Best Of The Best Tips About The Statement Of Cash Flows Helps Users

Information on the statement of cash flows helps users answer all of the following questions except:

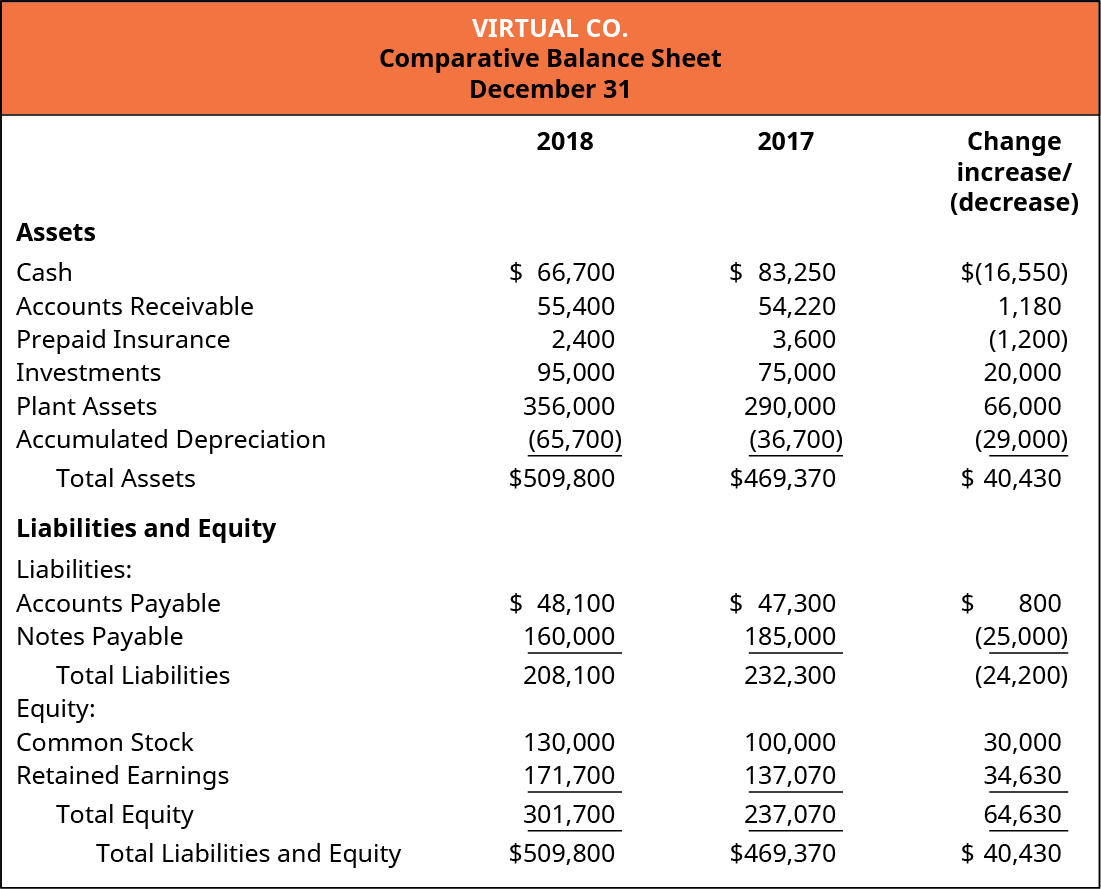

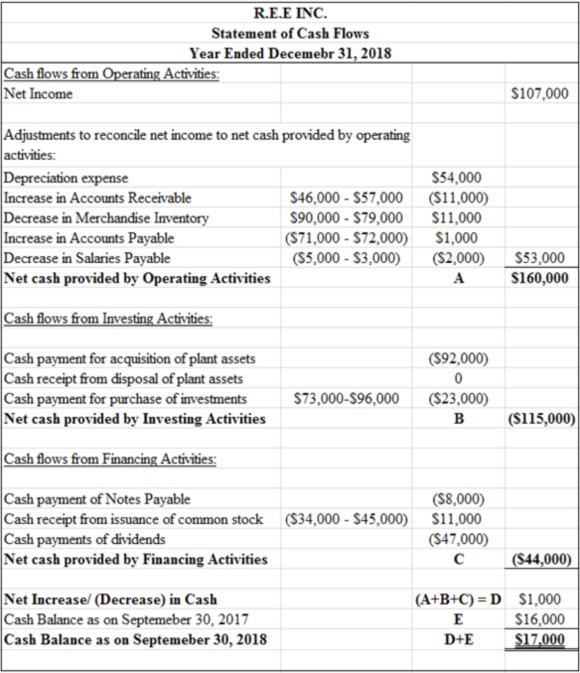

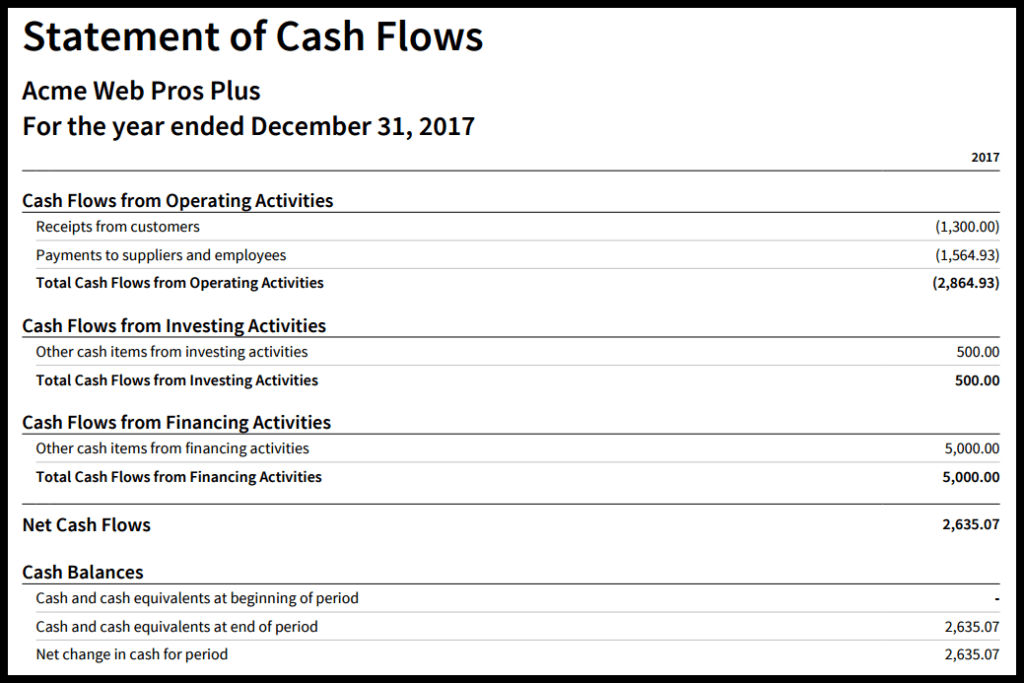

The statement of cash flows helps users. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Information about cash flows can influence decision makers in important ways. Companies compile the cash flow statement using information from the income statement, which shows sales and profits, and the balance sheet, which summarizes the company's assets, liabilities and shareholders' equity.

