Awe-Inspiring Examples Of Info About Other Expenses In Accounting

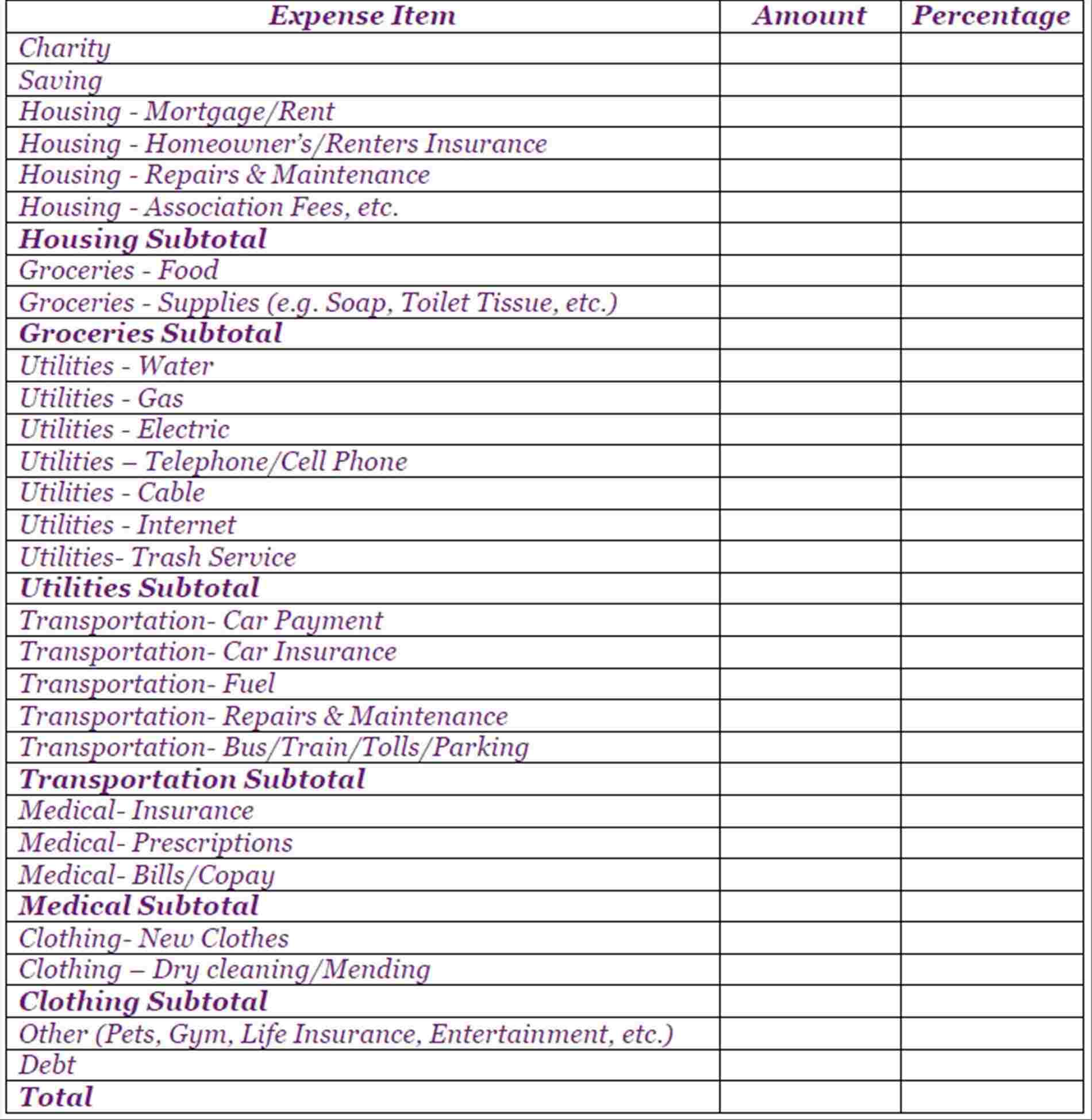

For accounting, expenses can be divided into two more types.

