Unique Info About Account Consolidation Meaning

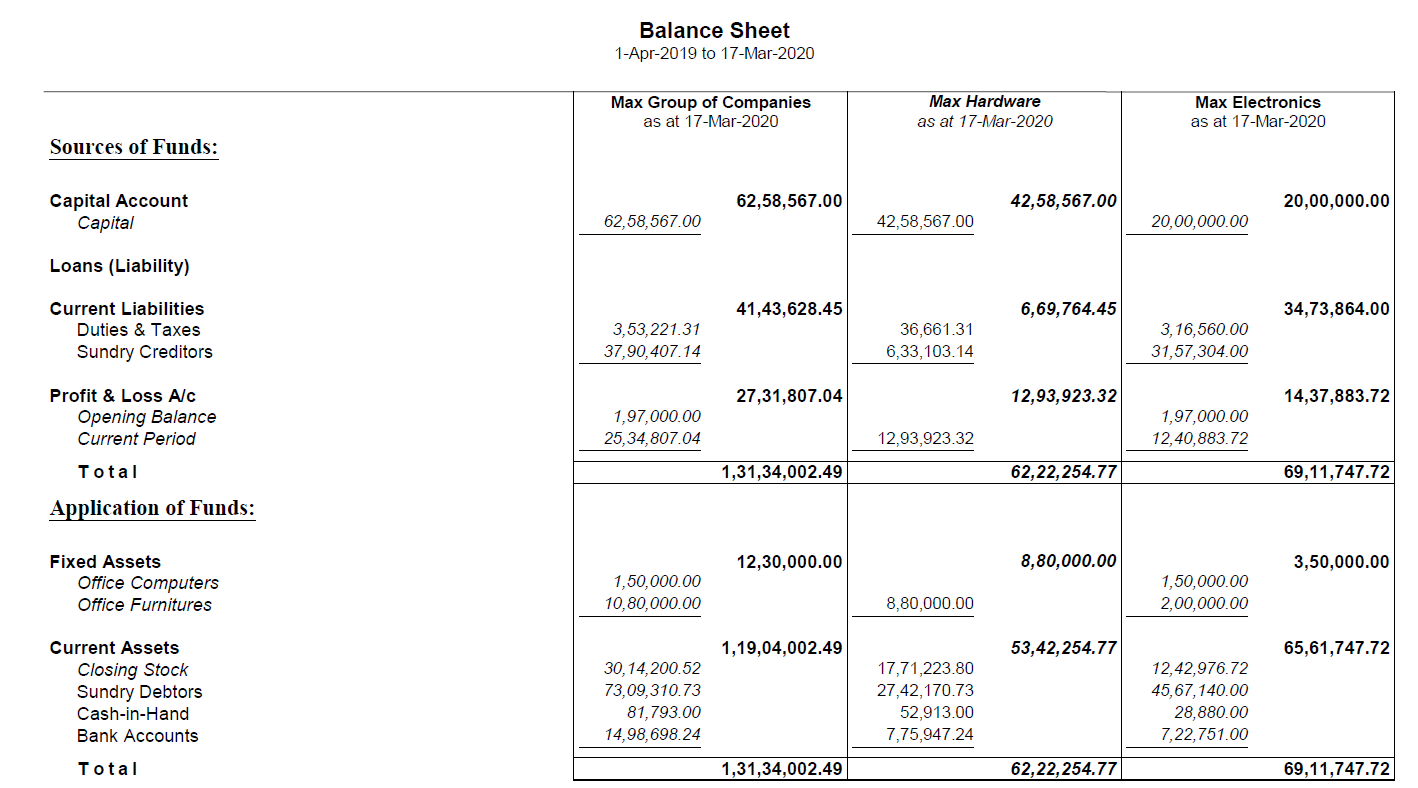

The consolidated accounts combine all the information from the subsidiaries under the parent’s control.

