Brilliant Info About Cash Flow Operating Investing Financing

Operating cash flow indicates whether a company can generate sufficient.

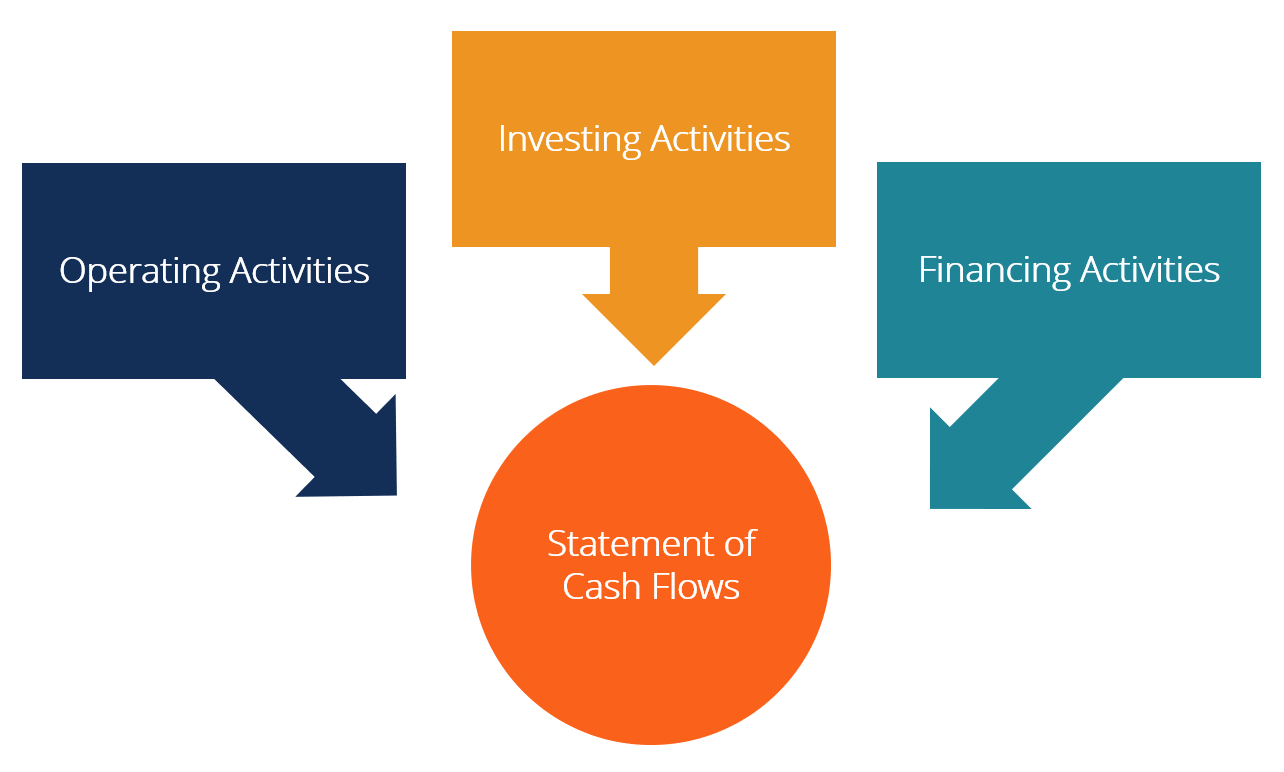

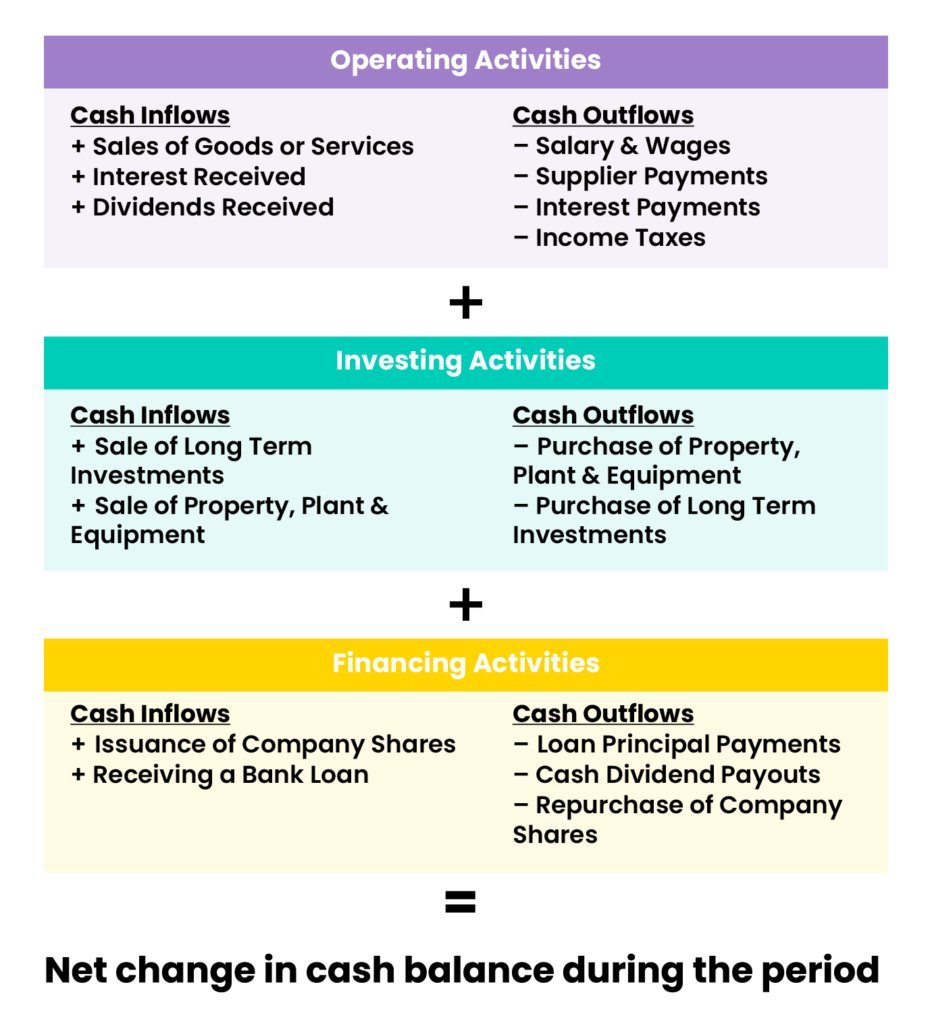

Cash flow operating investing financing. Transactions must be segregated into the three types of activities presented on the statement of cash flows: Operating cash flows arise from the normal operations of producing income, such as cash receipts from revenue and cash disbursements to pay for expenses. Learn how cash flows from operations, investing & financing, & the normal types of cash flows at different stages of a business.

Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. The statement of cash flows presents sources and uses of cash in three distinct categories: To keep a record of the cash flows, organizations prepare a cash flow statement.

Cash flows from operating activities arise from the activities a business uses to produce net income. You need to manage your cash flow carefully in order to grow your startup. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the change in cash reported on the balance sheet, supplemental information part 3 Investing cash flows arise from a. Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing.

Reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows interest and dividends taxes on income 17 18 21 22 25 Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)