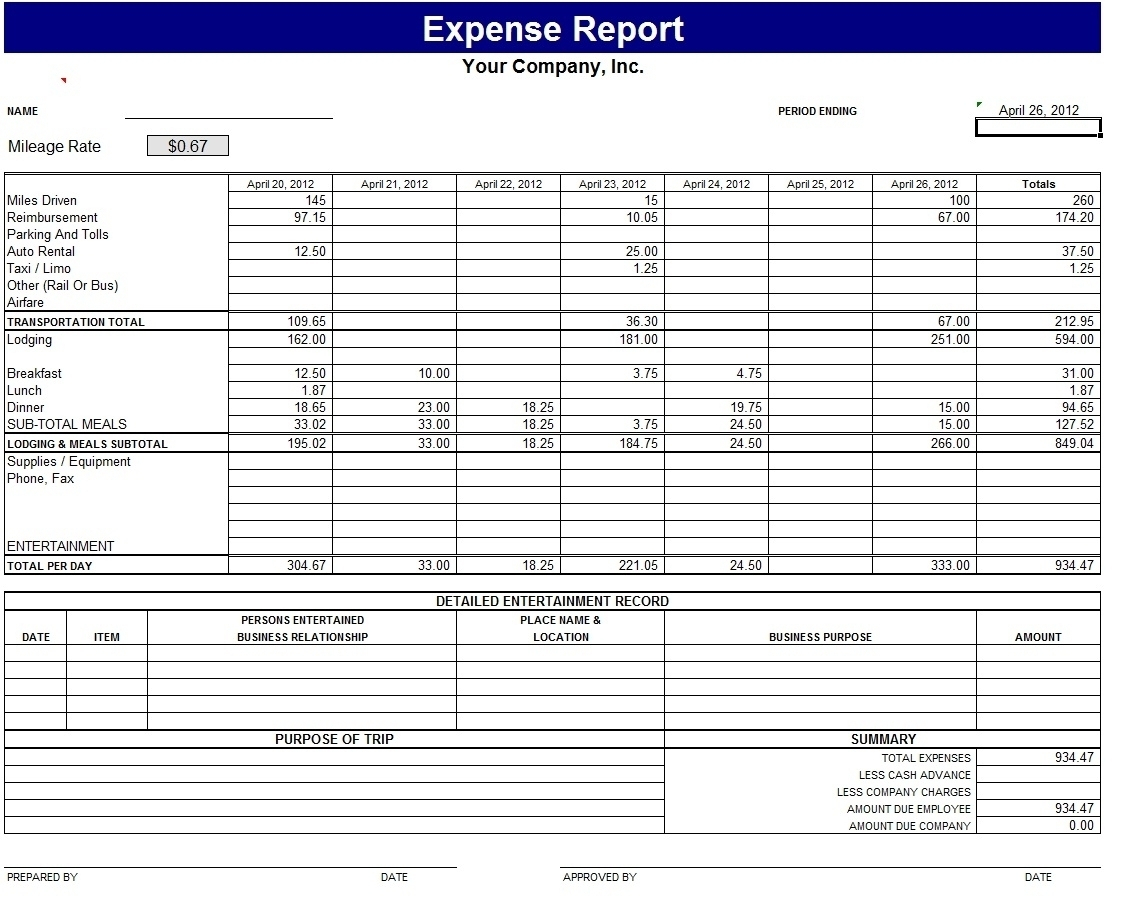

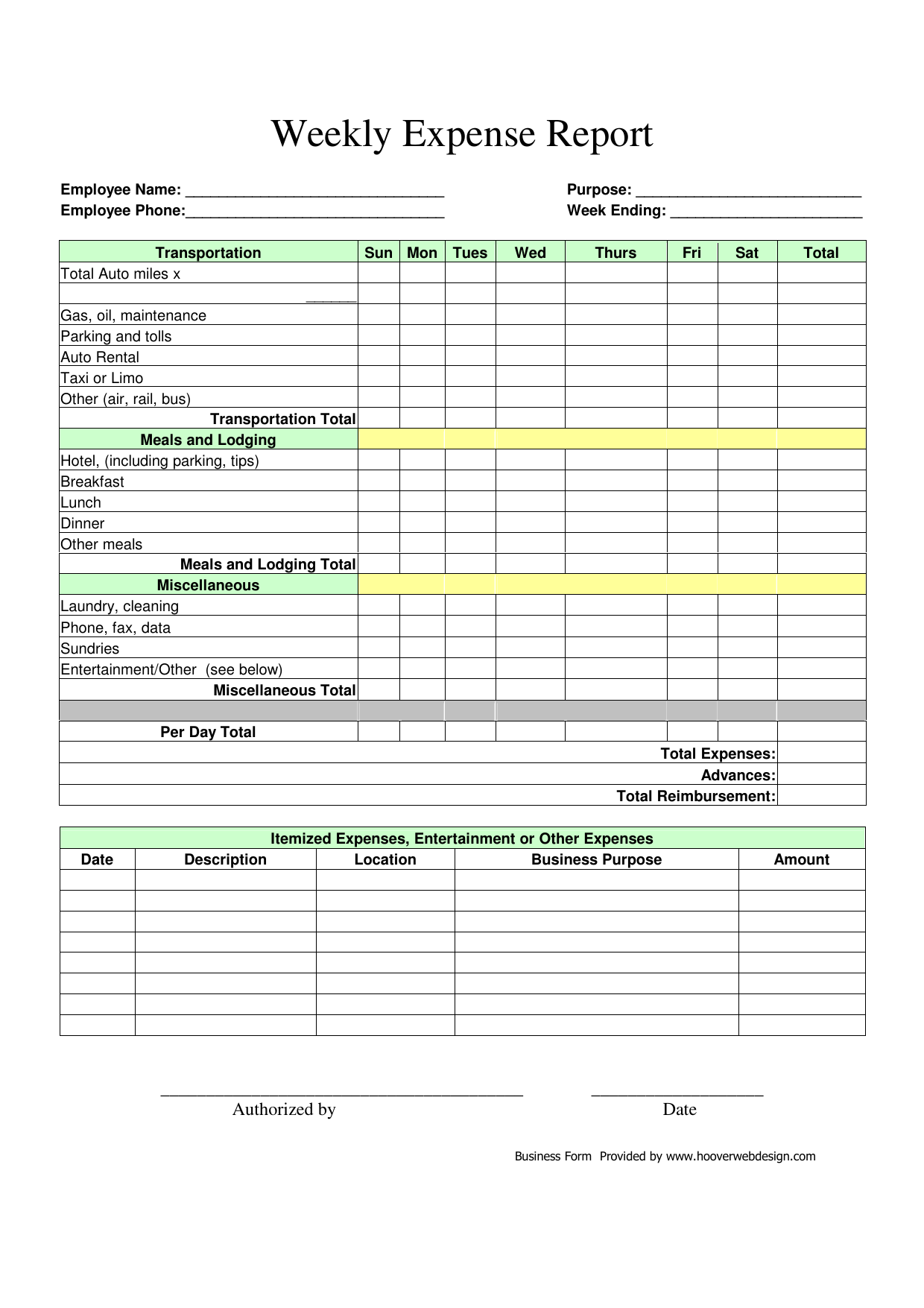

Other expenses in accounting. Other income and other expenses refer to items that don't fall into your regular business operations' revenue and expense categories. The best accounting software for cleaning businesses can help business owners keep track of expenses, payments, payroll, invoicing, and other financial data. The category of selling, general, and administrative expenses (sg&a) in a company's income statement includes all general and administrative expenses (g&a) as.

They’re the costs a company. In simple words, the costs of doing business are called expenses. Donald trump spent $52,431,858 on legal fees in 2023 using pac funds, a business insider analysis found.

They represent more static costs and pertain to general business functions,. These are outliers, unusual or. For example, cost of goods sold is an expense caused by sales.

