Awesome Tips About Retained Earnings Statement Formula

Give the heading to statement.

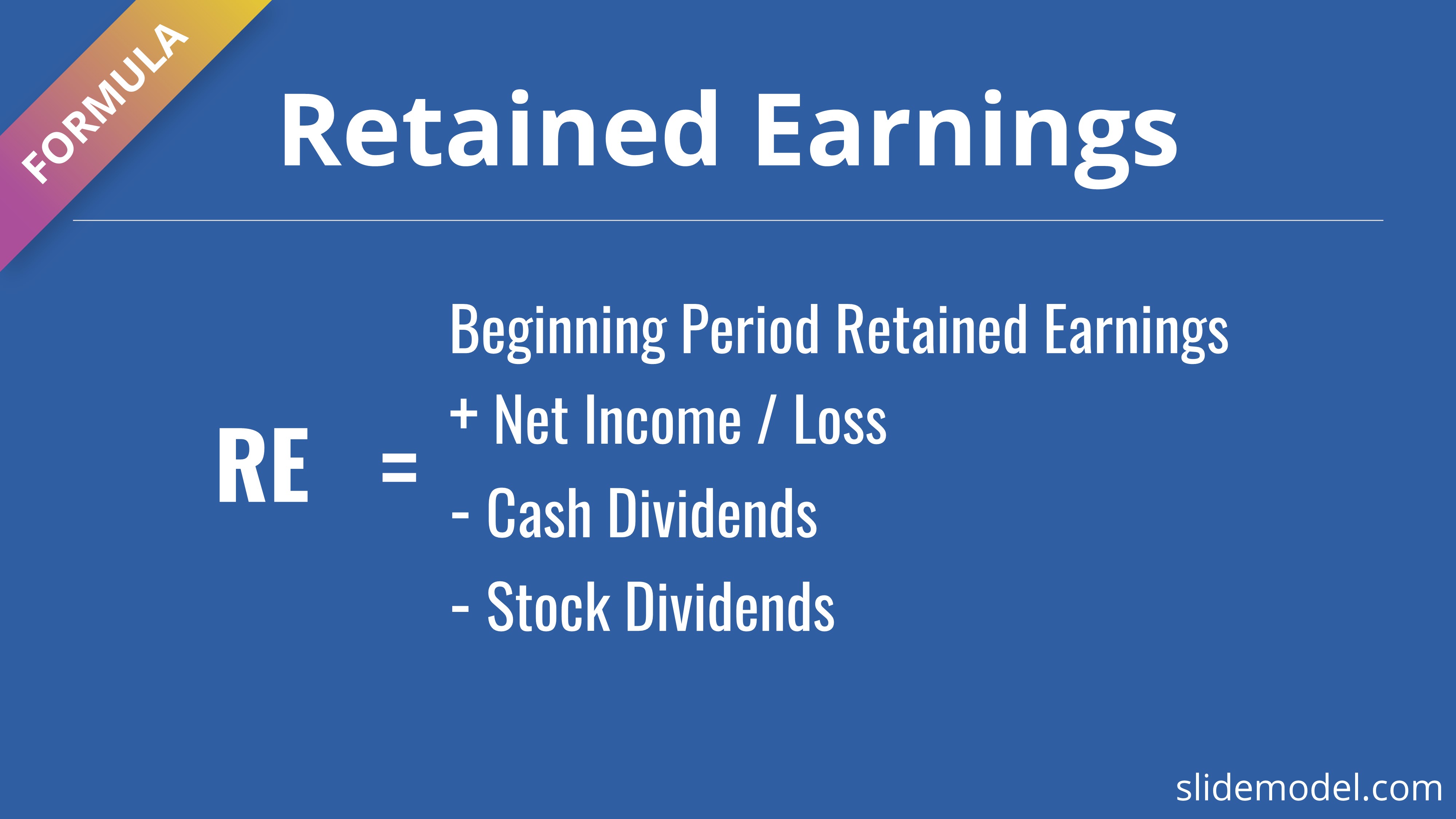

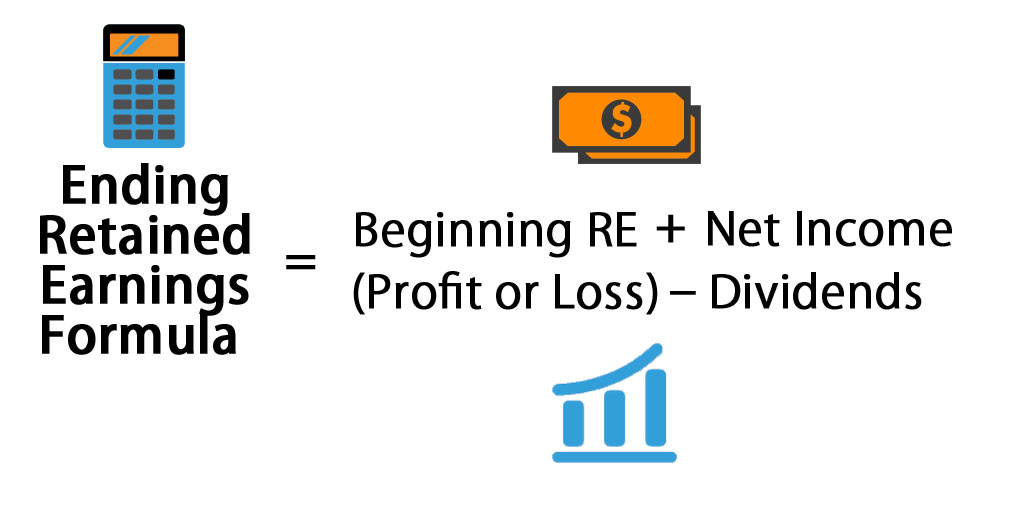

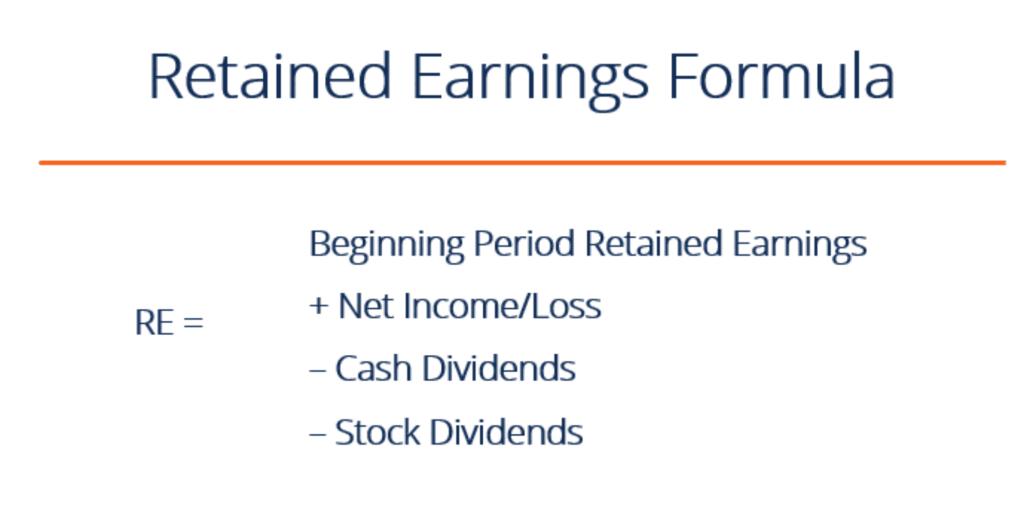

Retained earnings statement formula. The formula is as follows: Retained earnings are calculated by subtracting distributions to shareholders from net income. The retained earnings formula provides a way to calculate a company's retained earnings at the end of a specific period:

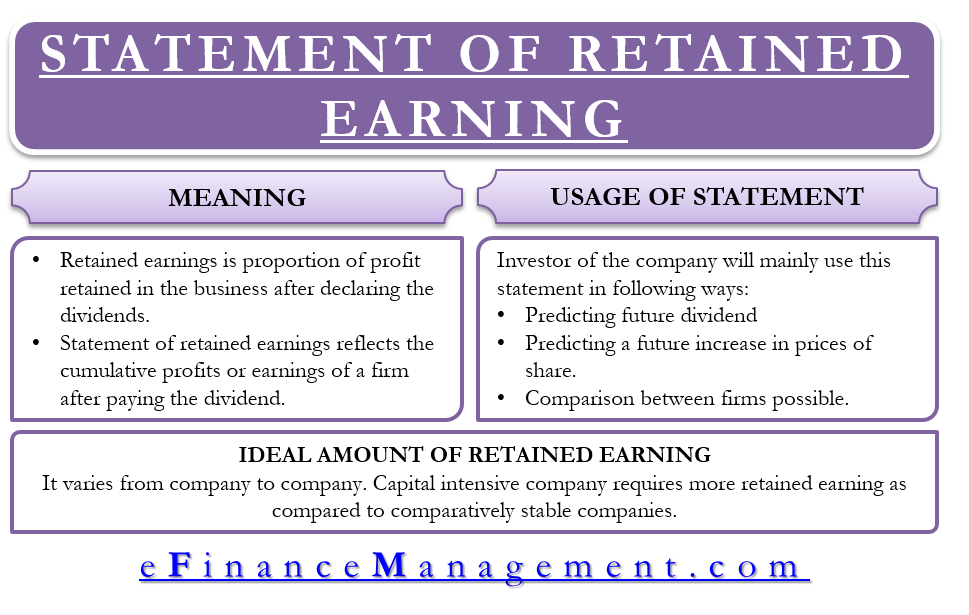

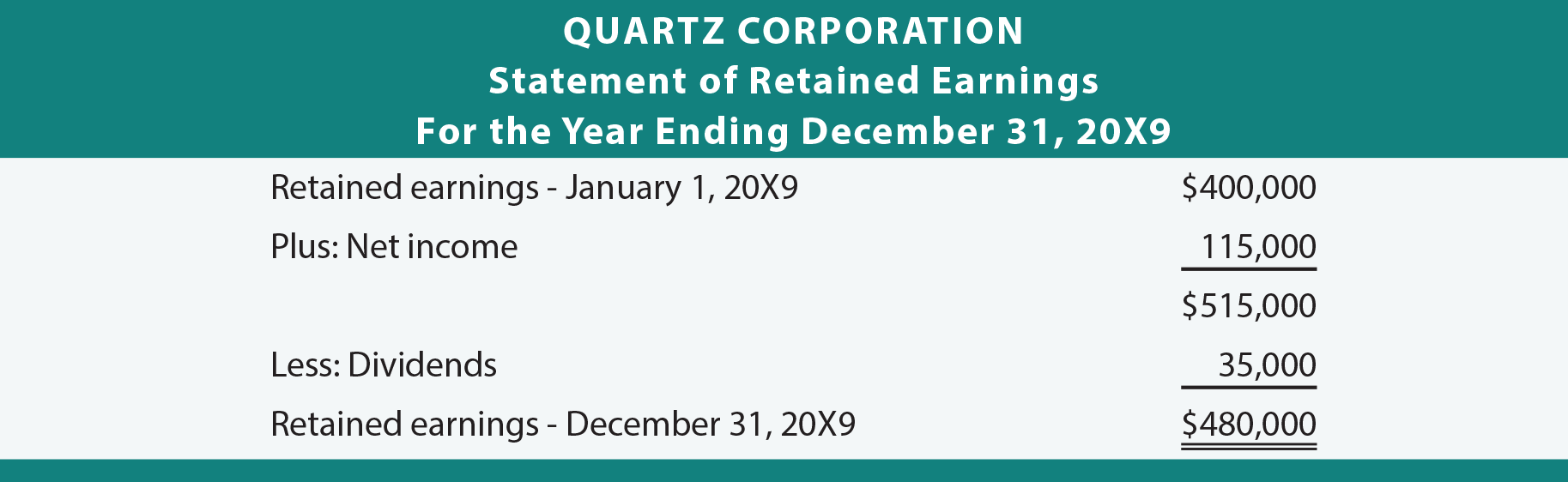

What is retained earnings? How do you prepare a retained earnings statement? Beginning retained earnings corrected for adjustments, plus net income, minus dividends, equals ending retained.

The retained earnings calculation or formula is quite simple. Retained earnings are the portion of profits set aside to be reinvested in your business. Gather your financial statements and ensure all figures are correct before using the retained earnings formula.

The structure/formula of the statement of retained earnings is: Starting retained earnings + loss dividends. The formula to calculate retained earnings is:

Activities what is retained earnings in simple words? The formula for the statement of retained earnings is: Learn how to calculate them using a simple formula, find them on your.

The retained earnings formula is fairly straightforward: Retained earnings formula and calculation. Retained earnings (re) are created as stockholder claims against the corporation owing to the fact that it has achieved profits.

In simple terms, retained earnings are the net profits that a company has earned since it began. The formula to calculate retained earnings is: The re formula is as follows:

A statement of retained earnings is a financial statement that shows how the retained earnings have changed during the financial period and. Like all other equity claims, re. A company reports retained earnings on a balance sheet under the shareholders equity section.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)