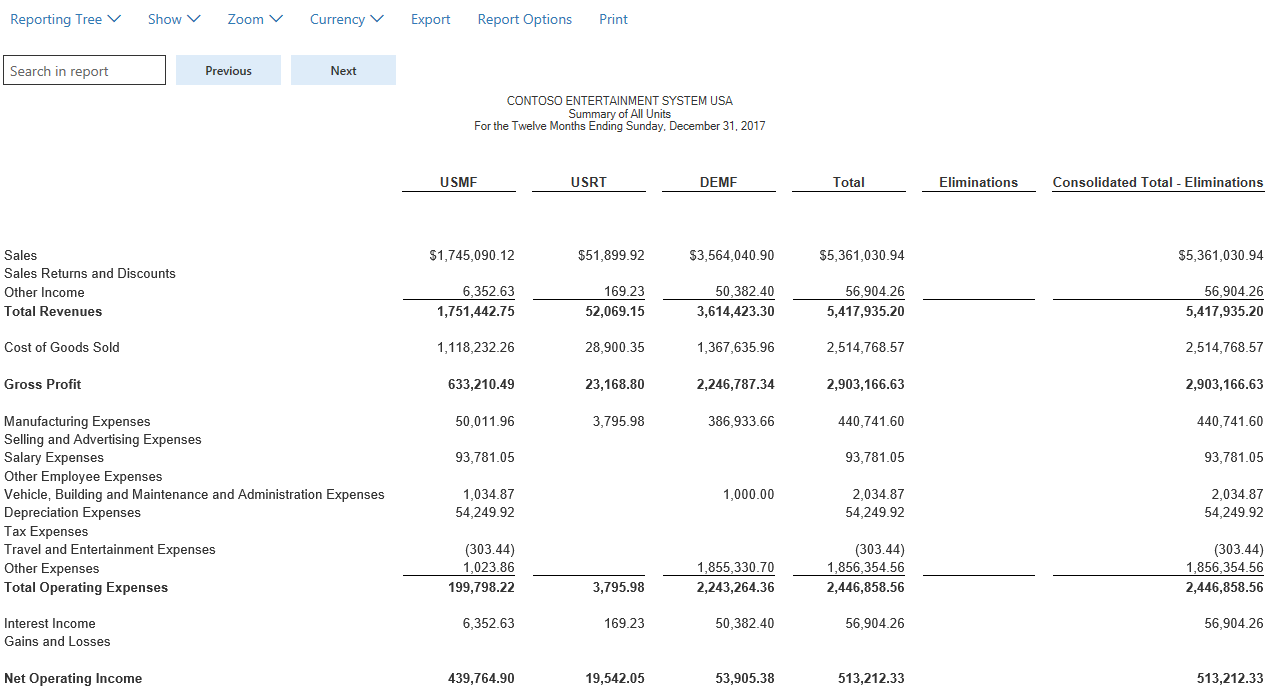

Account consolidation meaning. Consolidation accounting is a process whereby financial reports of subsidiary companies are put together and then combined with those of the parent company. To consolidate (consolidation) is to combine assets, liabilities, and other financial items of two or more entities into one. Under us gaap, there are two primary consolidation models:

On the radar briefly summarizes emerging issues and trends related to the accounting and financial reporting topics addressed in our roadmaps. This method is typically used when a parent entity owns more than. A consolidated financial statement ( cfs) is the financial statement of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity , according to international accounting standard 27 consolidated and separate financial stateme.

In the context of financial accounting , consolidation refers to the aggregation of financial statements of a group company as consolidated financial statements. A set of accounts that combines the financial results of a group of companies, rather than showing the results of each company separately: The process in which amounts or sets of numbers are added together to form a single amount, statement, etc.:

In accounting, consolidation is a fundamental idea. Both require the reporting entity to identify whether it has a “controlling. Group accounts report the underlying commercial reality of the effective control of the parent.

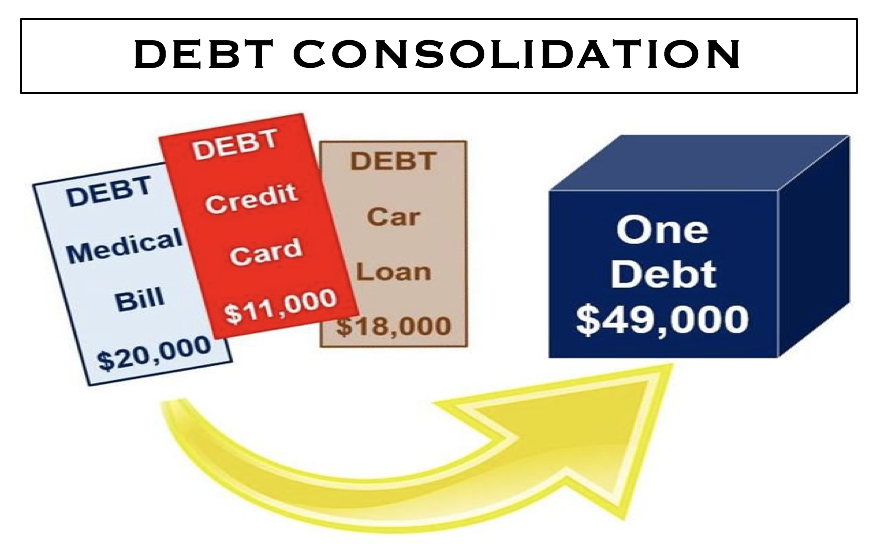

There is no objection in principle to the consolidation of bank. By itself, the term “consolidation” simply means to put things together. Consolidation is generally interpreted as market indecisiveness, which ends when the asset’s price moves above or below the trading pattern.

In financial accounting, consolidation is defined as a set of statements that presents (consolidates) a parent and subsidiary company as one company. According to the federal reserve bank of new york, total household debt in the us has risen more than 24% since before the pandemic in 2019 and now sits at $17.5 trillion. In financial accounting, this can relate to things like assets, liabilities, and other financial items from more than one company or subsidiary.

(1) the voting interest entity model, and (2) the vie model. The diagram below shows an example of a typical group structure: Consolidation is the combining of all the assets, liabilities, revenues and expenses of a parent and all its subsidiaries under one group set of accounts as if it were a single entity.

Consolidated financial statements are produced when control has been achieved by a holding company. Business consolidation is a combination of several business units or companies into a single, larger organization. In business, consolidation or amalgamation is the merger and acquisition of many smaller companies into a few much larger ones.

This process helps businesses learn more about their assets, debts, and other financial information. How does the term consolidate relate to accounting? Here we show you what consolidation involves, how it is done and what it means for companies.

It means combining two or more separate things into one more significant thing. Consolidation accounting is a method of accounting used when a parent company owns subsidiaries (from 20% to upward of 50 %). In financial accounting, the term consolidate often refers to the.

:max_bytes(150000):strip_icc()/TermDefinitions_Consolidate_colorv1-a3c1be00e6344ca7b265869d516bb4c3.png)