Exemplary Info About Profit And Loss Suspense Account Financial Accounting Balance Sheet Example

Example hania is in partnership with sohaib.

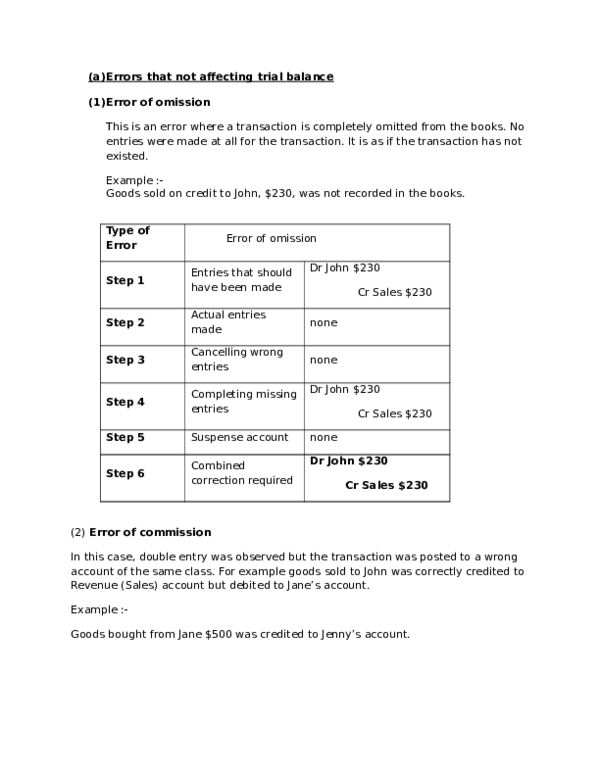

Profit and loss suspense account financial accounting balance sheet example. Suspense account examples. Of these three statements, two are commonly confused: Amanda cameron | oct 26, 2022 sometimes, you don’t have all the necessary information for accounting.

