Great Tips About Form 26as And 16

Form 26as reflects only the tds details mentioned in form 16.

Form 26as and form 16. Form 16 or 16a are provided by employer to employee as a proof of tax deduction. As we have seen above, form 16 and form 16a are used by the employer for tds deduction. Ensure that you have received the correct.

The information in form 26as should match with form 16. One should reconcile the figures in form 16 issued by the deductor with form 26as. Difference between form 16 and.

Between forms 16 and 26as. Every salaried individual who falls under the taxable bracket is permitted for form 16. Waiting for the final updates minimizes the chances of mismatches between form 16 and form 26as.

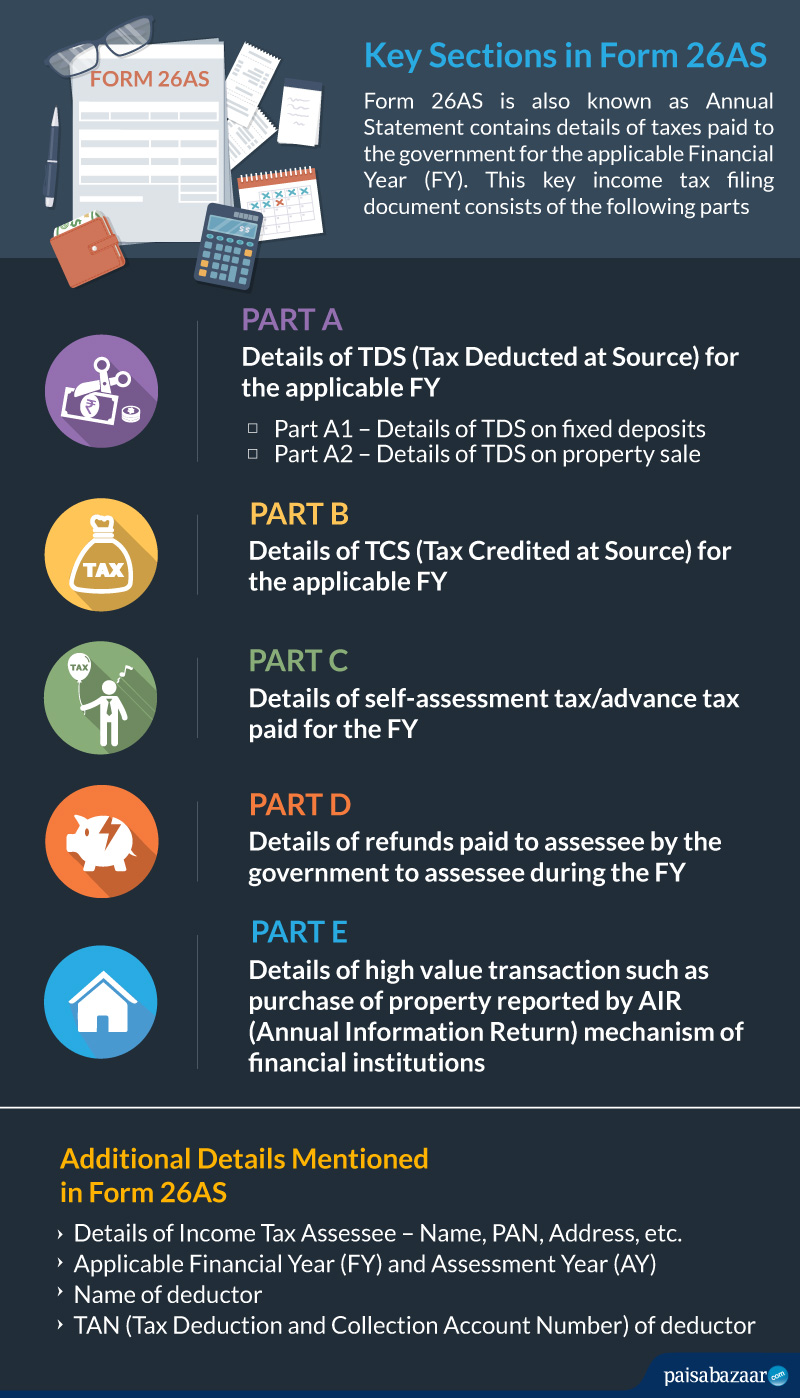

Usually, it could be institutions or banks from. The employer is not obligated to provide this form if an employee does not fall. Compare the tax deduction details in part a of form 16 with the information in your form 26as and annual information statement (ais).

One of the key bits of information available from form 16 part a is a detailed record of the tds deposits made. It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Log in to your account using your pan.

