Favorite Info About Going Concern Financial Statements

When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the.

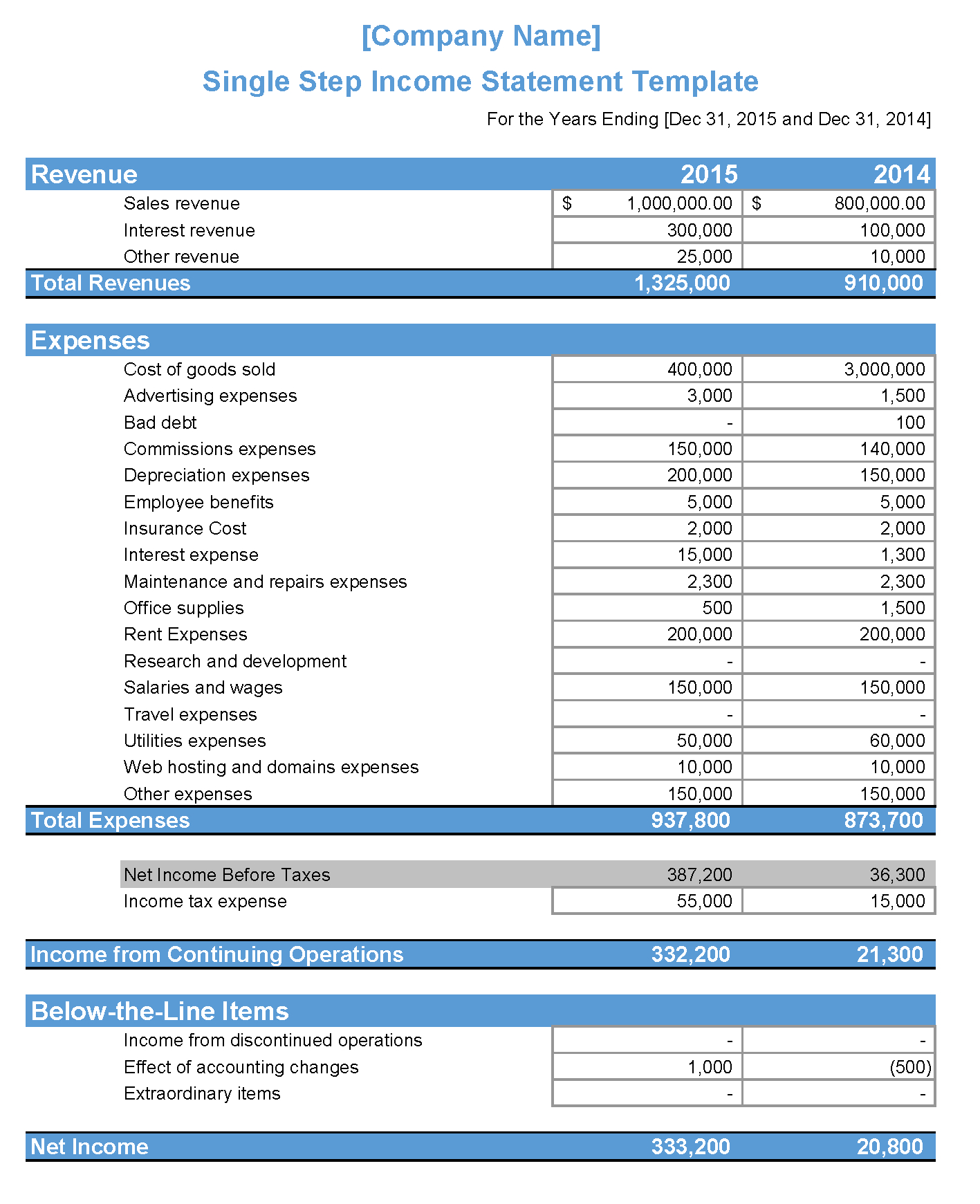

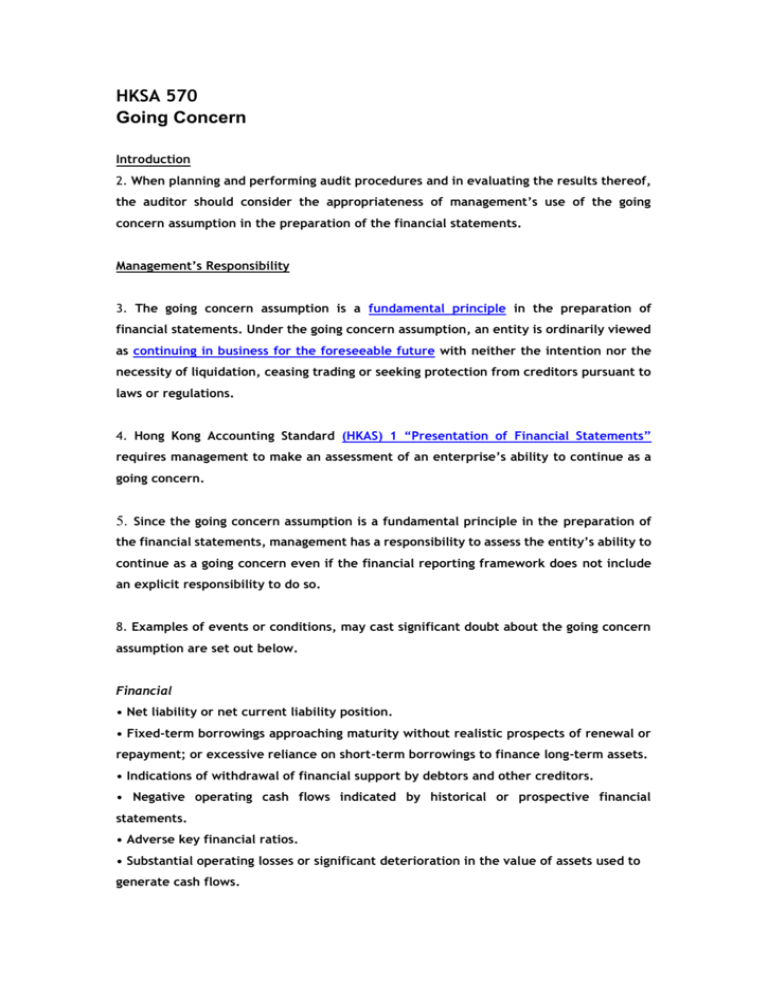

Going concern financial statements. Going concern issues arising after end of the reporting period. A statement of the issues or events giving rise to the uncertainty, which repeats the information contained in the auditor's report and may or may not provide additional information on events or conditions; This is confirmed by ias 10 which states that “an entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period date either that it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so.”(ias 10.14).

Capital one to acquire discover. Under ifrs standards, financial statements are prepared on a going concern basis, unless management intends or has no realistic alternative other than. In terms of the choice of accounting policies, the ordering of notes to the financial statements, how the disclosures should be tailored to reflect the reporting entity’s specific circumstances, and the