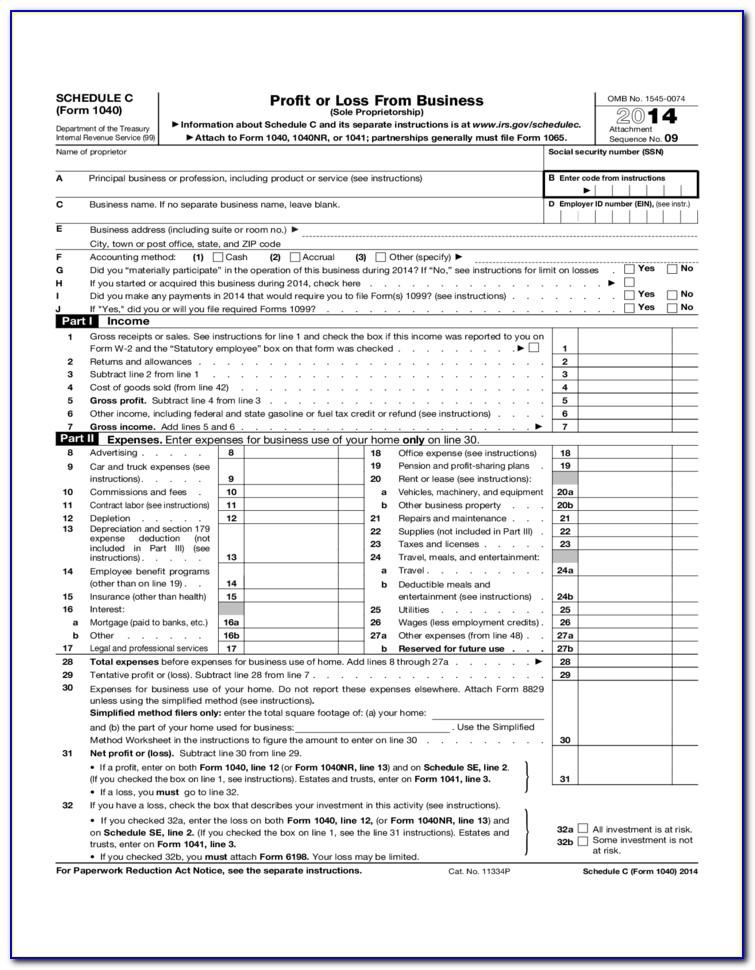

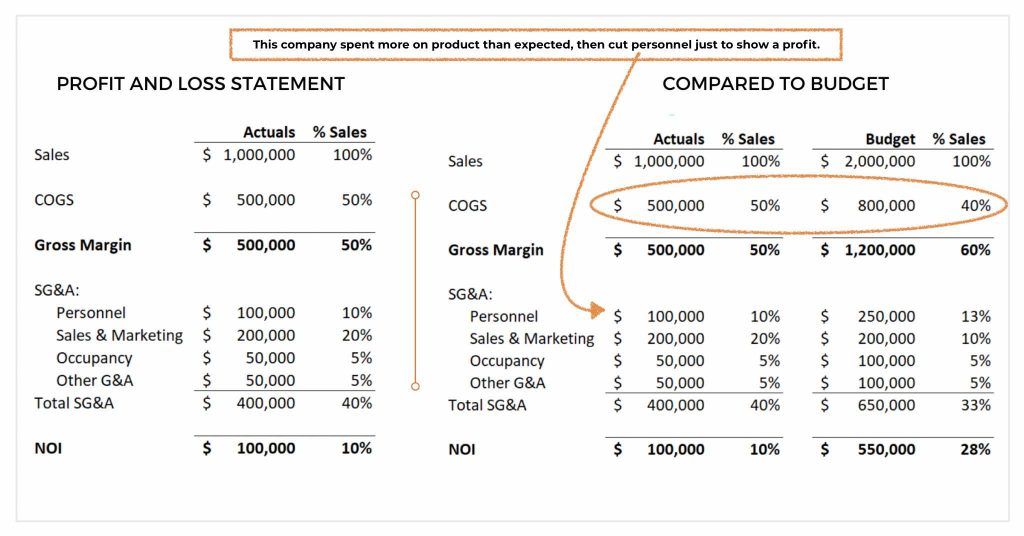

Following is the profit and loss account of pqr for the year ending dec 20yy in the above example, the debit total is 20,000, and the credit total is 10,000. Use a suspense account when you’re not sure where to record general ledger entries. By quickbooks july 13, 2022 when looking at your financial statements, there are three main types that you will issue on a regular basis:

The business uses suspense account accounting when it cannot determine the correct classification at the time of posting. A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a. Below are a few examples of the items on a typical balance sheet.

Its operating expenses consist of cost of sales, fulfillment, marketing, technology, g&a, and others. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

Hence, it verifies the arithmetical accuracy of the postings in the ledger accounts. Calculation of profit and loss suspense a/c. A suspense account is the general ledger account that the company uses for recording transactions temporarily.

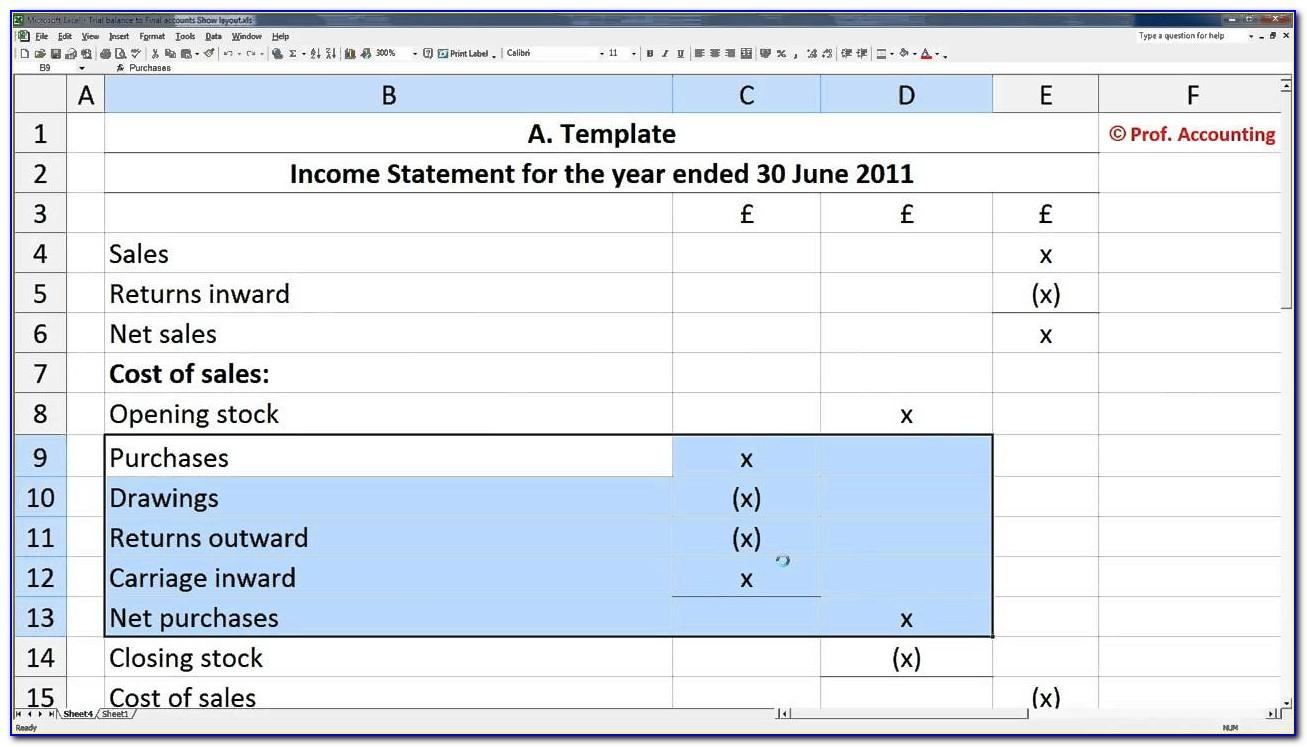

Each suspense account implies a reconciliation rule, because at the end of the period its net balance should be zero. Factory wages easily done the wrong way round The profit and loss statement, abbreviated as p&l, is a financial statement that summarises revenues, expenditures, and expenses incurred during a specific time period, generally a fiscal year.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. Example example 2 profit and loss account faqs. Amazon breaks down its total revenue into product sales and service sales.

As a result, the trial balance will be invalidated. Share of retiring/deceased partner is calculated on the basis of proportionate profit. It adds up your total revenue, then subtracts your total expenses, and gives you your net income.

When recording those transactions, the accountant may be unsure of the type of account most appropriate to record those transactions. It is prepared to determine the net profit or net loss of a trader. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies.

In case a suspense a/c is not closed at the end of an accounting period, the balance in suspense account is shown on the asset side of a balance sheet if it is a “debit balance”. For example, if a customer of a business makes a payment but writes down their account number incorrectly, that money may be parked in a suspense account until the error is corrected and. The p&l statement corresponds to the income statement.