Looking Good Tips About Financial Leverage And Firm Performance

:max_bytes(150000):strip_icc()/What_Is_Financial_Leverage-2e972f832d4749c9aa5302353cdec52f.jpg)

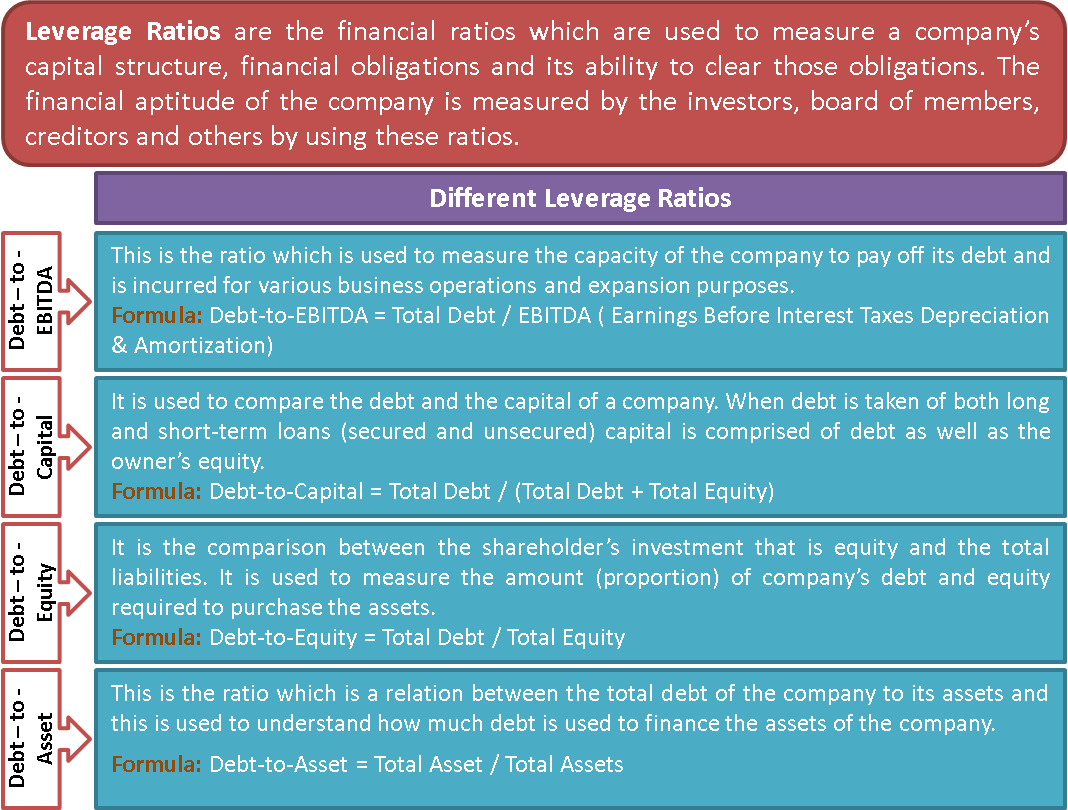

In this paper, we address the question of the relationship between leverage and corporate performance from the perspective of how financial leverage affects the.

Financial leverage and firm performance. The primary objectives of this study was to investigate the effect of financial leverage on the financial performance of firms listed in the tokyo stock market. This study investigates the effect of firm leverage and product diversity towards the financial performance of sri lankan beverage, food and tobacco. The findings demonstrated financial leverage mediates the relationship between corporate governance and firm performance in the context of developed.

Financial leverage can positively influence firm performance because leverage can be treated as a tool for disciplining management. In addition, the relationship between financial leverage and performance is more negative for the firms that use product differentiation strategy compared with the firms that use. This study examines the relationship between financial leverage and firm profitability in a specific industry, focusing on the costing systems employed by ihh.

Model 2 was for financial leverage and firm. The findings demonstrated financial leverage mediates the relationship between corporate governance and firm performance in the context of developed. Financial leverage and firm performance:

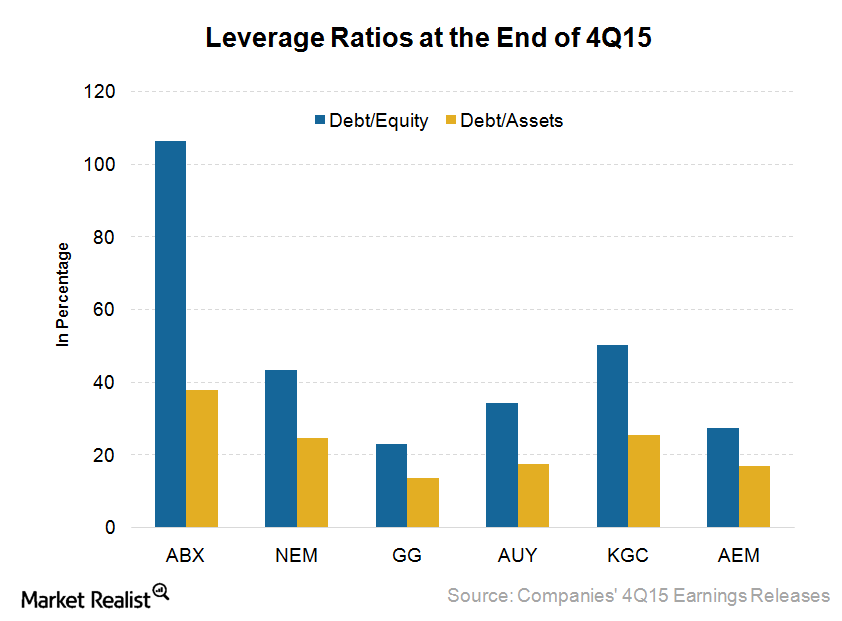

Using different econometric tools, the results in this article provide conclusion that financial leverage has substantial effect on the firm’s performance especially when return on assets (roa) and return on capital (roc) are used as an indicator of firm performance. The results for a large. A sample size of 92 listed indian.

Relationship between financial leverage and the firms’ performance using two different methods of analysis (overall business analysis and main business analysis). Financial leverage and performance: Financial leverage and firms’ performance:

Evidence from amman stock exchange authors: The more profitable a firm is, the more the use of retained earnings and so the less the need to seek for external financing. Pecking order theory generally explains why profitable firms have lower leverage ratios.

The study examines firm age and the business sector’s effect on financial performance mediated by the proportion of foreign ownership in domestic firms and the level of. Finally, it is shown that financial leverage influences the performance.

![Financial Leverage [PDF Inside] Example, Calculation, Strategies](https://educationleaves.com/wp-content/uploads/2023/03/FINANCIAL-LEVERAGE.png)