Brilliant Tips About Bank Efficiency Ratio Formula

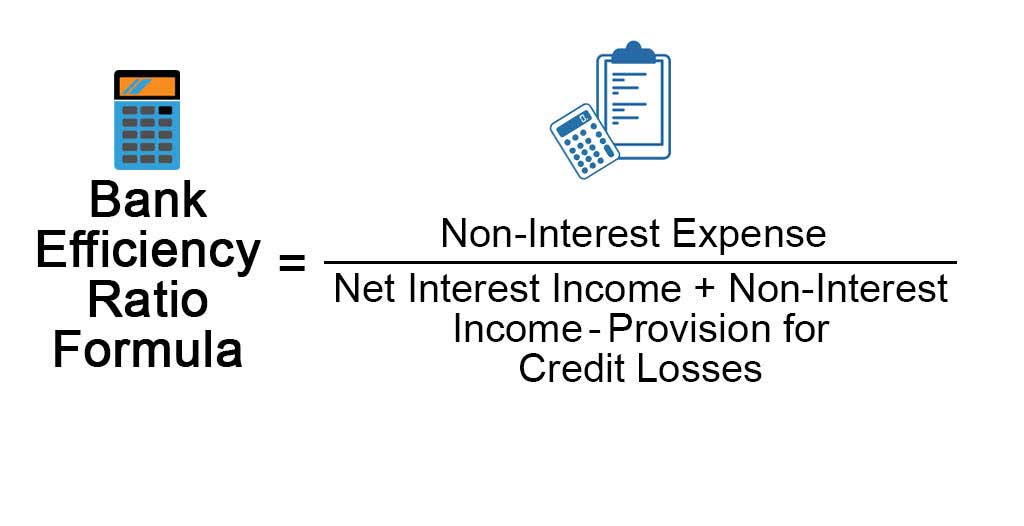

Learn how to calculate the bank efficiency ratio, a measure of a bank's overhead as a percentage of its revenue, using the formula:

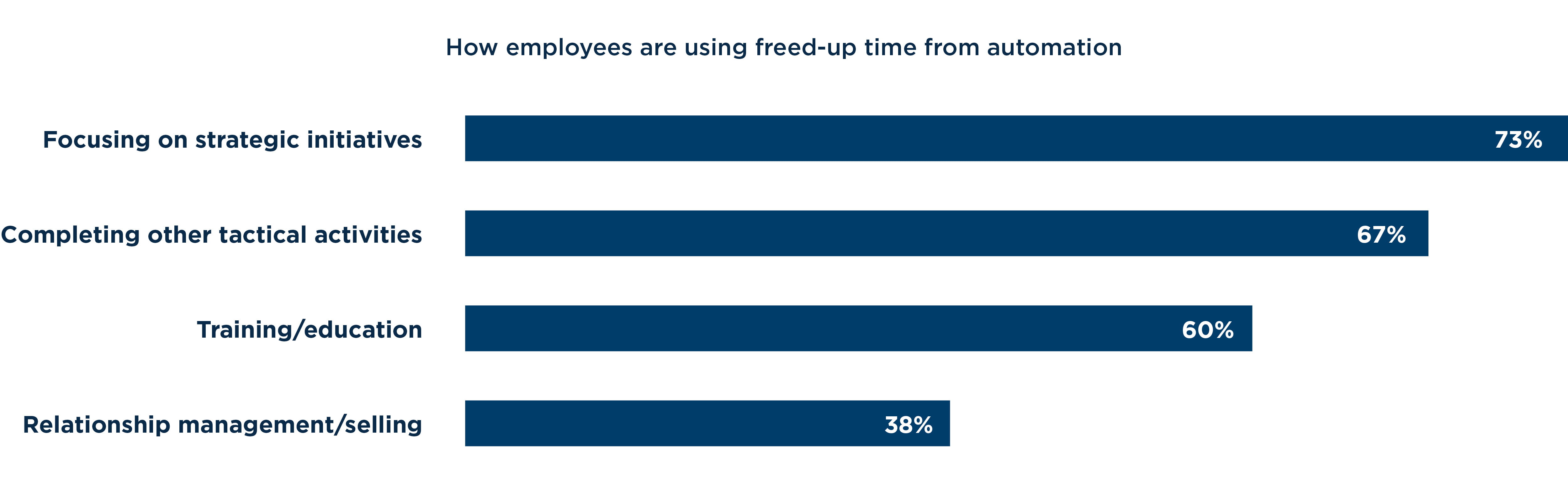

Bank efficiency ratio formula. The efficiency ratio formula is a financial metric used to measure the efficiency of banks. The formula for the bank efficiency ratio is as follows: One of the key benefits of using the efficiency ratio formula is that it allows banks to identify areas where they can improve efficiency.

