Best Of The Best Info About Deferred Income Tax In Cash Flow Statement

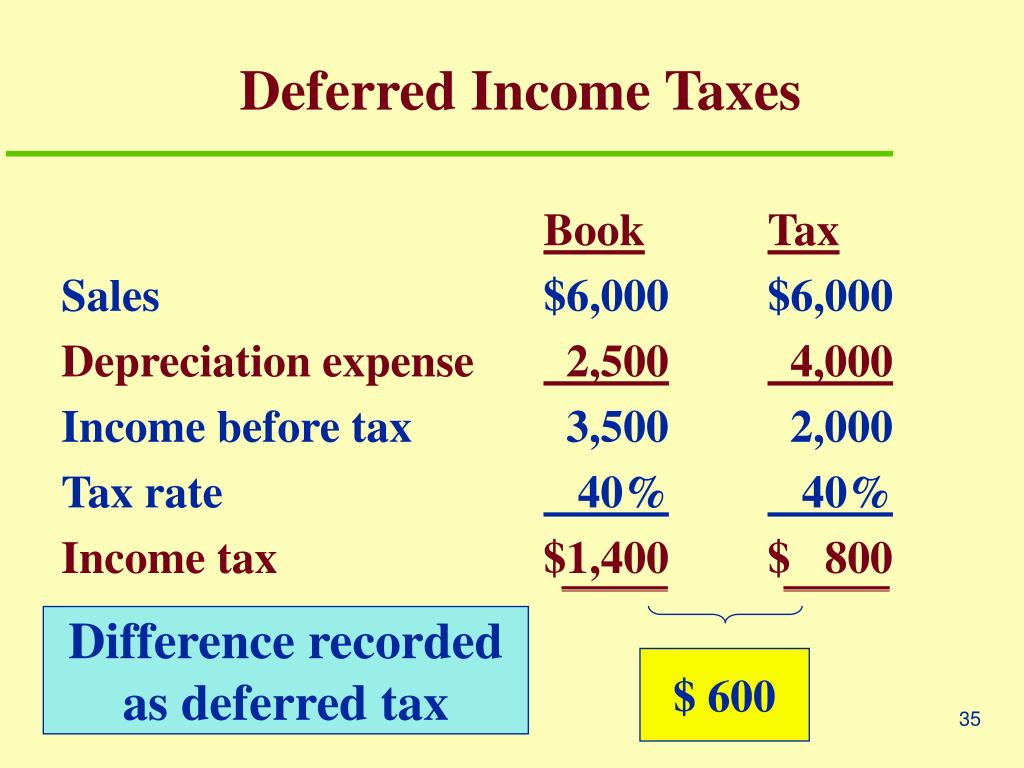

Deferred income taxes in a company’s consolidated balance sheet and cash flow statement is an easy concept in principle, but when deferred income tax.

Deferred income tax in cash flow statement. Whether you’re providing subscription boxes or selling digital software, your business could end. If we prepare a statement of cash flow using. Unrealized foreign currency transaction gains or losses;

Adjustment accrual and deferred taxes are recognized to account for the future income tax payments and/or receipts. May help the directors to manage their cash flow better and ensure they have enough cash to pay tax bills once the deferred tax ‘turns into’ current tax. Therefore, it is not presented in the cash flow under the direct method.

Adjustments for cash flows from investing and financing activities recognized. The amount of taxes your company paid for the accounting period goes on the cash flow statement. If you paid $30,000 during the last quarter and accrued a total.

A video tutorial designed to teach investors everything they need to know about deferred income taxes on the cash flow statement.visit our free website at ht. A high level of deferred revenue can have a significant impact on cash flow. We also conclude that the partial allocation method should be.

It represents the difference between the company’s book taxes.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)