Top Notch Tips About Bad Debts In Cost Sheet

Let’s say company abc manufactures laptops and sells them to retailers.

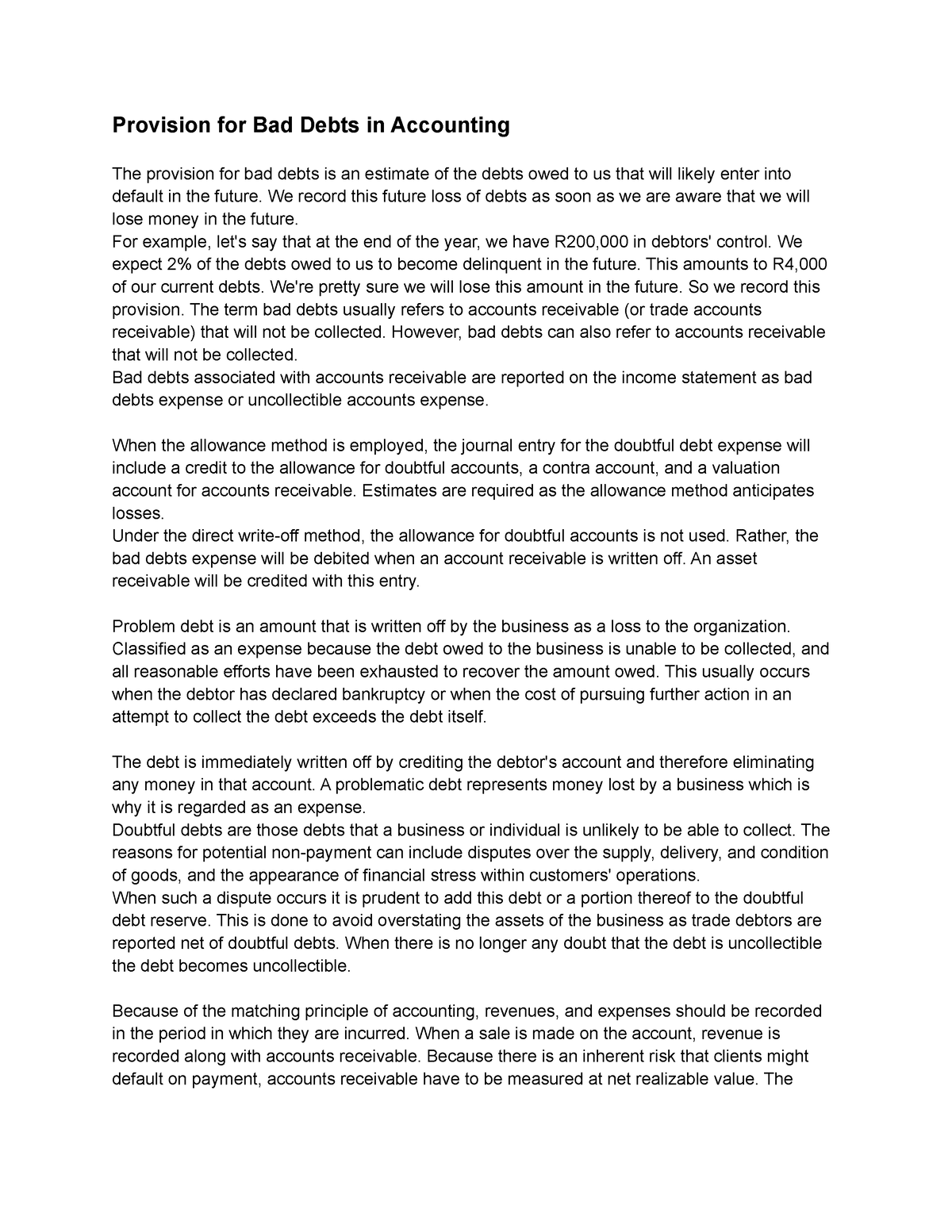

Bad debts in cost sheet. Companies classify them as operating expenses since they do not relate to their core activities. Bad debts is the amount of credit sales which can not be recovered or become irrecoverable are called bad debts. The amount of bad debts is not debited to the profit and loss account since it was already debited in earlier years.

Bad debt expense is an unfortunate cost of doing business with customers on credit, as there is always a default risk inherent to extending credit. The adjusting entry would still be for $5,000. Essentially, bad debt expenses reduce profits while decreasing account receivable balances.

A cost sheet is an exercise in collection of information regarding all the costs incurred in the industry and arranging them in a certain order. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. A cost sheet is a document or statement that provides detailed information about the various costs incurred in the production or manufacturing of a product or.