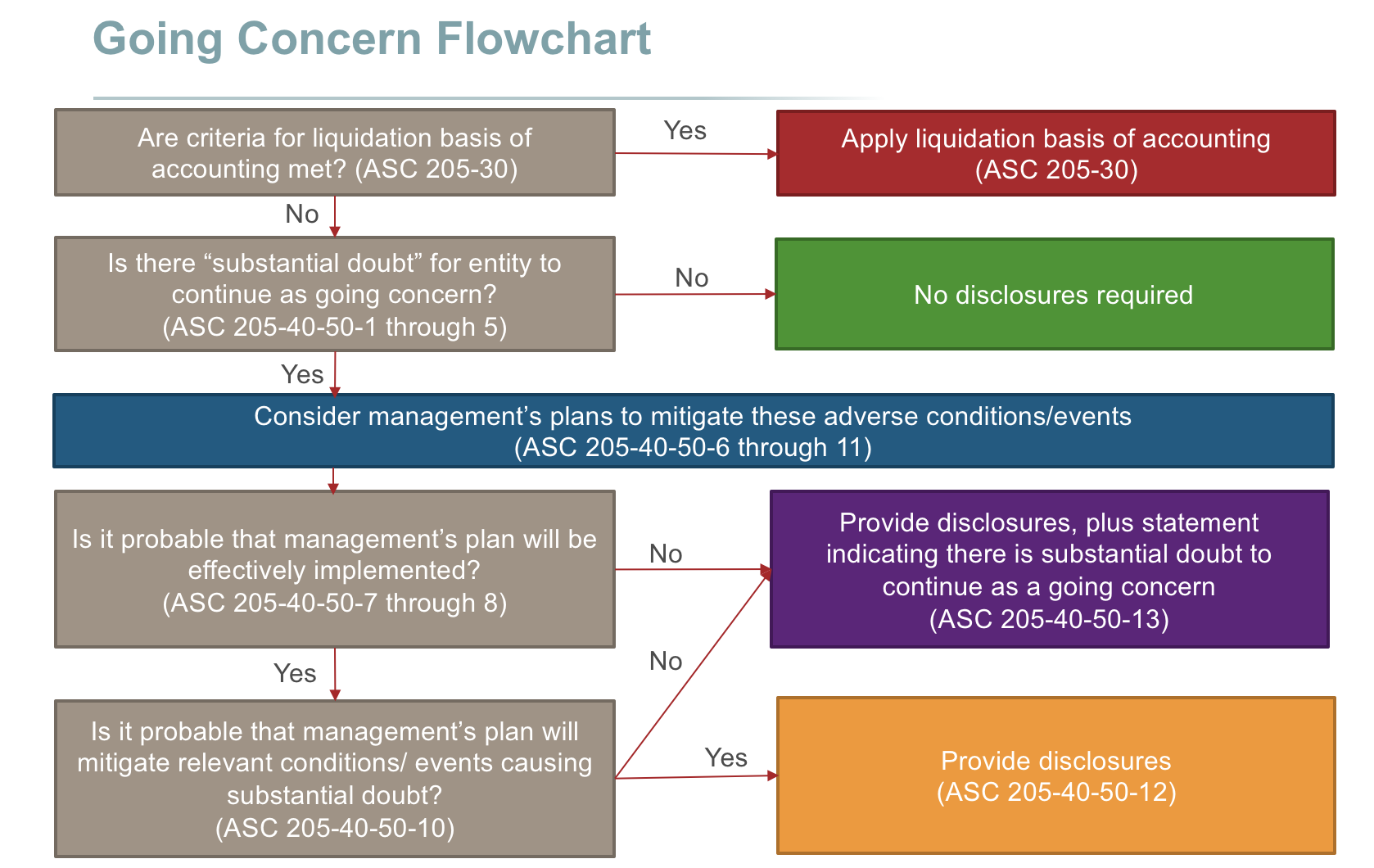

The reason the going concern assumption bears such importance in financial reporting is that it validates the use of historical cost accounting. The standard defines going concern by explaining that financial statements are prepared on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. Assessing going concern for financial reports

An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. Going concern is an accounting term for a company that is financially stable enough to meet its obligations and continue its business for the foreseeable future. Certain expenses and assets may.

This discussion paper sets out the issues and challenges related to the expectation gap (the difference between what users of the financial statements expect and the financial statement audit) and explores some possible actions that the iaasb could undertake to help narrow the expectation gap. Under the going concern basis of accounting, the financial statements are prepared on the assumption that the entity is a going concern and will continue its operations for the foreseeable Financial statements are prepared on the basis that a business will continue to operate for the foreseeable future i.e., that it is a going concern.

24.5.1 assessing going concern financial reporting under us gaap assumes that a reporting entity will continue to operate as a going concern until its liquidation becomes imminent. Anz group's a$4.9 billion ($3.2 billion) buyout of suncorp's banking business was cleared by the australian competition tribunal on tuesday, paving the way for the bank to press on with the. Standard defines going concern by explaining that financial statements are prepared on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so.

An entity shall not prepare its financial statements on a going concern basis if management determines after the end of the reporting period either that it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so. A1) going concern basis of accounting 2. Transaction is 100% stock consideration.

