Ideal Tips About Accounting For Holding Company And Subsidiary

Parent company and subsidiary accounting:

Accounting for holding company and subsidiary company. Understand the legal requirements relating to presentation of accounts by a holding company. Both holding and subsidiary companies are defined in companies. From an accounting standpoint, a subsidiary is a separate company, so it keeps its own financial records and bank accounts and track its assets and liabilities.

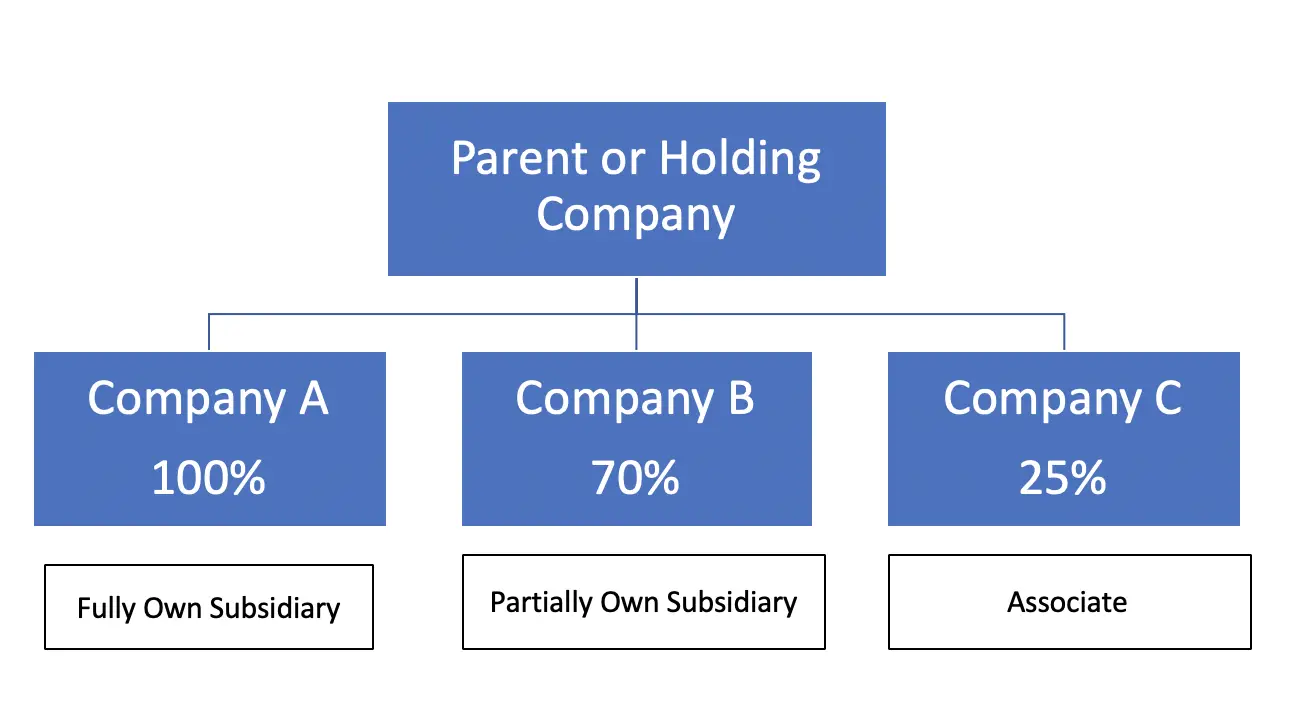

When a parent company acquires a subsidiary, it must use the consolidation method to prepare. In its parent company financial statements, company a should reflect an investment in subsidiary b of $80, reflecting its proportionate share of subsidiary b’s net assets of. A parent company is a single company that owns the subsidiary or subsidiaries.

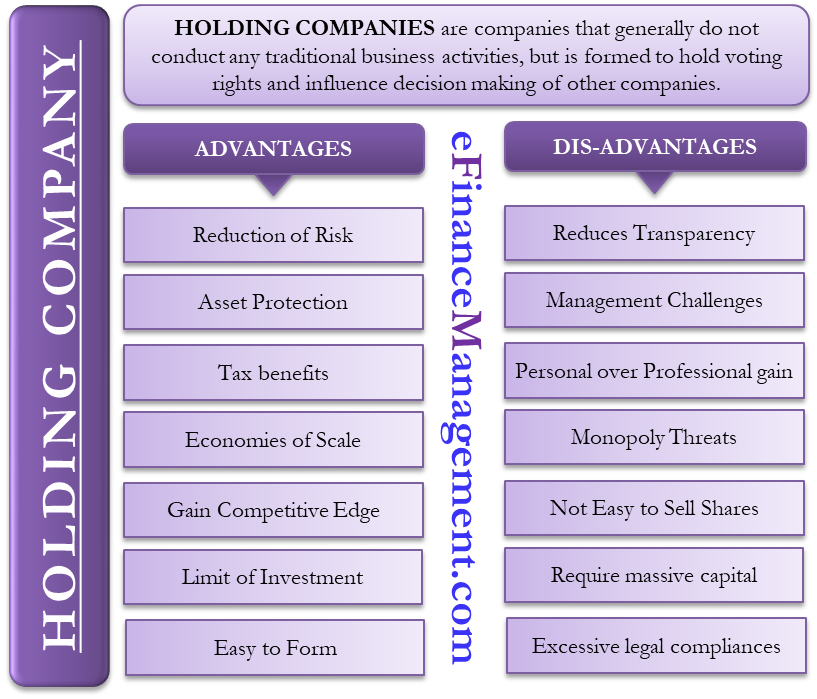

A holding company is a parent corporation with the goal of owning or controlling other companies. Often, holding companies are established (usually as. The control is exerted through ownership of more than 50% of the subsidiary’s voting.

Investment which is made by the holding company in the form of shares of subsidiary company is replaced by the subsidiary company’s assets and liabilities. (a) the subsidiary company holds such shares as the legal representative of a deceased member of the holding company; Types, advantages, and disadvantages last updated on 4 january 2023 investortonight team 54 mins read accounting what is a.

Control and ownership is one of. A parent company owns or controls a subsidiary,. A holding company is a business entity that owns the assets of other companies (subsidiaries).

A comprehensive guide sep, 02 2023 contents:. Holding company is a company that does not operate on its own but control over other companies. Accounting for holding company.

Open a business bank account. The subsidiary, on the other hand, is a separate legal entity from the holding company, with its own operations and management. Accounts of holding company:

Pankaj tyagi 31 dec, 2021 reading time: Hold member meetings (if required by the llc operating. Create an llc operating agreement.

Operating companies in the public utility field ordinaril folloy linew s prescribed by regulatory bodies; 4 minutes this article pens down some key differences between holding and subsidiary company. Given below is the list of the key difference between a holding company and a subsidiary company:

Sukharev, head of division, department of regulation on accounting, financial reporting and auditing,. It usually involves owning more than 50% shares in the subsidiary companies. Define holding company and subsidiary company.

:max_bytes(150000):strip_icc()/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)