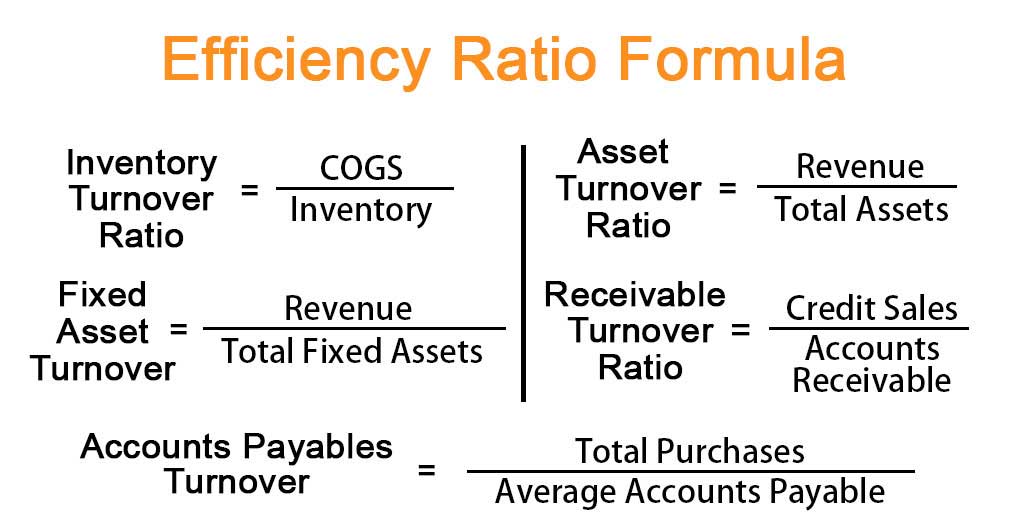

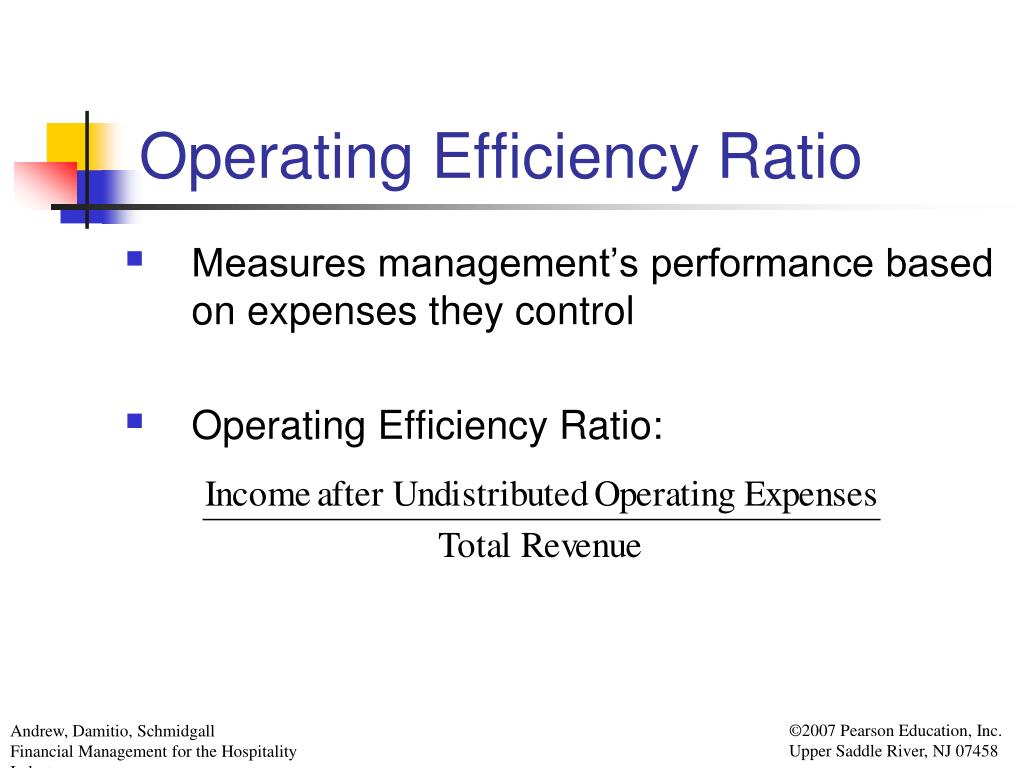

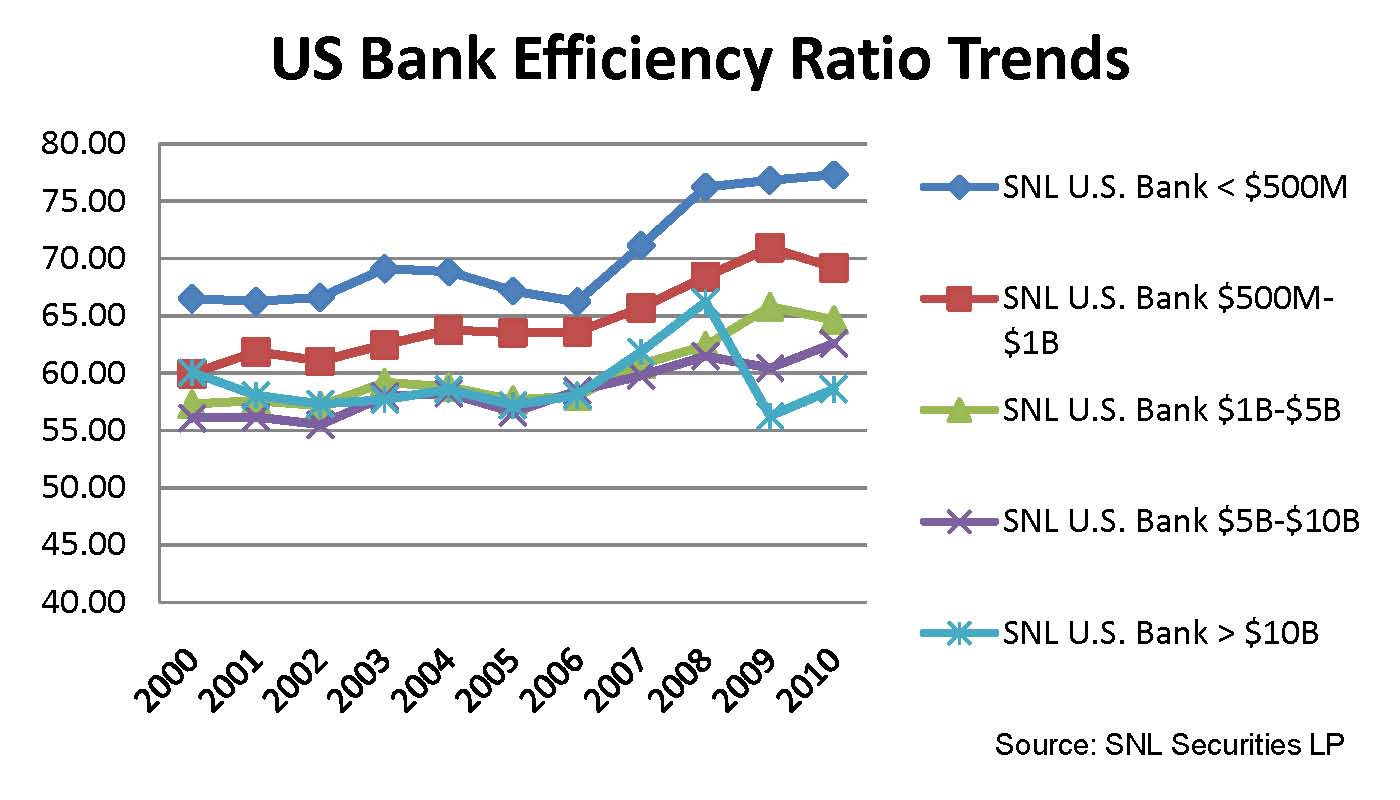

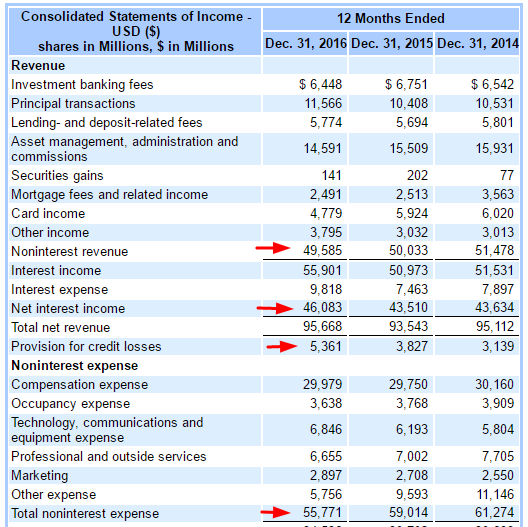

The bank efficiency ratio is a key performance metric used to assess a bank’s profitability. Explanation of efficiency ratios formula example #1 example #2 example #3 example #4 relevance and uses asset turnover ratio = sales / average total assets. If expenses are $60 and revenue is $80 (perhaps net of.

