Fantastic Info About Calculating Operating Activities Cash Flow

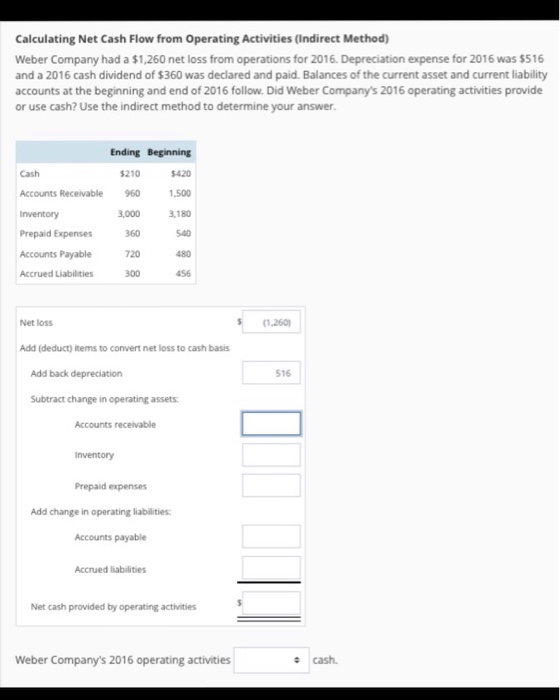

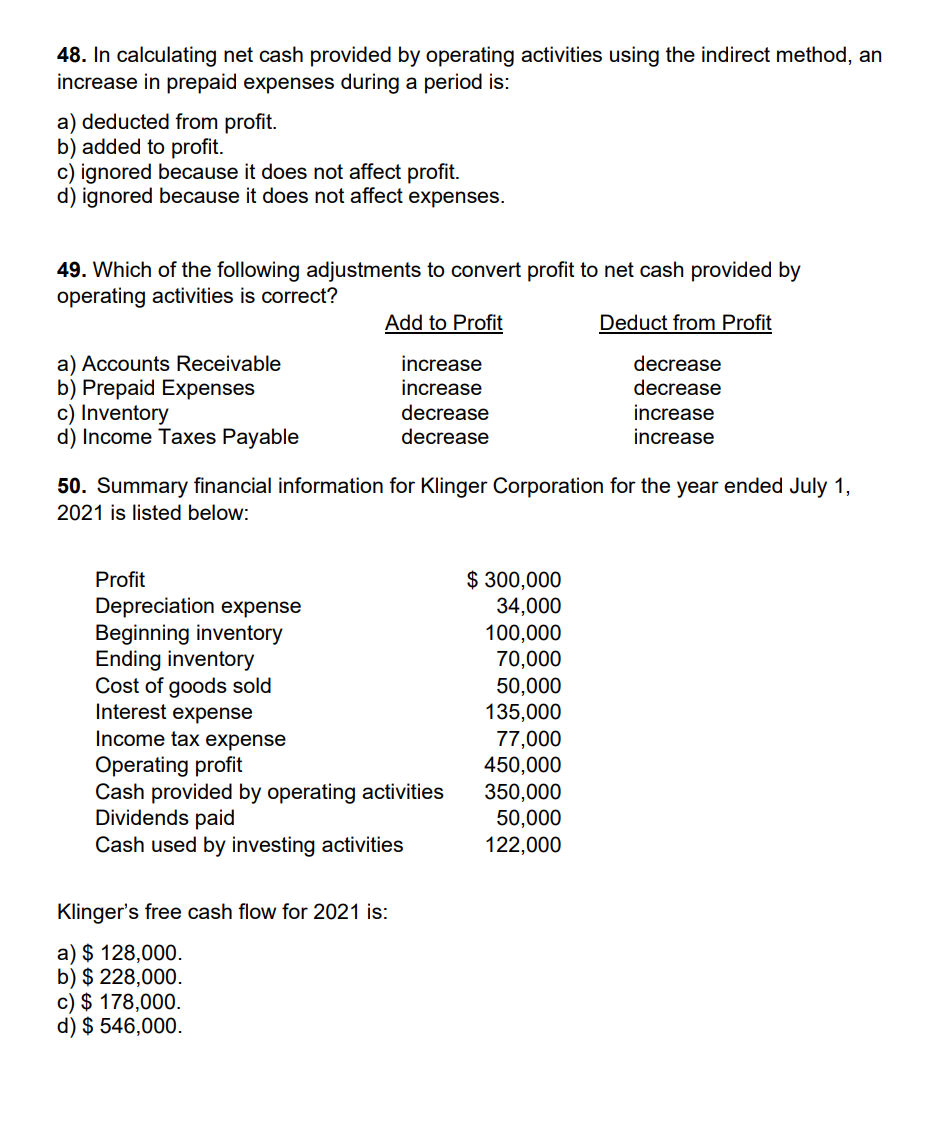

The calculation for ocf using the indirect method uses the following formula:

Calculating operating activities cash flow. How the cash flow statement is used the cash flow statement paints a picture as to how a company’s. Direct method under the direct method, the information contained in the company's accounting records is used to calculate the net cfo. How to calculate cash flow from operating activities there are two methods to calculate cash flow (via a cash flow statement):