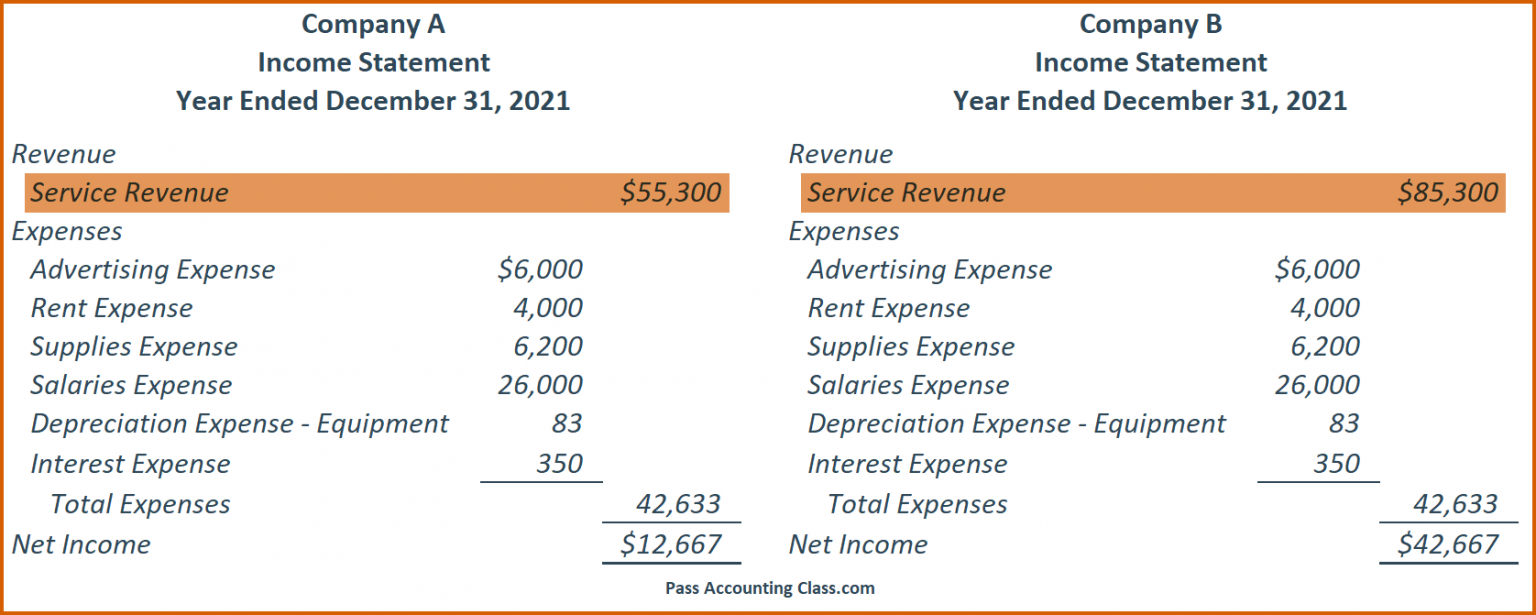

Expenses definition costs that are matched with revenues on the income statement. Other expenses and losses. Office expenses refer to the costs of running an office and keeping it operational.

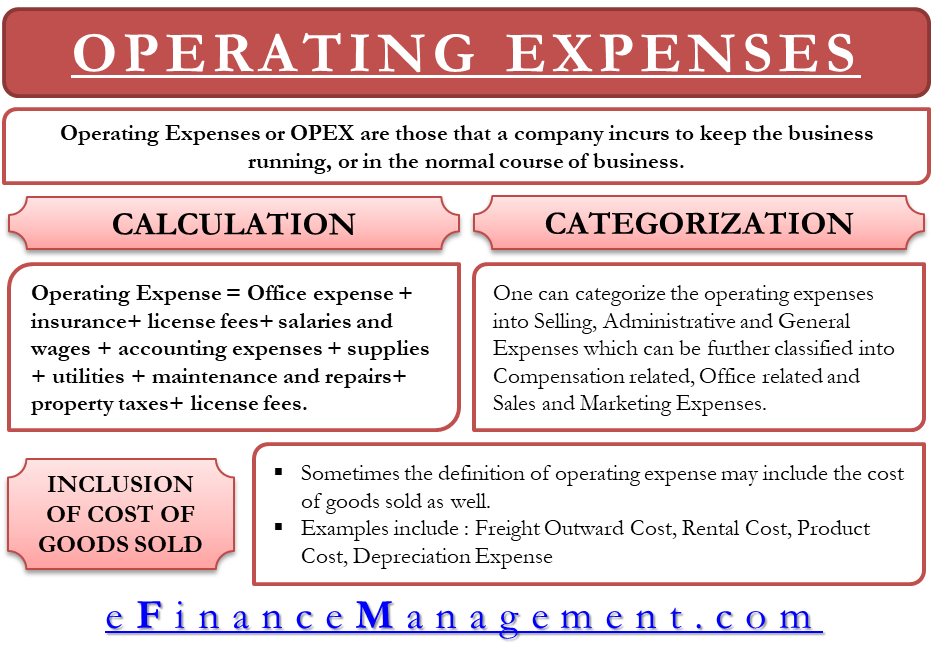

Expenses in accounting expenses are what a company must pay to run its operations and generate revenue. Often abbreviated as opex, operating. They are not directly related to the volume of production.