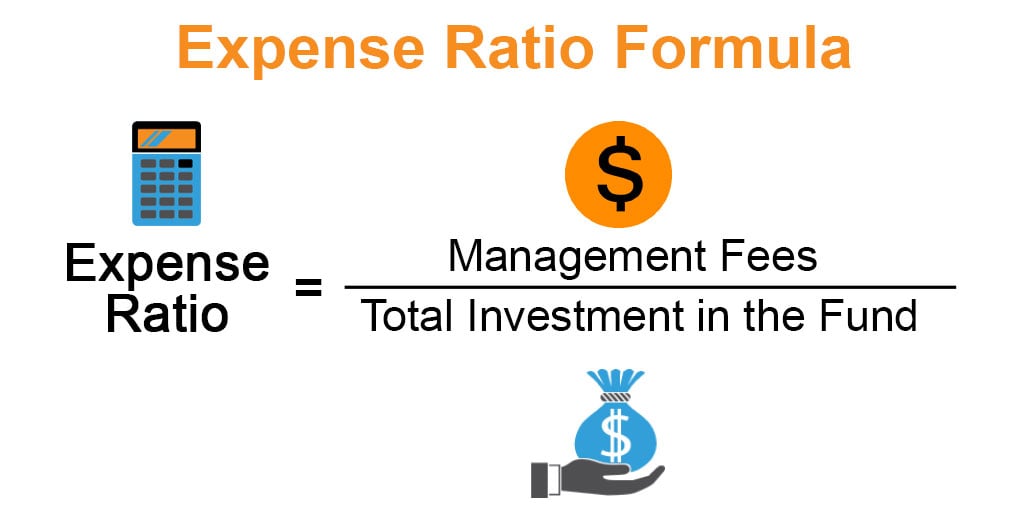

The efficiency ratio is calculated using a simple formula that divides a financial firm’s operating expenses by its net operating income or revenue. It calculates the amount of expenses required to generate each dollar in revenue,. Definition efficiency ratio in finance refers to a measure of a company’s ability to utilize its assets and liabilities to generate income, often used in banking sectors.