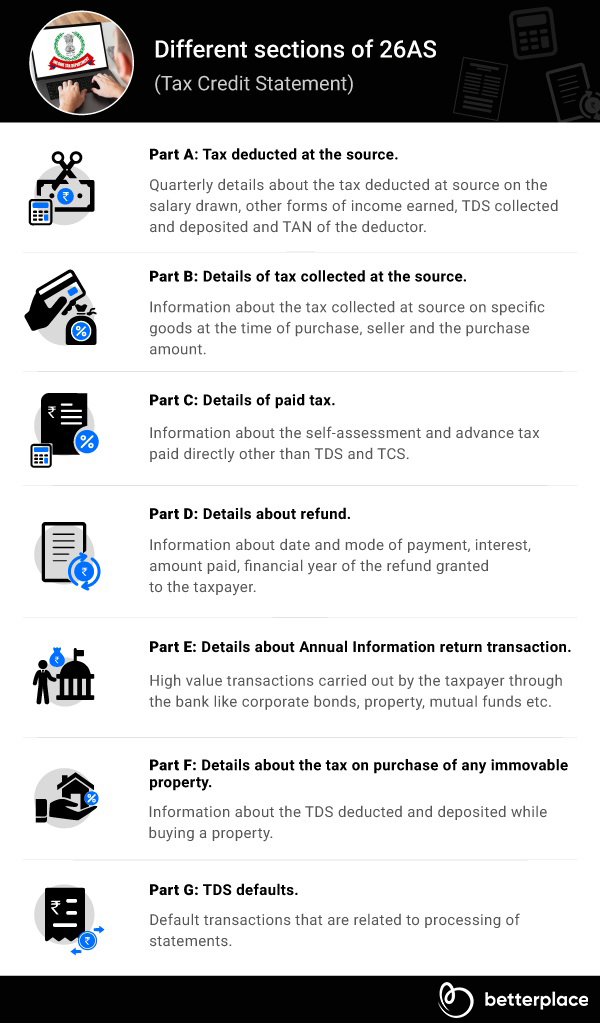

This form documents the records regarding the details related to tax deducted at source by different people. It is important to note that ais is the extension of form 16as. Can be verified online in the traces to check if the deductions by the employer are reflected in.

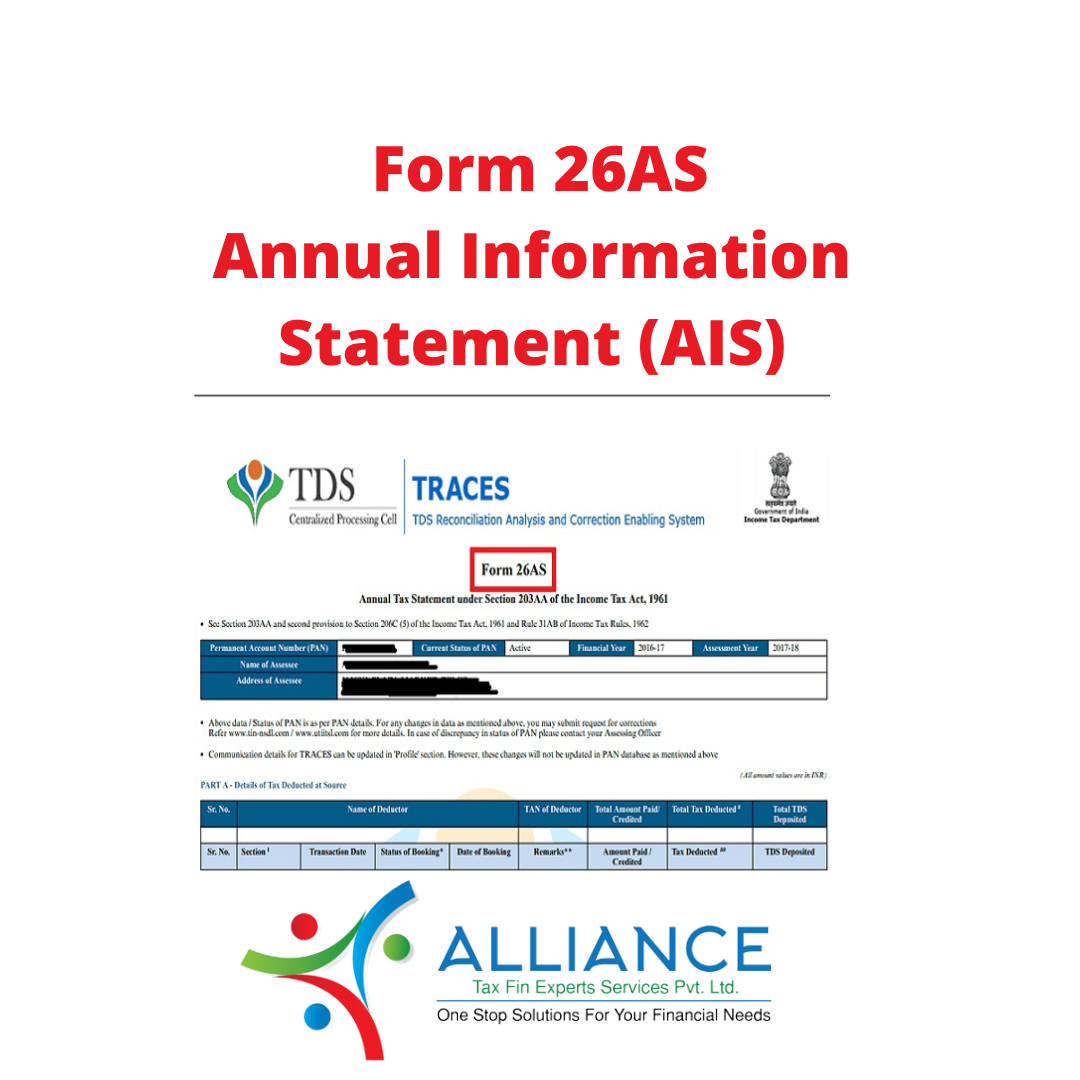

Are form 26as and form 16 the same? Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. If you fail to match all your actual financial transactions with form 26as and form 16 before filing income tax returns, and discrepancies are subsequently noticed,.

Is there a connection? The question arises between form 26as and ais which is more important for itr filing? Information on the tax that deductors (employer, bank, etc.) have taken out for taxpayers is included on form.

Part b of form 16: At the end of the financial year, tax payers file their income tax returns (itr). Enter the captcha code and click on proceed. step 4:

Form 26as is a consolidated tax.