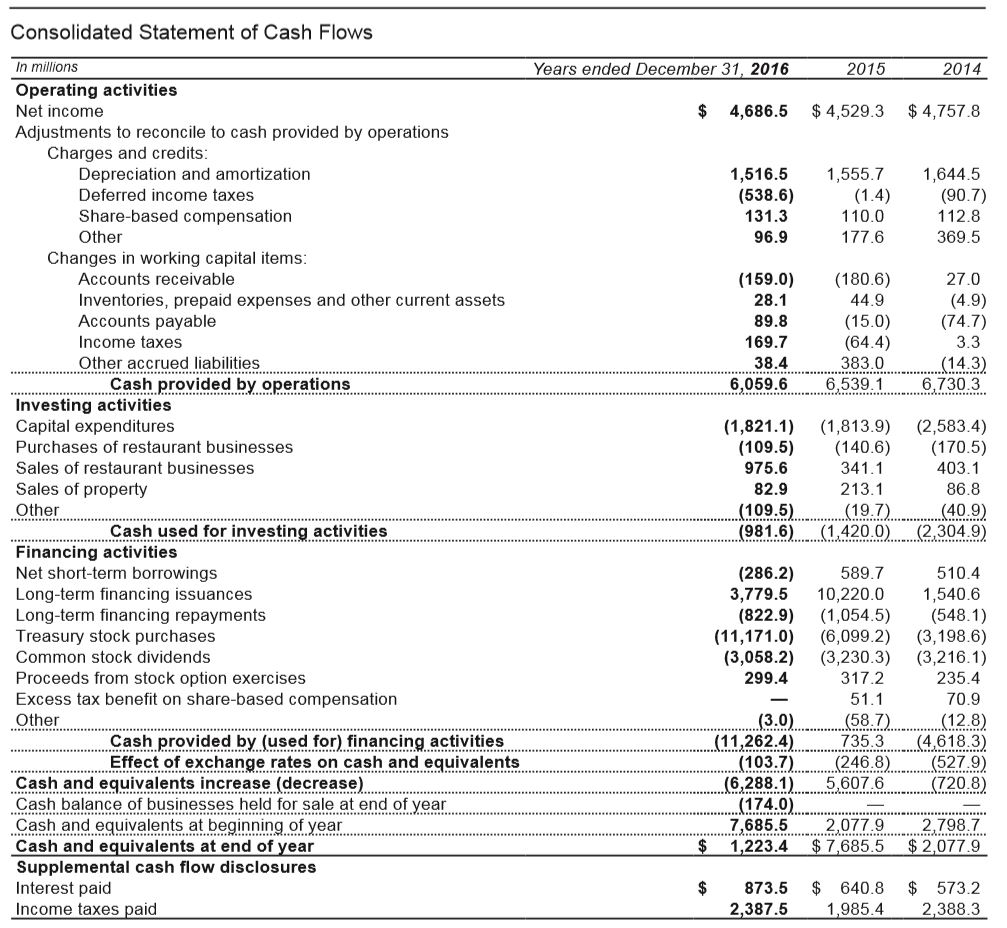

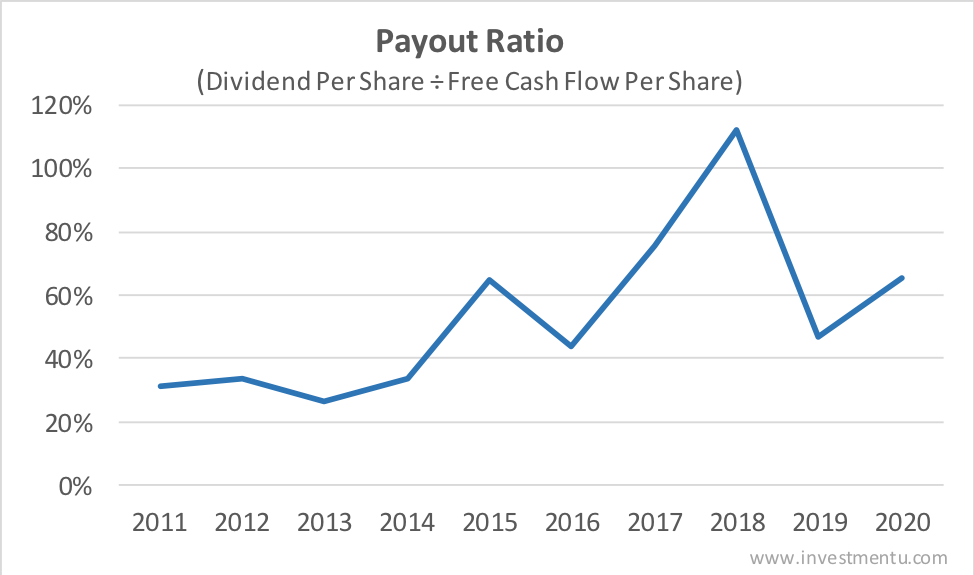

Fcfe is the cash available to common shareholders after expenses and debt payments, useful for equity valuation and dividend analysis. Management and investors use free cash flow. A comparison of dividend, cash flow, and earnings approaches to equity valuation * stephen h.

The payout ratio based on free cash flow is a financial metric that compares a company's dividend payments to its free cash flow. A company's cash flow can be categorized as cash. Adding up the cash flow from preferred and common.

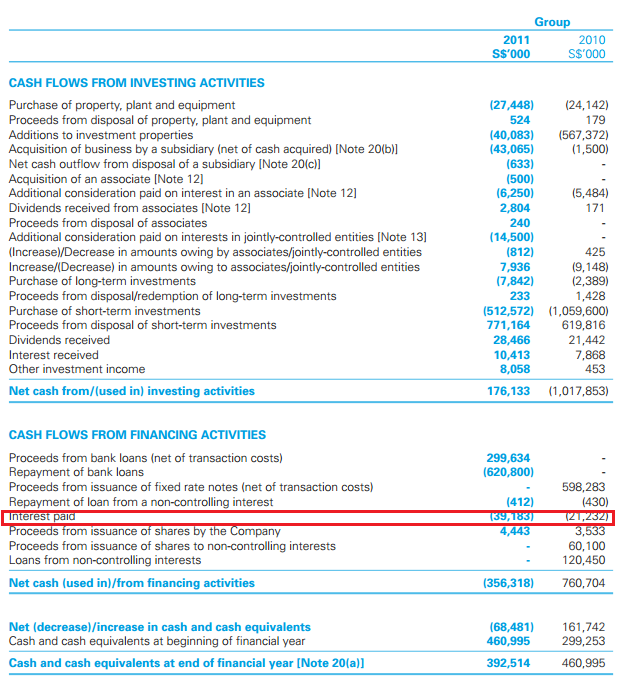

A dividend is a cash distribution of a company's earnings to its shareholders, which is declared by the company's board of directors. Reporting cash flows from investing and financing activities 21 reporting cash flows on a net basis 22 foreign currency cash flows 25 interest and dividends 31 taxes on income. Wmt) approved an annual cash dividend for fiscal year 2025 of $0.83 per.

Why are dividends listed on the cash flow statement? On the balance sheet, your retained earningsare. Despite similar objectives, ias 7 1 and asc 230 2 have different requirements, such as the composition of cash, and the classification of interest,.

Since repayments of loans to the business also go under this section (cash flow from financing activities), it seems logical to include dividends paid to investors in this section. Carrefour , europe's largest retailer, said on tuesday it was confident about this year as it reported record cash flow of 1.62 billion euros ($1.8 billion) for 2023 and. These results indicate that the higher the dividend premium and free cash flow of the company, the better the company’s dividend policy.

Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Here are some key limitations of the cash flow statement in reflecting dividends: Here’s how the process works in a little more detail:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)