Breathtaking Info About 5 Financial Ratios P&l And Balance Sheet Format

You can get more insight about your business by looking at and using balance sheet ratios.

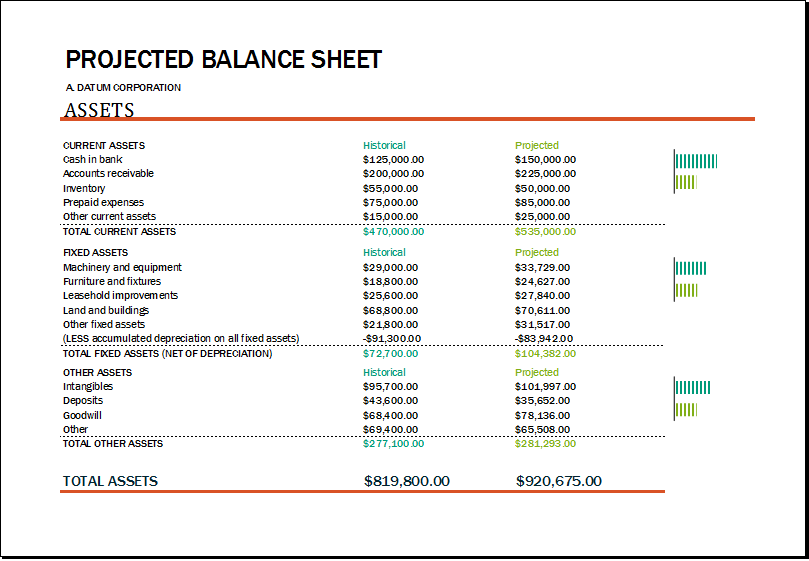

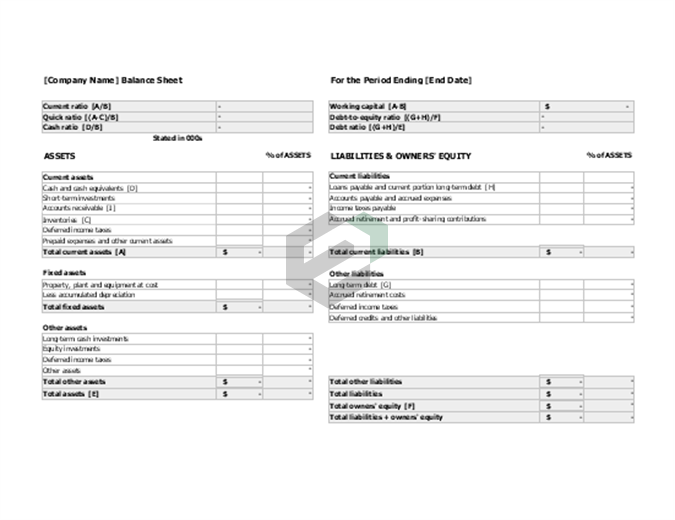

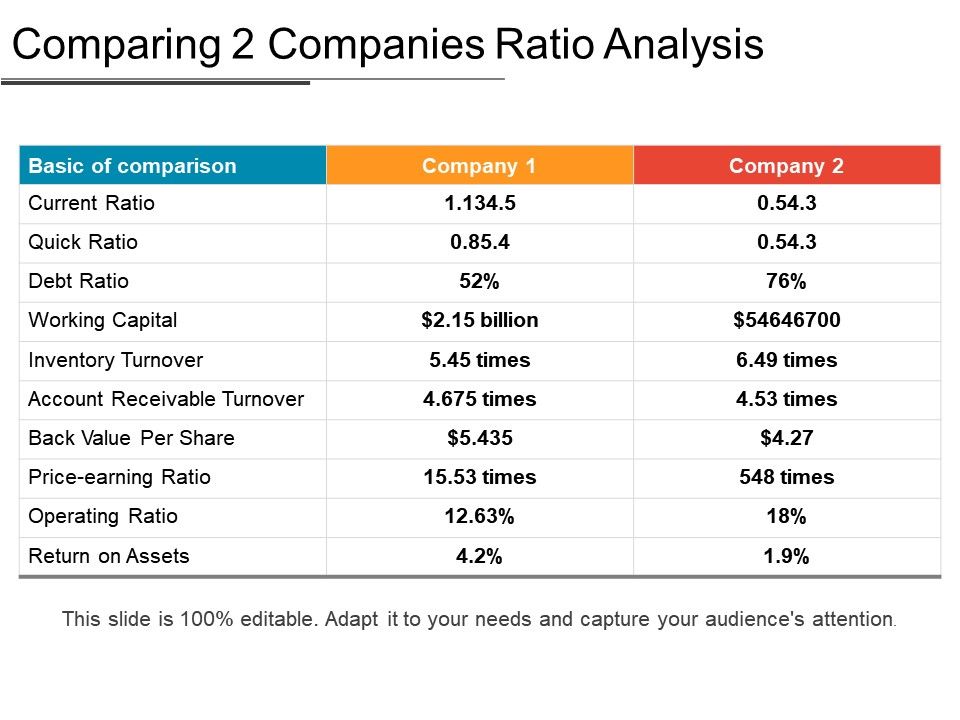

5 financial ratios p&l and balance sheet format. Below is a screenshot of the p&l statement template: Financial ratios using balance sheet amounts part 3 financial ratios using income statement amounts part 4 financial ratios using amounts from the balance sheet and income statement part 5 financial ratios using cash flow statement amounts, other financial ratios, benefits and limitations of financial ratios, vertical analysis,. Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders, and business owners to fetch an insight into the financial status of the organization.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. What is the difference between balance sheet and p&l statement? Guide to financial statement analysis one of the main tasks of an analyst is to perform an extensive analysis of financial statements.

Fundamental analysts use balance sheets to calculate financial ratios. Analysis of financial ratios serves two. It is important to note that when a company experiences losses instead of profit (net loss, operating loss, or even a gross loss), its profit ratios are negative, i.e.

They are financial ratio which includes debt to equity ratio, liquidity ratios which include cash ratio, current ratio, quick ratio and efficiency ratios which include account receivable turnover, payable account turnover, inventory turnover ratio. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. A p&l statement provides information about whether a company can.

Revenues minus cost of goods sold. This ratio analyzes the company’s liquidity by using its current asset to pay the current liability. Balance sheet ratios are a great means to estimate the financial standing.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Financial ratios are used to calculate the business’s financial position, including liquidity and gearing ratios. In this free guide, we will break down the most important types and techniques of financial statement analysis.

Types of balance sheet ratios; Financial ratios are grouped into the following categories: Uses and users of financial ratio analysis.

This sheet consists of 5 major categories of ratios: #1 monthly profit and loss template the monthly p&l template is perfect for businesses that require regular reporting and detail. The most important p&l ratios include the following.

A balance sheet and a profit and loss (p&l) statement serve different purposes and provide distinct financial insights: This financial ratio is used to measure the average number of days a company holds inventory before selling it. This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period.

The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value ratios. By showing all of the information in a series of monthly columns, much more detail is visible than if. 20 balance sheet ratios to help you determine the financial health of a company & includes a pdf download.