Here’s A Quick Way To Solve A Tips About Operating Activity On The Statement Of Cash Flows

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

Operating activity on the statement of cash flows. The statement of cash flows presents sources and uses of cash in three distinct categories: Add back noncash expenses, such as depreciation, amortization, and depletion. The statement of cash flows is prepared by following these steps:

The cash flow from operating activities section appears at the top of a company's cash flow statement. A cash flow statement tells you how much cash is entering and leaving your business in a given period. The general structure of a cash flow statement prepared using the indirect method is as follows:

The economic decisions that are taken by users require an. Begin with net income from the income statement. It is these operating cash flows which must, in the end, pay off all cash outflows relating to other activities (e.g., paying loan interest, dividends, and so on).

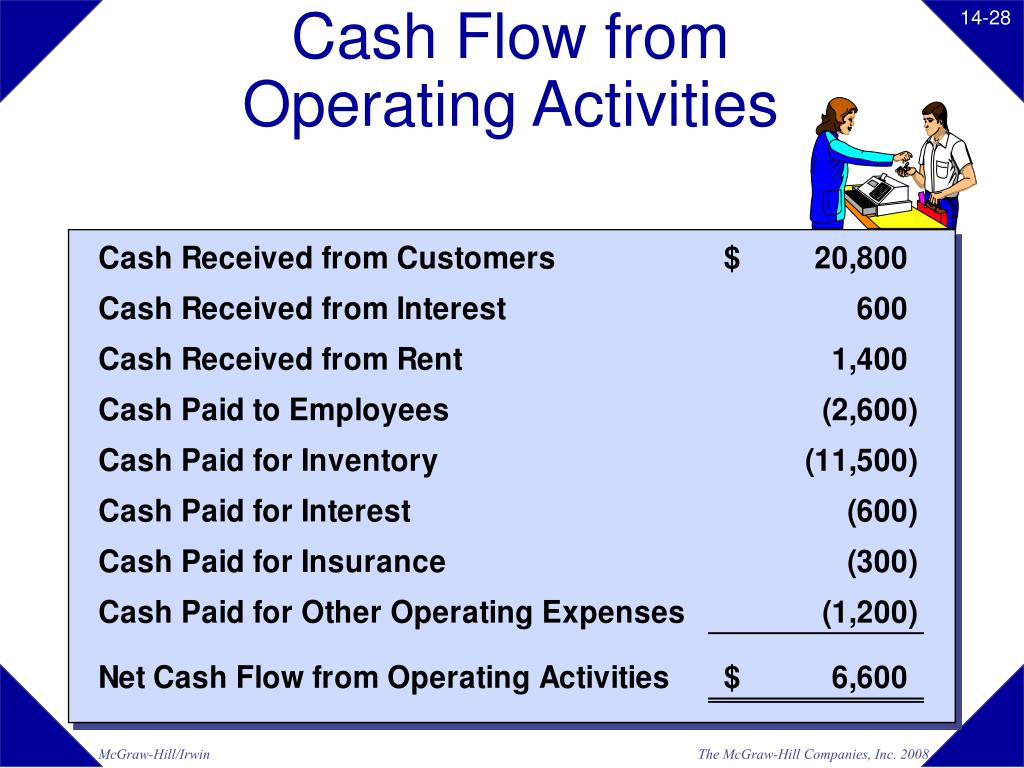

7.2.2 cash inflows and outflows. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Cash flow from operating activities represents the total amount of cash generated from operating activities throughout a specified period.

The cash flow statement is typically broken into three sections: Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. Apr 5, 2022 | 7 min read finance & accounting article cash flow is the movement of money in and out of a business during a specific accounting period.

It is used to explain where a company gets its cash from ongoing regular. Information about the cash flows of an entity is useful in providing users [refer: When reviewing your financing statements, you’ll find either a negative or positive cash flow, depending on whether your company spends more than it makes or makes more than it spends.

Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income,. The operating activities on the cfs include any sources and uses of cash from business activities. Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing.

An inflow occurs when cash is paid to a business. The three sections of the cash flow statement are: Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

The operating activities cash flow is based on the company’s net profit, with adjustments for items that affect cash differently than they affect net profit. The net profit on the income statement can be calculated by adding all the revenues. When the direct method of presenting the statement of cash flows is used, the major classes or receipts and payments are listed out, and the final balance of these gives us the net cash flows from operating activities.

Operating activities is perhaps the key part of the cash flow statement because it shows whether (and to what extent) a business can generate cash from its operations. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. The ocf calculation will always include the following three components:

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)