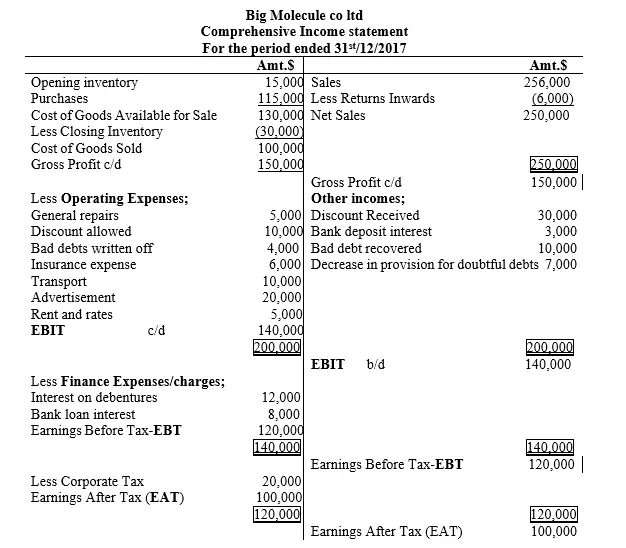

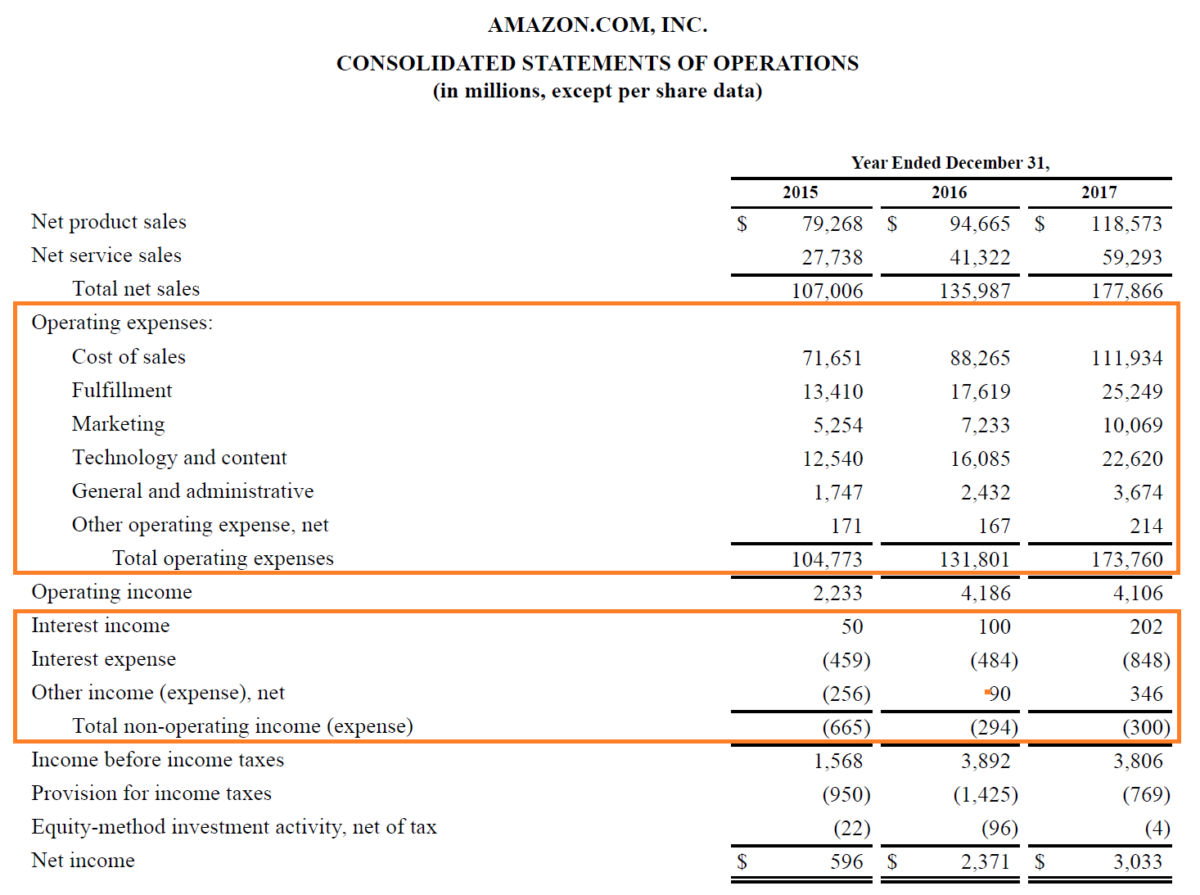

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a. Other expenses and losses are a section of the income statement that shows expenses and losses that are unrelated to the company’s main. Other costs, also known as other expenses, are isolated or recurring costs that don’t fit into primary cost categories but must be paid nevertheless, such as closing costs on the.

When accounting standards codification topic 606 (asc 606), revenue from contracts with customers, took effect in 2019 for private companies, many government. Certain office expenses may be tax deductible. (explained) financial accounting the income statement is a financial statement that reports a company’s performance for a period.

Expenses explained from the technical definition of expense, we can draw the following points: Other expense types. An operating expense is an expense a business incurs through its normal business operations.

An expense is a cost that has been incurred in the process of earning income and revenue. The accounting for an expense usually involves one of the following transactions: An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income.

What are other operating expenses? It's the sum of money required to buy something, to put it simply. Debit to expense, credit to cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)