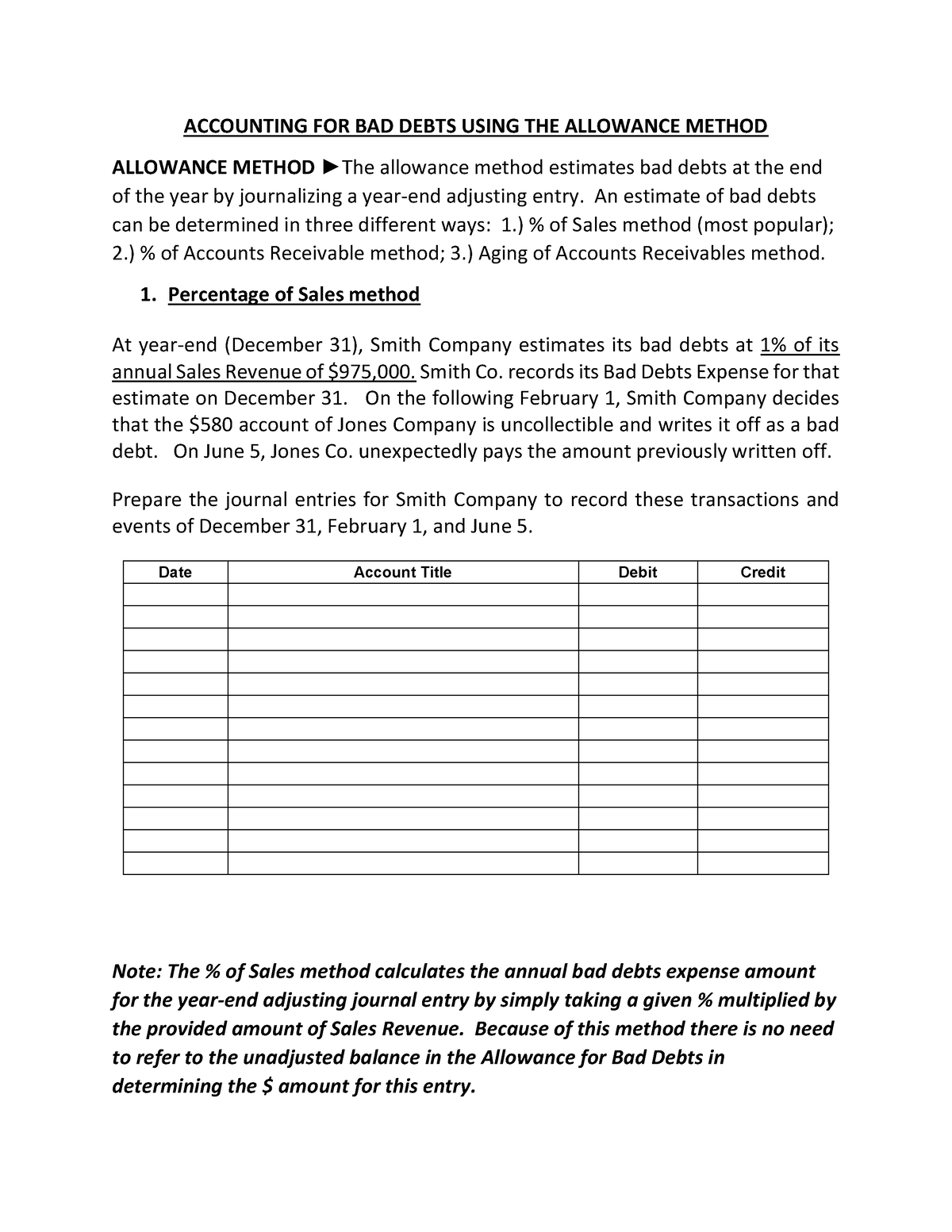

Percentage of every expenditure to the total cost. If, however, bad debts are included in cost, it should be treated as selling overhead and may be apportioned to various products on the basis of the credit sales of products. Expenses excluded from cost sheet:

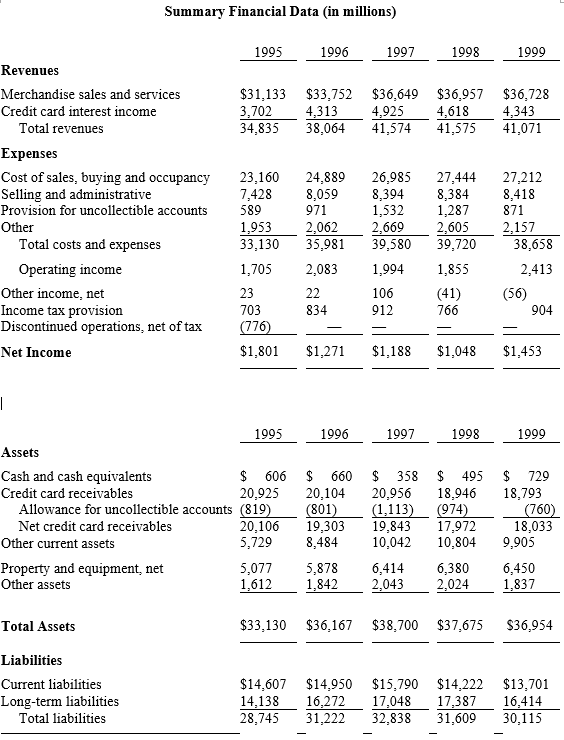

Compare the cost of any two periods and ascertain the inefficiencies if any. The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. To record bad debts in the account books, firms must initially estimate their.

Bad debt example can be discussed as follows: Bad debt expense relates to balances that companies deem irrecoverable. A retailer receives 30 days to pay company abc after receiving the laptops.

In addition to the $354.9 million judgment in the civil fraud. A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. How to calculate bad debt expenses there are two ways to calculate your business’ bad debts:

The implications are, for example, that if an entity applies a flat percentage of 50% of receivables in 90 days, and 100% of receivables/debtors in 120 or more days for example, in order to estimate the impairment loss, this will not. For example, in one accounting period, a company can experience large increases in their receivables account. However, the balance sheet would show $100,000 accounts receivable less a $5,300 allowance for doubtful accounts, resulting in net receivables of $ 94,700.

If so, the account provision for bad debts is a contra asset account (an asset account with a credit balance ). · donation, · income tax, · profit or loss on the sale of assets, · provision for income tax and bad debts, etc., · transfer to reserves, · goodwill and intangible assets written off, · preliminary expenses, Also called doubtful debts, bad debt expenses are recorded as a negative transaction on your business’s financial statements.

In simple words, it amount of debt which is impossible to collect is called bad debts. Bad debts meaning. Company abc records the amount due as “accounts receivable” on the balance sheet and records the revenue.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)