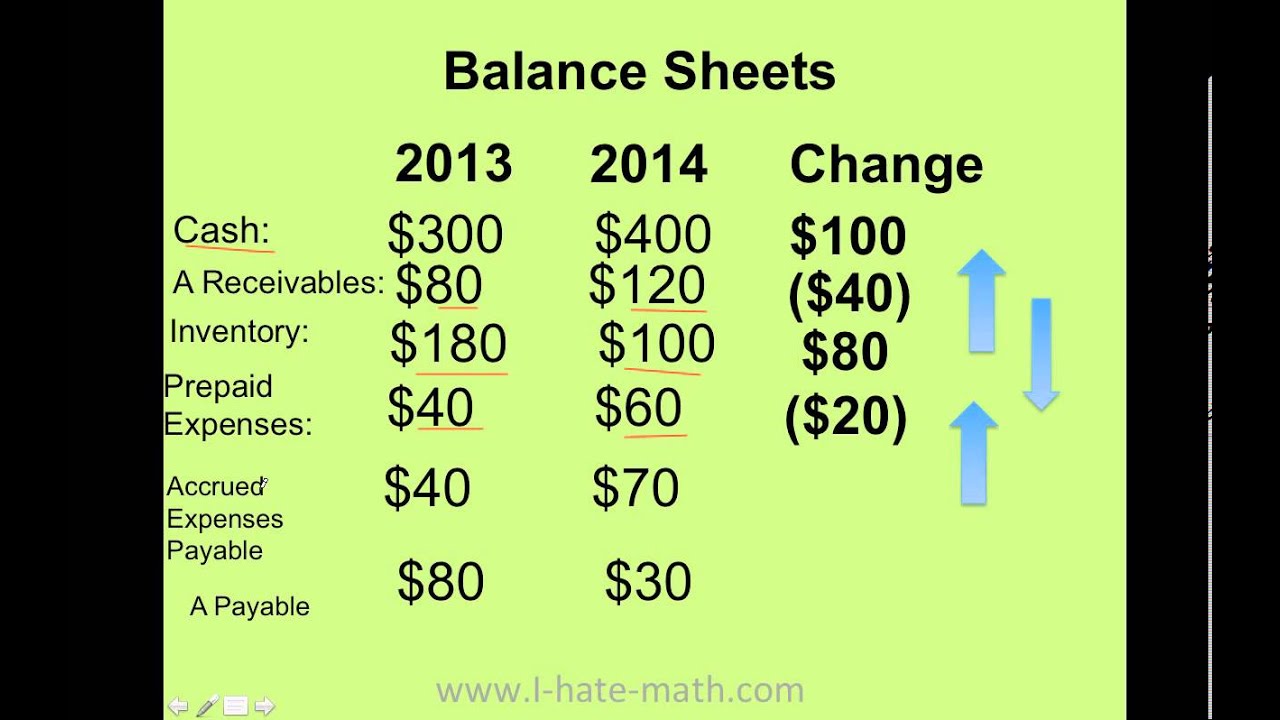

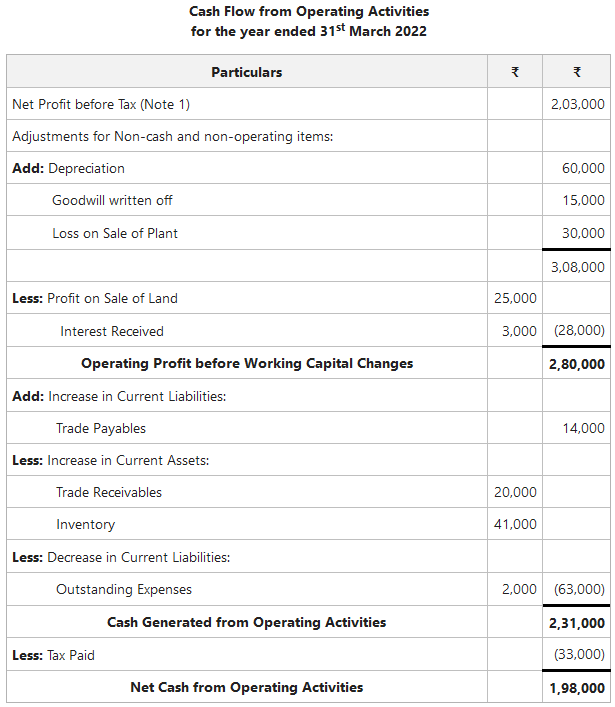

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year; Cash flow from operations ratio.

Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Cash flow from operating activities = net income + depreciation, depletion, & amortization + adjustments to net income + changes in accounts receivables + changes in liabilities + changes in. The calculated operating cash flow (ocf) will be displayed, representing the cash generated or.