The formula for calculating the efficiency ratio for banks is as follows. The efficiency ratio is calculated by dividing the bank’s noninterest expenses by their net income.banks strive for lower efficiency. The efficiency ratio shows the operating cost incurred to earn each dollar of revenue, and it varies across banking firms.

Average net fixed assets = (opening net fixed asset + closing net fixed asset) / 2. By analyzing their expenses and. Definition of efficiency ratio.

The formula to calculate average net fixed assets is as below: It is calculated by dividing a. How profitable is your bank?

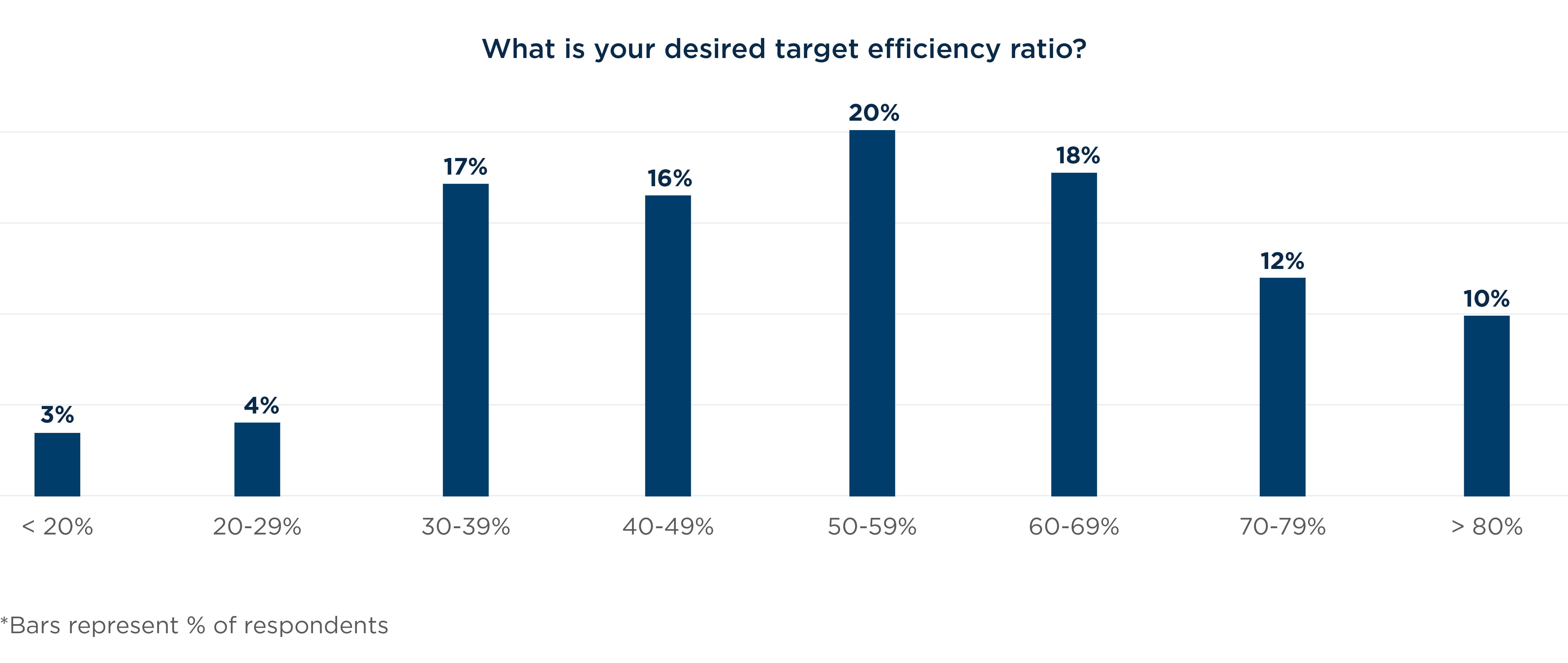

What is the “bank efficiency ratio”?