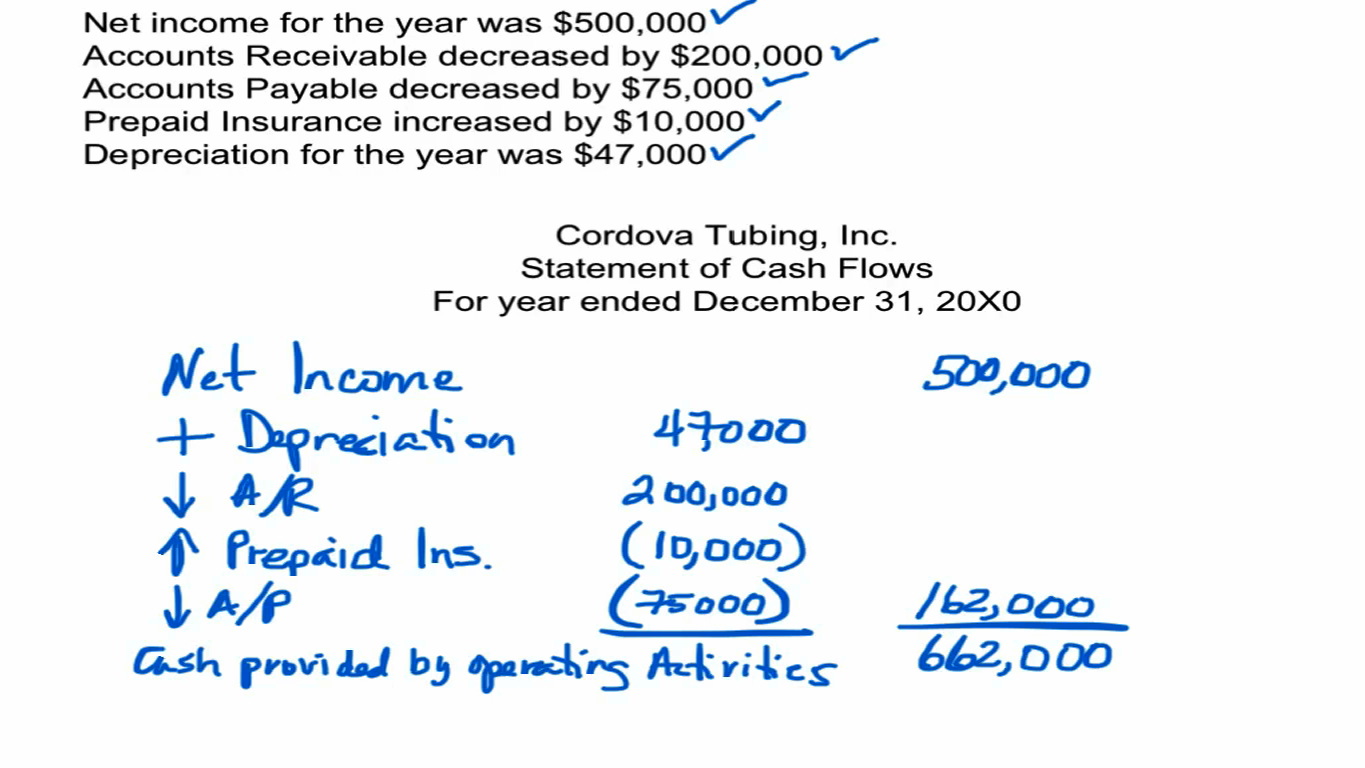

Internal users can assess sources of and uses of cash in order to aid in adapting, as. Cash flow statements provide details about all the cash coming into and exiting a company. Accrual accounting creates timing differences between income statement accounts and cash.

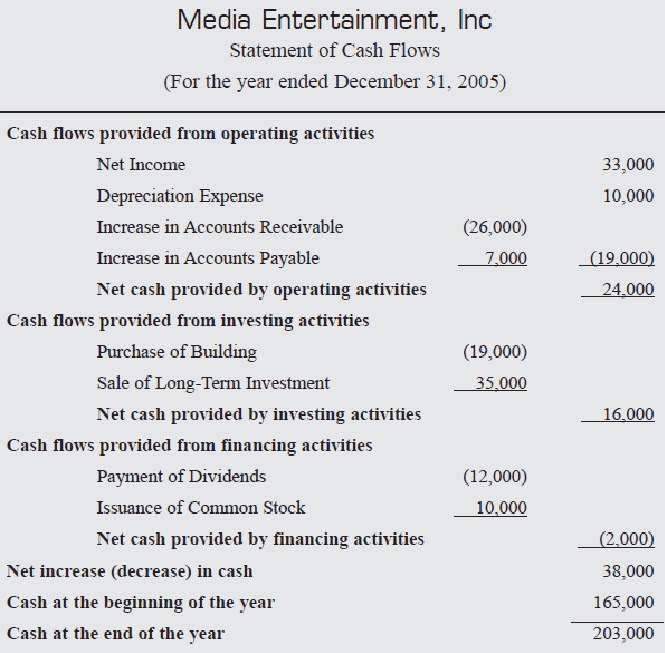

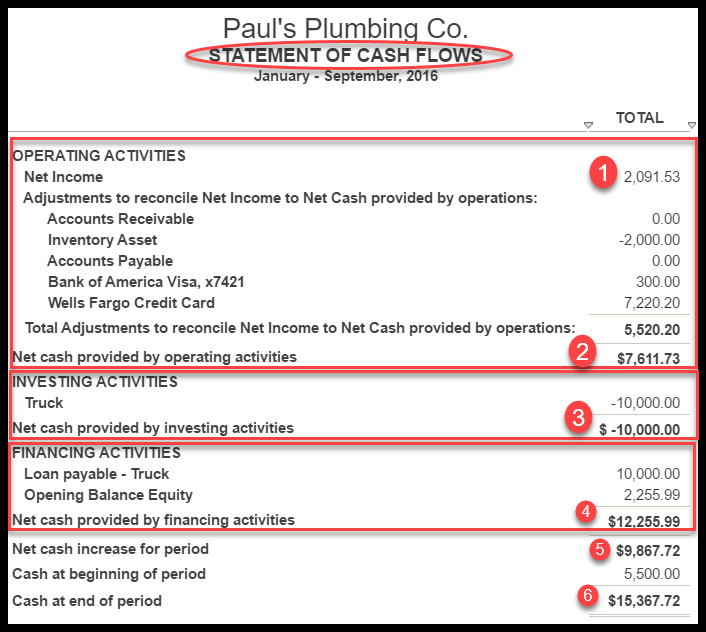

The statement of cash flows enables users of the financial statements to determine how well a company’s income generates cash and to predict the potential of a company to generate cash in the future. The statement of cash flows helps users do the following: The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