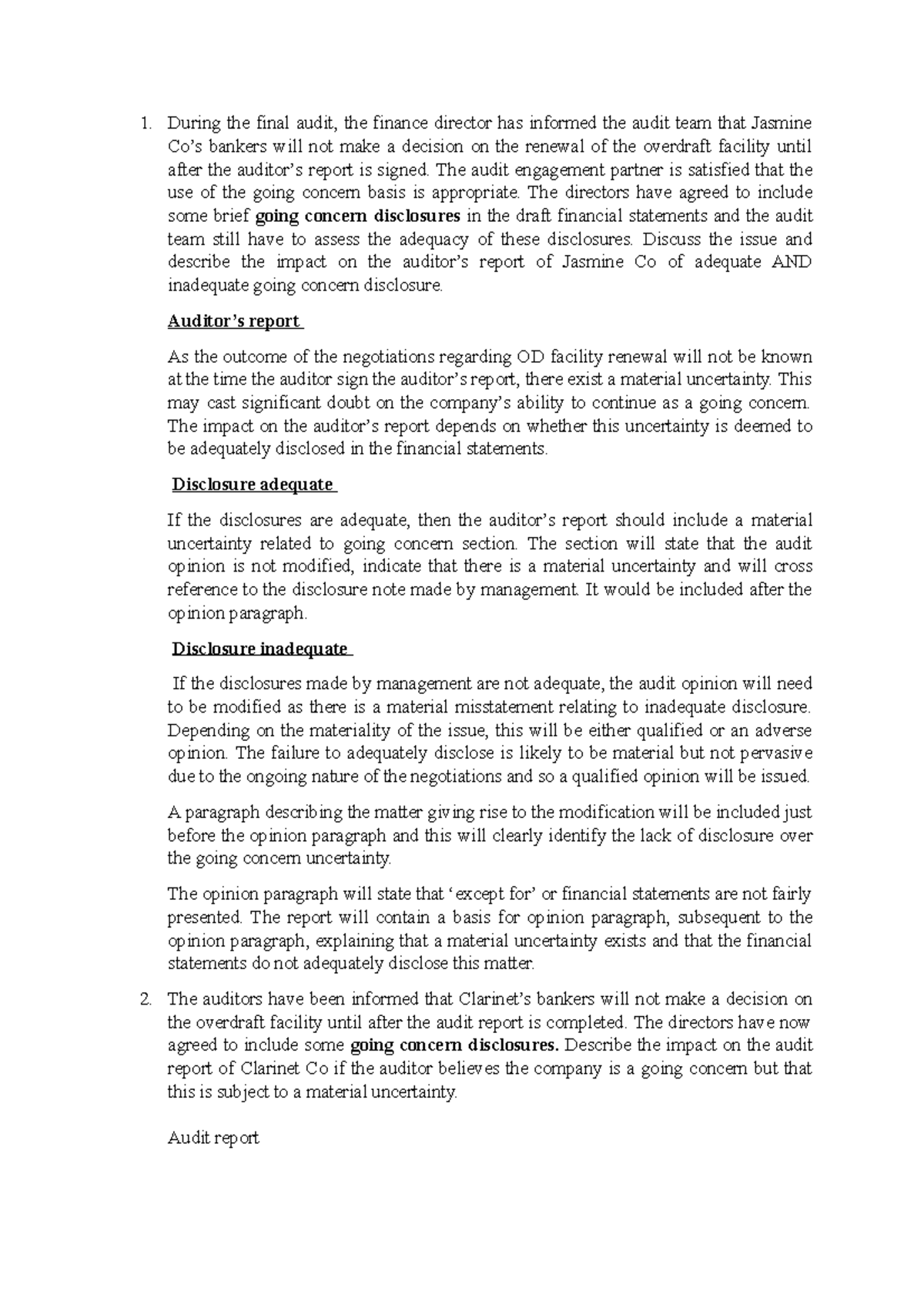

Financial statements relating to going concern and the implications for the auditor’s report. A statement that the directors believe it is appropriate to prepare the consolidated financial statements on a going concern basis; Going concern is an accounting term used to describe a business that is expected to operate for the foreseeable future or at least the next 12 months.

Once liquidation is deemed imminent, an entity must. Under the going concern basis of accounting, the financial statements are prepared on the assumption that the entity is a going concern and will continue its operations for the foreseeable future. In severe cases, management will need to assess whether the going concern assumption is still appropriate as a basis for the preparation of the company’s financial statements.

Financial statements relating to going concern and the implications for the auditor’s report. The standards explain that a material uncertainty related to going concern (murgc) is by its nature a key audit matter.9 however, when a murgc exists and adequate disclosure is made in the financial statements, such a matter. It assumes that the business can.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/going_concern_value_final-7ec0c2d15f4e4861ab51b29e15319c58.png)