Cash flow from operating activities is the first of the three parts of a company's cash flow statement. Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service. The two methods of calculating cash flow are the direct method and the indirect method.

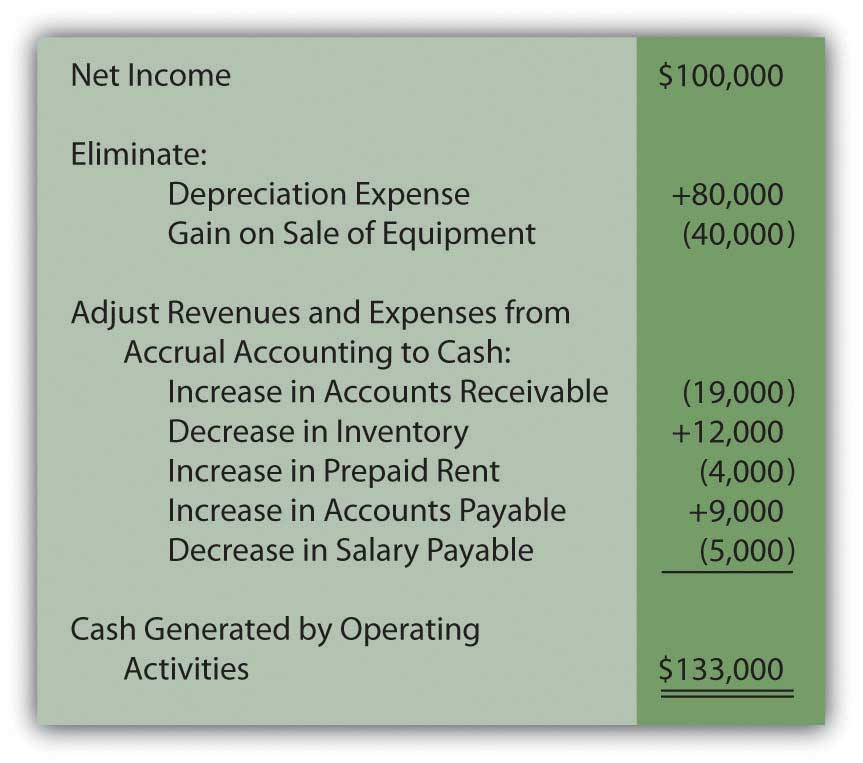

These operating activities may include: Start calculating operating cash flow by taking net income from the income statement. But as it does not provide much detailed information to the investor, companies use the indirect method of ocf.