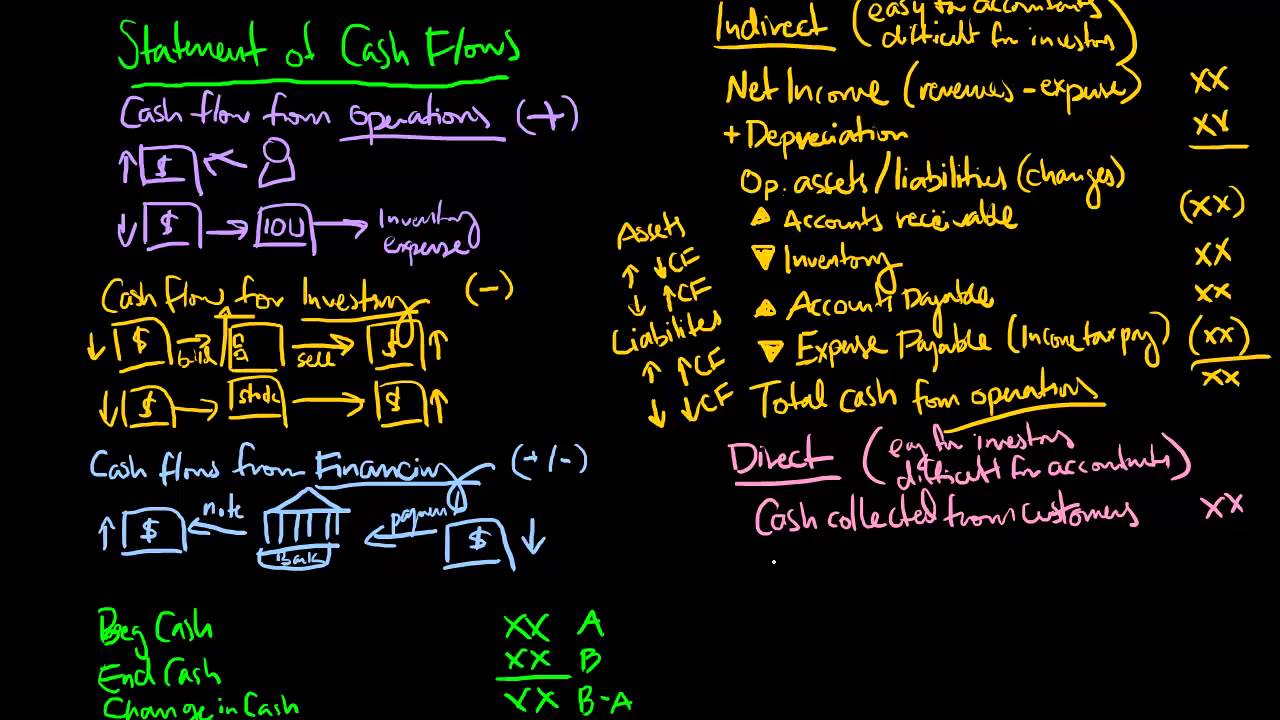

Multiple choice question information on the statement of cash flows helps users answer all of the following questions except: The statement of cash flows can be used in a number of ways to assess firm performance by both internal and external financial statement users. Key points in financial accounting, a cash flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating, investing, and financing activities.

There is no business if there is no cash flow (otherwise known as bankruptcy). A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. A statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

The three basic types of cash flow activities are: The users usually use historical cash flow information as the indicator to estimate the amount, timing and certainty of. The statement of cash flows helps users ________.

The statement of cash flows is one of the financial statements issued by a business, and describes the cash flows into and out of the organization. With the cash flow statement, you gain a better understanding of how and when to pay back loans, purchase commodities, or even invest in becoming more profitable as a business. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period.

Predict ability to pay debts and dividends. Describe the three basic types of cash flow activities. This chapter discusses the purpose of the statement of cash flows, the steps in preparing the scf, as well as how to interpret various sections of the statement of cash flows.

For example, depreciation is recorded as a. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. The statement of cash flows explains the difference between beginning and ending balances of cash and cash equivalents.

Predict the ability of a company to pay debts and dividends. The cfs measures how well a. What is a cash flow statement?

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)