Another key figure is cash flow from operations ratio. Begin with net income from the income statement. Key takeaways operating cash flow is an important quantifier of a company's financial health.

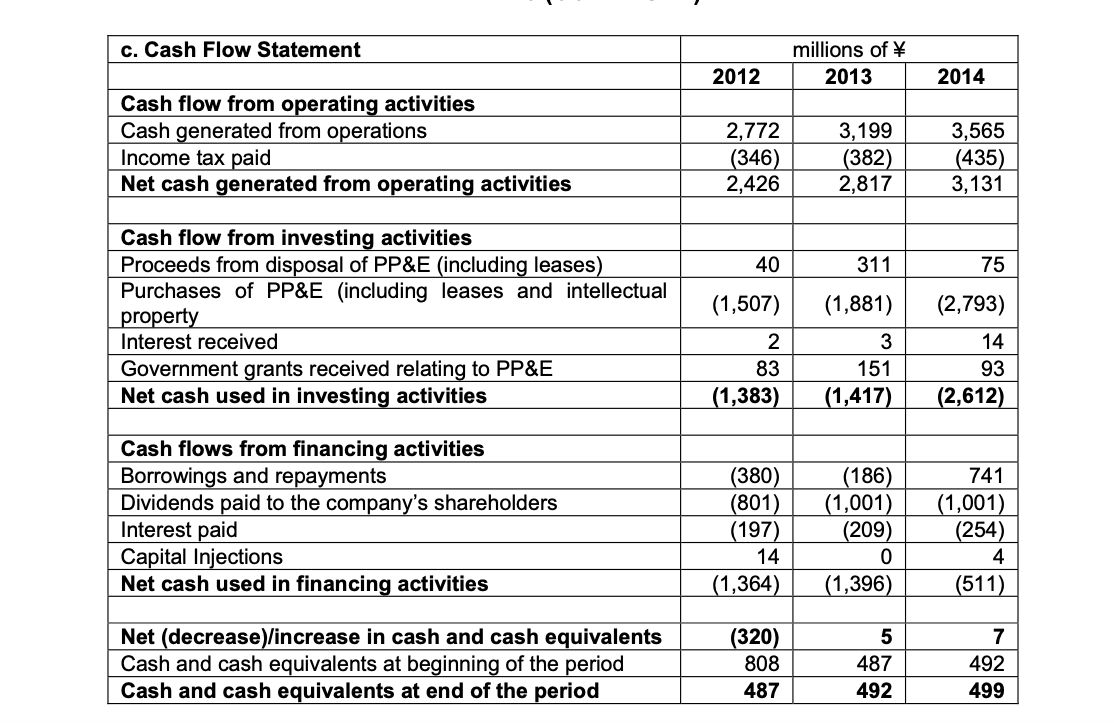

Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. The transactions of a cash flow statement are categorised into three activities; Add back noncash expenses, such as depreciation, amortization, and depletion.

It represents the amount of cash a company spends or earns from carrying out its operating activities over a period. Namely, cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Operating cash flow formula:

The format shown below can be used. In contrast, a cash flow statement is a broader financial document that includes cash flows from investing and financing activities as well. The direct method of calculating operating cash flow tracks all transactions as cash during a financial period.

Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Businesses can calculate the net cash flow from operating activities (cfo) using: Cash flow from operations = net income + depreciation + amortisation + adjustments to net income + changes in accounts receivable + changes in accounts payable + changes in inventories + changes in other operating activities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)